Director Thomas Erickson's Strategic 50,000 Share Purchase in 3D Systems Corp

In a notable move within the 3D printing industry, Director Thomas Erickson of 3D Systems Corp (NYSE:DDD) has recently increased his stake in the company by purchasing 50,000 shares. This transaction, dated November 28, 2023, has caught the attention of investors and market analysts alike, as insider buying can often signal confidence in the company's future prospects.

Who is Thomas Erickson?

Thomas Erickson is a seasoned executive with a track record of leadership in various technology companies. His experience spans across different sectors, including software and services, which provides him with a unique perspective on the potential applications and growth of 3D printing technology. Erickson's role as a director at 3D Systems Corp involves providing strategic guidance and oversight, ensuring that the company remains at the forefront of innovation within the industry.

3D Systems Corp's Business Description

3D Systems Corp is a company that specializes in 3D printing technology and solutions. It offers a comprehensive range of products and services, including 3D printers, print materials, on-demand manufacturing services, and digital design tools. The company's technology is used in a variety of industries, such as aerospace, healthcare, automotive, and education, to create prototypes, manufacturing tools, and end-use parts. 3D Systems Corp is known for its commitment to innovation and its ability to adapt to the evolving needs of the market.

Understanding Insider Buy/Sell

Insider buying occurs when an officer, director, or any person with key access to company information purchases shares of the company's stock. This is often interpreted as a positive sign, as insiders may buy shares because they believe the stock is undervalued or that there are positive developments ahead for the company. Conversely, insider selling might indicate that insiders believe the stock is fully valued or that there may be challenges on the horizon. However, insider selling can also occur for personal reasons and does not always reflect a negative outlook on the company's future.

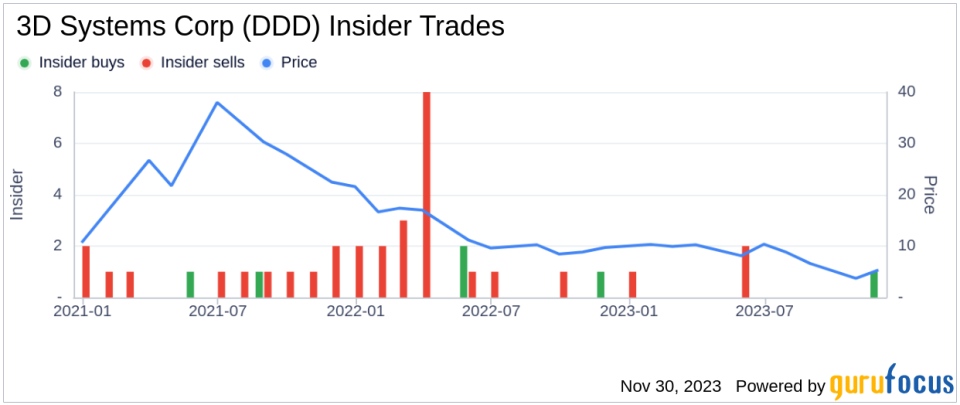

Insider Trends at 3D Systems Corp

The insider transaction history for 3D Systems Corp shows a mix of insider activity over the past year. There have been 2 insider buys and 3 insider sells during this period. The recent purchase by Thomas Erickson is particularly significant due to the size of the transaction.

Valuation and Market Cap

On the day of Erickson's purchase, shares of 3D Systems Corp were trading at $5.3, resulting in a market cap of $711.203 million. This valuation is an important factor to consider when analyzing the implications of insider transactions.

Price-to-GF-Value Ratio

With the current share price at $5.3 and a GuruFocus Value of $9.76, 3D Systems Corp has a price-to-GF-Value ratio of 0.54. This suggests that the stock may be undervalued, as it is trading below its intrinsic value estimate. However, the designation of "Possible Value Trap, Think Twice" indicates that investors should be cautious and conduct further analysis before making investment decisions.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, an adjustment factor based on the company's past performance, and future business performance estimates provided by analysts. This comprehensive approach to valuation aims to provide a more accurate representation of a stock's intrinsic value.

Conclusion

The insider buying activity by Thomas Erickson at 3D Systems Corp is a noteworthy event that warrants attention from the investment community. Erickson's purchase aligns with the company's current undervaluation based on the GF Value, potentially signaling his belief in the company's future growth and success. While the price-to-GF-Value ratio suggests that the stock may be a value trap, Erickson's decision to increase his holdings could be based on information and strategic insights not fully reflected in the public domain.As with any investment decision, it is crucial for investors to conduct their own due diligence, considering both the insider trends and the broader market context. Erickson's recent insider buying at 3D Systems Corp is a piece of the puzzle that, when combined with other data and analysis, can help investors form a more complete picture of the company's potential investment value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.