Director Timothy Parker's Strategic Investment in Matador Resources Co (MTDR)

In the realm of stock market movements, insider trading activity is often a significant indicator that garners the attention of investors seeking clues about a company's future prospects. A recent transaction by Director Timothy Parker, who purchased 5,000 shares of Matador Resources Co (NYSE:MTDR) on December 12, 2023, has sparked interest in the energy sector. This article aims to provide an objective analysis of this insider buying event, focusing on the data and implications it may hold for investors.

Who is Timothy Parker?

Timothy Parker is a seasoned member of the board of directors at Matador Resources Co, bringing with him a wealth of experience in the energy industry. His role as a director involves providing strategic guidance and oversight to the company's operations and long-term objectives. Parker's insider status gives him an intimate understanding of Matador's performance, strategy, and potential, making his market activities particularly noteworthy.

Matador Resources Co's Business Description

Matador Resources Co is an independent energy company engaged in the exploration, development, production, and acquisition of oil and natural gas resources in the United States. With a focus on the Permian Basin in Southeast New Mexico and West Texas, Matador Resources Co is strategically positioned in one of the most prolific oil-producing regions in the country. The company's operations are centered around maximizing the value of its high-quality asset base through a combination of technological innovation, operational efficiency, and financial discipline.

Understanding Insider Buy/Sell

Insider buying occurs when a company's executives, directors, or other key employees purchase shares of their own company's stock. Such transactions are closely monitored as they can signal insiders' confidence in the company's future performance. Conversely, insider selling might indicate that insiders believe the stock is fully valued or potentially overvalued. However, it's important to note that insiders might sell shares for various reasons unrelated to their outlook on the company, such as personal financial planning.

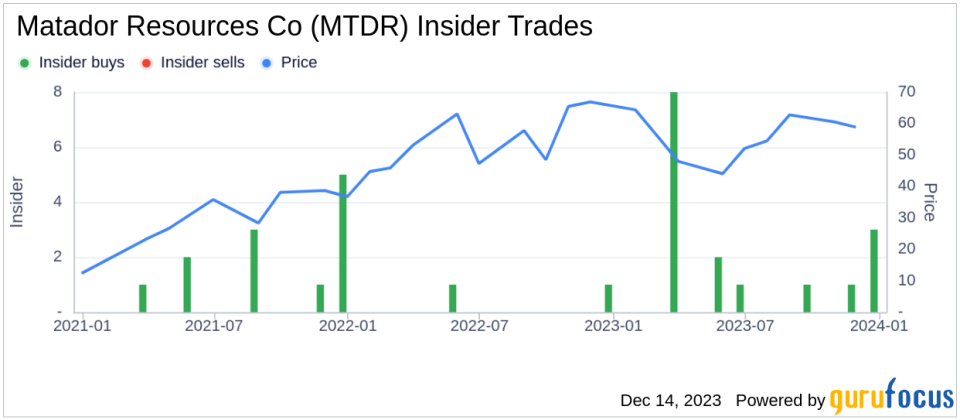

Insider Trends at Matador Resources Co

The insider transaction history for Matador Resources Co reveals a pattern of confidence among insiders. Over the past year, there have been 18 insider buys and notably, no insider sells. This trend suggests a collective optimism about the company's trajectory among those with the most intimate knowledge of its operations.

Timothy Parker's Recent Transactions

The insider's recent purchase of 5,000 shares adds to a series of transactions over the past year, during which Timothy Parker has acquired a total of 9,500 shares. The absence of any sales by the insider further underscores a bullish stance on the company's prospects.

Valuation and Market Perception

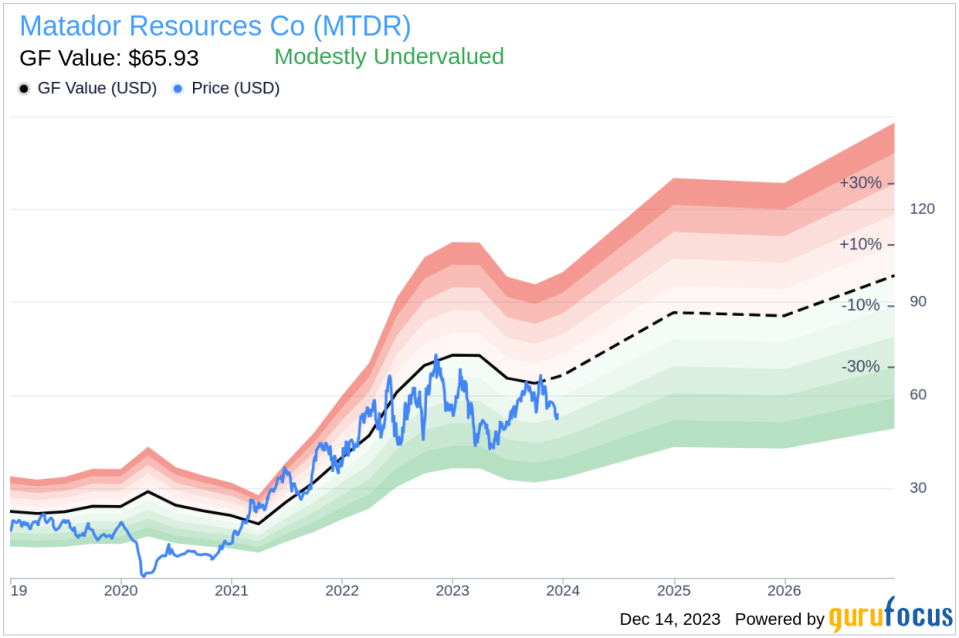

On the date of the insider's latest buy, shares of Matador Resources Co were trading at $52.13, resulting in a market cap of $6,460.686 million. The price-earnings ratio of 7.70 is lower than both the industry median of 9.045 and the company's historical median, suggesting that the stock may be undervalued relative to its peers and its own past performance.With a price of $52.13 and a GuruFocus Value of $65.93, Matador Resources Co's price-to-GF-Value ratio stands at 0.79, indicating that the stock is modestly undervalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Implications for Investors

The insider's decision to increase their stake in Matador Resources Co aligns with the company's favorable valuation metrics and the broader insider buying trend. This confluence of factors may suggest that the company is positioned for positive performance, potentially offering an attractive entry point for investors.However, it is crucial for investors to conduct their own due diligence, considering not only insider activity but also the company's fundamentals, industry conditions, and broader market trends. While insider buying can be a positive signal, it should be one of many factors considered in a comprehensive investment decision-making process.In conclusion, Director Timothy Parker's recent purchase of Matador Resources Co shares is a move that aligns with a pattern of insider confidence and a valuation that suggests the stock may be undervalued. As the energy sector continues to evolve, Matador Resources Co's strategic position in the Permian Basin and the insider's increasing investment could be indicative of a bright future for the company and its shareholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.