Director Sharp Ingle Sells 2000 Shares of Ingles Markets Inc

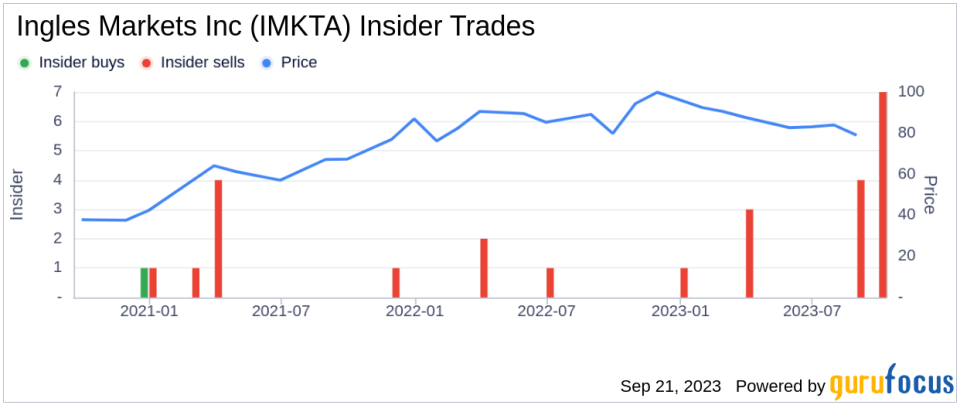

On September 21, 2023, Sharp Ingle, a director at Ingles Markets Inc (NASDAQ:IMKTA), sold 2,000 shares of the company. This move is part of a larger trend for the insider, who has sold a total of 31,500 shares over the past year and has not made any purchases.

Ingles Markets Inc is a leading supermarket chain in the Southeastern United States. The company operates supermarkets, fluid dairy processing and shopping centers. Its supermarkets offer food products, including grocery, meat and dairy products, produce, frozen foods and other perishables, non-food products, including fuel centers, pharmacies, health and beauty care products and general merchandise, as well as private label items.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To better understand this, we need to delve into the company's financials and the insider's trading history.

The insider transaction history for Ingles Markets Inc shows a clear trend of selling over the past year. There have been 15 insider sells and no insider buys. This could indicate that insiders believe the stock is currently overvalued or that they expect the company's performance to decline in the future.

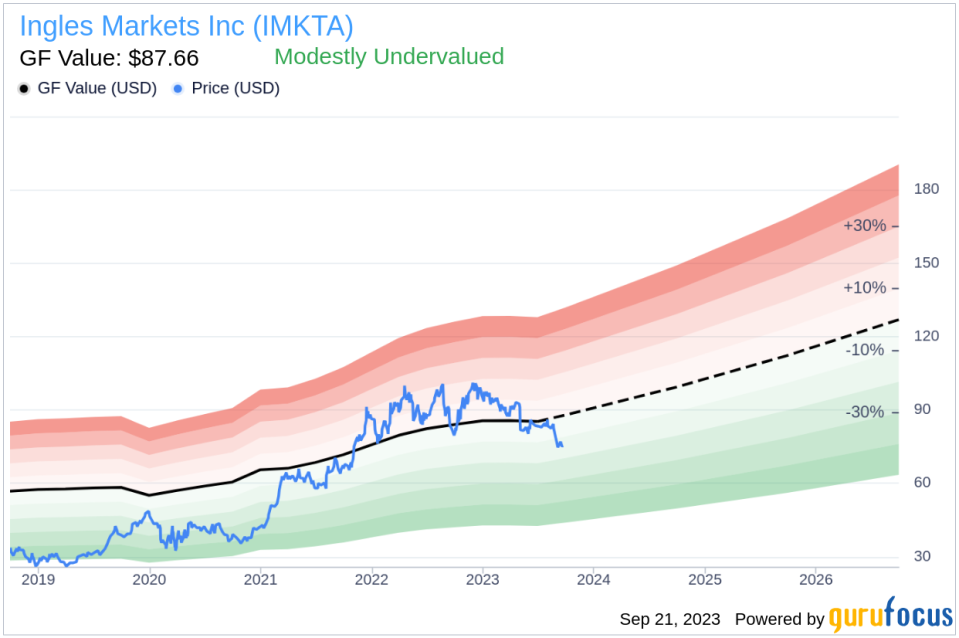

On the day of the insider's recent sell, shares of Ingles Markets Inc were trading for $75.26, giving the company a market cap of $1.43 billion. The price-earnings ratio was 6.27, significantly lower than the industry median of 17.13 and the company's historical median price-earnings ratio. This suggests that the stock may be undervalued compared to its peers and its own historical valuation.

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Ingles Markets Inc is modestly undervalued. The stock's price-to-GF-Value ratio is 0.86, with a GF Value of $87.66 compared to the current price of $75.26.

In conclusion, while the insider's recent sell-off may raise some concerns, the company's financials and valuation suggest that the stock may still be a good investment. However, potential investors should keep a close eye on insider trading activity and the company's performance to make informed decisions.

This article first appeared on GuruFocus.