Director Sharp Ingle Sells 4000 Shares of Ingles Markets Inc

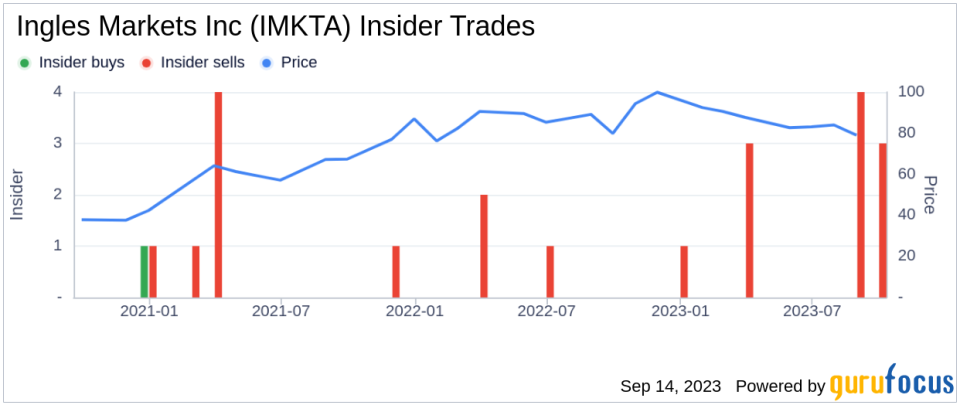

On September 12, 2023, Director Sharp Ingle sold 4,000 shares of Ingles Markets Inc (NASDAQ:IMKTA). This move comes as part of a series of transactions by the insider over the past year, during which Ingle has sold a total of 21,500 shares and made no purchases.

Sharp Ingle is a key figure at Ingles Markets Inc, a leading supermarket chain primarily operating in the Southeastern United States. The company offers its customers a wide range of food products, including grocery, meat and dairy products, and other locally sourced goods. With a strong commitment to customer service and community involvement, Ingles Markets Inc has established a solid reputation in the industry.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To gain a better understanding of this, we need to delve into the company's financials and the insider's trading history.

The insider transaction history for Ingles Markets Inc shows a clear trend of selling over the past year, with 11 insider sells and no insider buys. This could be indicative of the insider's sentiment towards the company's current valuation and future prospects.

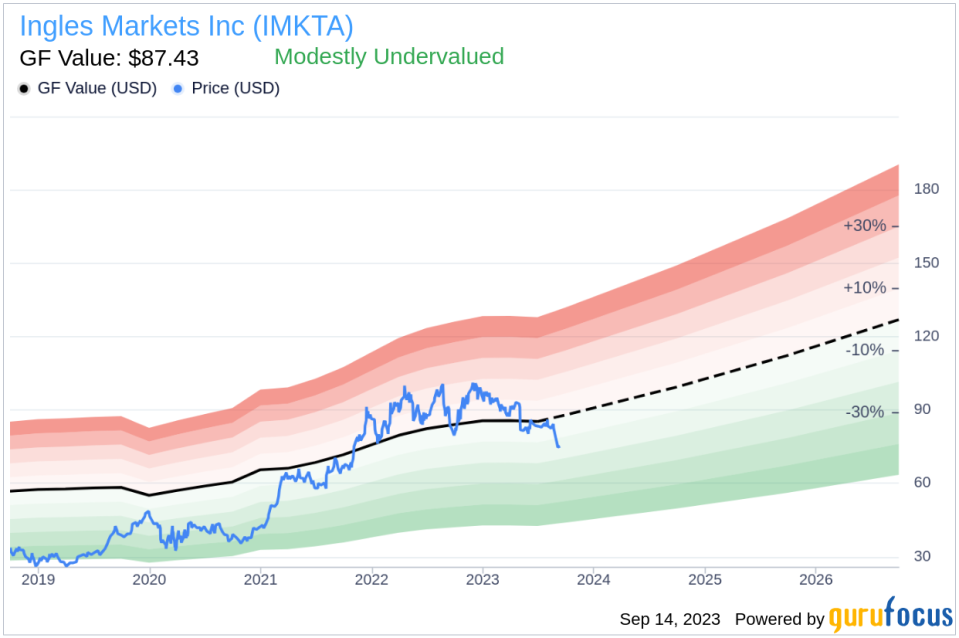

On the day of the insider's recent sell, shares of Ingles Markets Inc were trading at $75.75, giving the company a market cap of $1.43 billion. The price-earnings ratio stood at 6.26, significantly lower than the industry median of 16.51 and the company's historical median price-earnings ratio. This suggests that the stock may be undervalued.

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Ingles Markets Inc is modestly undervalued. With a price of $75.75 and a GuruFocus Value of $87.43, the stock has a price-to-GF-Value ratio of 0.87.

In conclusion, the insider's recent sell-off, coupled with the company's modest undervaluation, suggests that investors should keep a close eye on Ingles Markets Inc. While the insider's selling activity may raise some concerns, the company's strong fundamentals and undervalued status could present a potential investment opportunity.

This article first appeared on GuruFocus.