Director Thomas Krummel Sells 2,220 Shares of California Water Service Group (CWT)

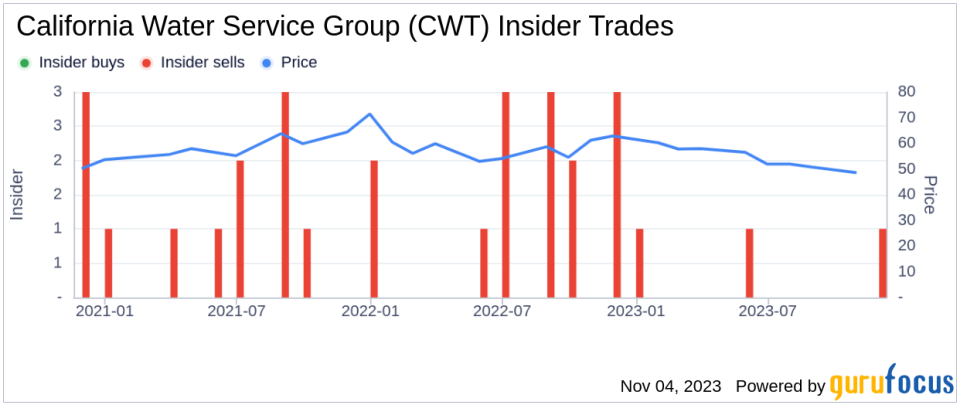

On November 2, 2023, Thomas Krummel, a director at California Water Service Group (NYSE:CWT), sold 2,220 shares of the company. This move is part of a trend for the insider, who over the past year has sold a total of 4,218 shares and purchased none.

The California Water Service Group is a utility company that provides water service to approximately two million people across four states: California, Washington, New Mexico, and Hawaii. The company is the third-largest publicly traded water utility in the United States, with a market cap of $3.03 billion.

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been five insider sells and zero insider buys. This could potentially signal a lack of confidence in the company's future prospects, although it's also possible that insiders are simply taking profits after a period of strong performance.

On the day of the insider's recent sell, shares of California Water Service Group were trading at $50 each. This gives the stock a price-earnings ratio of 72.89, significantly higher than the industry median of 14.9 and the company's historical median price-earnings ratio. This suggests that the stock may be overvalued, which could be another reason why insiders are selling.

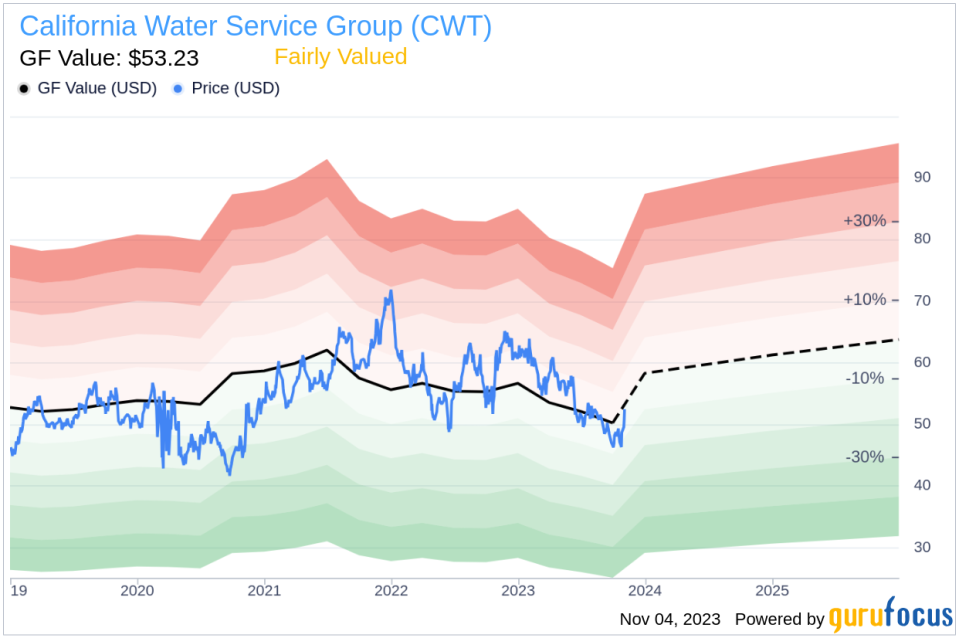

However, according to GuruFocus's GF Value, the stock is fairly valued. With a price of $50 and a GF Value of $53.23, the stock has a price-to-GF-Value ratio of 0.94. The GF Value is an intrinsic value estimate that takes into account historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

In conclusion, while the insider's recent sell-off and the high price-earnings ratio may raise some concerns, the GF Value suggests that the stock is still fairly valued. Investors should keep a close eye on the company's future performance and any further insider trading activity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.