Director Todd Snyder Buys 2679 Shares of Amplify Energy Corp

On September 12, 2023, Director Todd Snyder of Amplify Energy Corp (NYSE:AMPY) made a significant move in the stock market by purchasing 2679 shares of the company. This insider buying activity is a key indicator of the company's current market status and future prospects.

Todd Snyder is a key figure in Amplify Energy Corp, serving as a Director. His decision to invest in the company's shares is a strong vote of confidence in the company's future performance. Snyder's insider trading activity over the past year shows a clear trend of buying, with a total of 2679 shares purchased and no shares sold.

Amplify Energy Corp is an independent oil and natural gas company engaged in the acquisition, development, exploration, and production of oil and natural gas properties. The company's operations are focused in the Rockies, offshore California, Oklahoma, East Texas / North Louisiana, and South Texas.

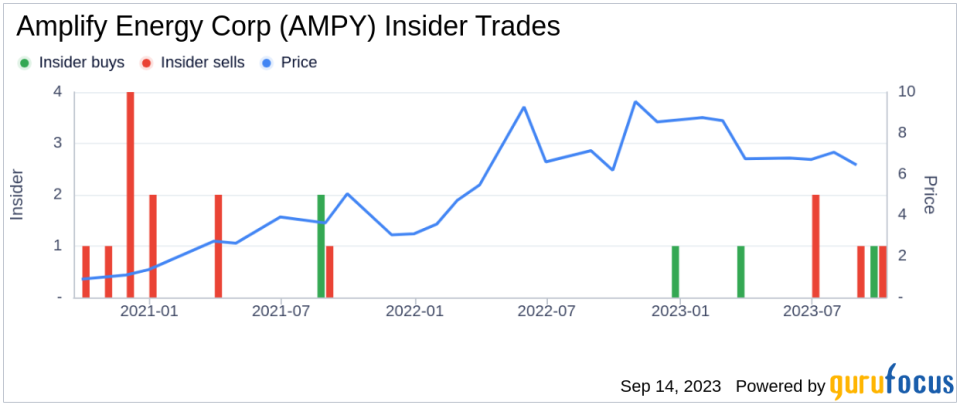

The insider's recent buying activity is a significant indicator of the company's current market status. Over the past year, there have been 3 insider buys in total, compared to 4 insider sells. This suggests a positive sentiment among the company's insiders.

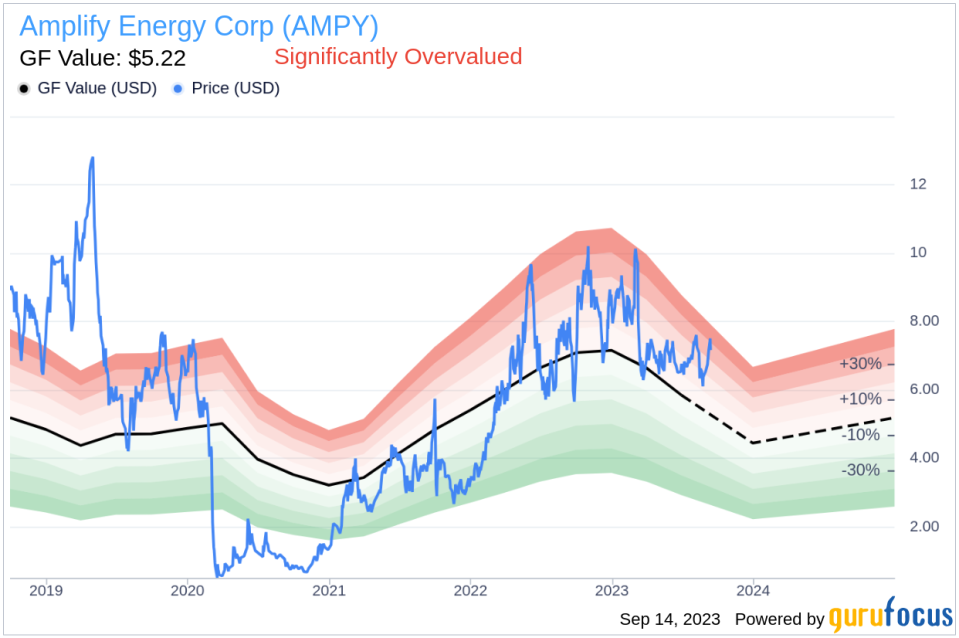

On the day of the insider's recent buy, shares of Amplify Energy Corp were trading for $7.44 apiece, giving the stock a market cap of $280.077 million. The price-earnings ratio is 0.66, which is lower than the industry median of 9.36 and lower than the companys historical median price-earnings ratio.

With a price of $7.44 and a GuruFocus Value of $5.22, Amplify Energy Corp has a price-to-GF-Value ratio of 1.43. This means the stock is significantly overvalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus that is calculated based on the following three factors: historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's decision to buy shares at a time when the stock is considered overvalued suggests a strong belief in the company's future performance. This could be a positive sign for potential investors considering Amplify Energy Corp.

In conclusion, the insider's recent buying activity, coupled with the company's strong fundamentals, suggests a positive outlook for Amplify Energy Corp. However, potential investors should also consider the stock's current overvaluation before making an investment decision.

This article first appeared on GuruFocus.