Director Sharp Ingle Sells 4,000 Shares of Ingles Markets Inc (IMKTA)

On September 25, 2023, Sharp Ingle, a director at Ingles Markets Inc (NASDAQ:IMKTA), sold 4,000 shares of the company. This move is part of a larger trend for the insider, who has sold a total of 35,500 shares over the past year and purchased none.

Ingles Markets Inc is a leading supermarket chain in the Southeastern United States. The company operates supermarkets, fluid dairy processing and shopping centers. Its supermarkets offer a range of food products, non-food products, and private label items. The company's strategy involves providing superior customer service, high-quality products, and competitive prices.

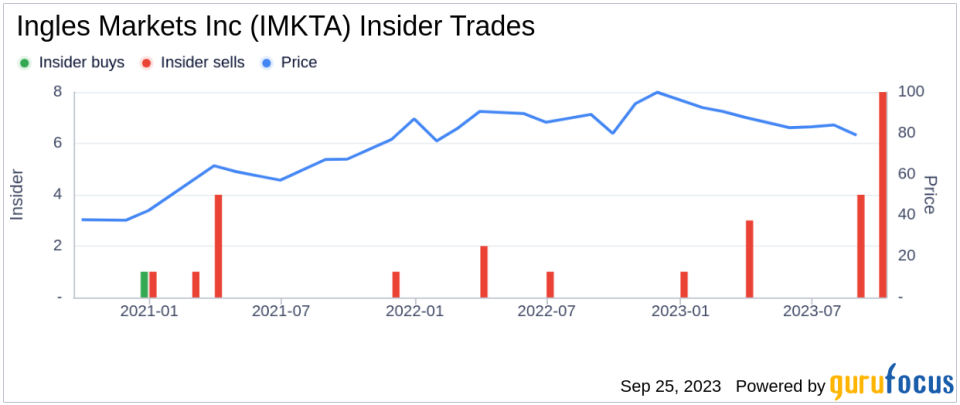

The insider's recent sell comes amidst a backdrop of 16 insider sells over the past year, with no insider buys recorded for the same period. This trend is illustrated in the following image:

On the day of the insider's recent sell, shares of Ingles Markets Inc were trading at $76.09, giving the company a market cap of $1.442 billion. The price-earnings ratio stood at 6.36, significantly lower than the industry median of 17.05 and the company's historical median price-earnings ratio. This suggests that the stock may be undervalued.

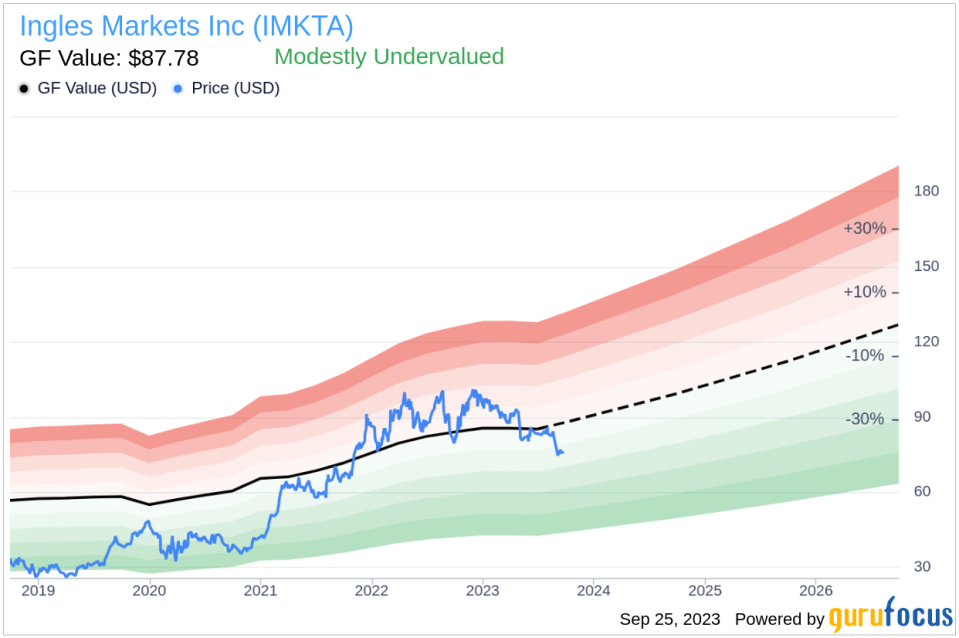

The GuruFocus Value of Ingles Markets Inc is $87.78, resulting in a price-to-GF-Value ratio of 0.87. This indicates that the stock is modestly undervalued. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts. The GF Value is illustrated in the following image:

The insider's decision to sell shares could be influenced by a variety of factors. It's important to note that insider selling does not necessarily indicate a negative outlook for the company. The insider may have personal financial reasons for selling, or they may simply be diversifying their investment portfolio. However, the lack of insider buying over the past year could be a cause for concern for potential investors.

In conclusion, while the insider's recent sell and the overall trend of insider selling at Ingles Markets Inc may raise some eyebrows, the company's stock appears to be modestly undervalued based on its GF Value. Investors should keep a close eye on the company's financial performance and any future insider transactions to make informed investment decisions.

This article first appeared on GuruFocus.