Director Valeria Nikolov Sells 25,380 Shares of Torrid Holdings Inc (CURV)

Director Valeria Nikolov executed a sale of 25,380 shares of Torrid Holdings Inc (NYSE:CURV) on January 16, 2024, according to a recent SEC Filing. The transaction was reported to have occurred at an average price of $5.62 per share, which calculates to a total sale amount of approximately $142,636.

Torrid Holdings Inc operates as a direct-to-consumer apparel and intimates brand in North America. The company offers a broad range of apparel, intimates, and accessories for women, focusing on the plus-size market segment. Torrid's business model emphasizes fit, style, and comfort across its product lines, catering to the needs of plus-size women seeking fashionable clothing options.

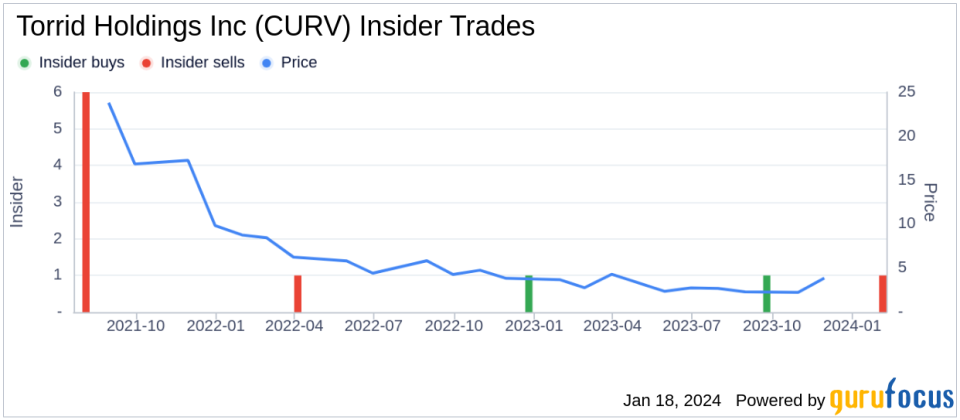

Over the past year, the insider has sold a total of 25,380 shares and has not made any purchases of the company's stock. This latest transaction continues the trend of insider sales activity for the company.

The insider transaction history for Torrid Holdings Inc shows a pattern of insider activity. Over the past year, there has been only 1 insider buy and 1 insider sell, indicating a balanced level of insider transactions.

On the valuation front, shares of Torrid Holdings Inc were trading at $5.62 on the day of the insider's recent transaction. The company's market cap stands at $616.288 million. Torrid Holdings Inc's price-earnings ratio is currently 59.20, which is above both the industry median of 17.16 and the company's historical median price-earnings ratio.

Investors often monitor insider buying and selling trends as an indicator of management's perspective on the future direction of the company. While insider selling does not always suggest a lack of confidence in the company, it can provide context to the overall sentiment among those with intimate knowledge of the company's operations and prospects.

It is important for investors to consider the broader context of insider transactions alongside other financial metrics and industry trends when evaluating the potential impact on the stock's performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.