Director Victor Fetter Acquires 3,700 Shares of Horace Mann Educators Corp (HMN)

Horace Mann Educators Corp (NYSE:HMN) has reported an insider purchase according to the latest SEC filings. Director Victor Fetter has added 3,700 shares of the company to his holdings on March 4, 2024. The transaction was disclosed in a filing with the SEC, which can be accessed through this link.

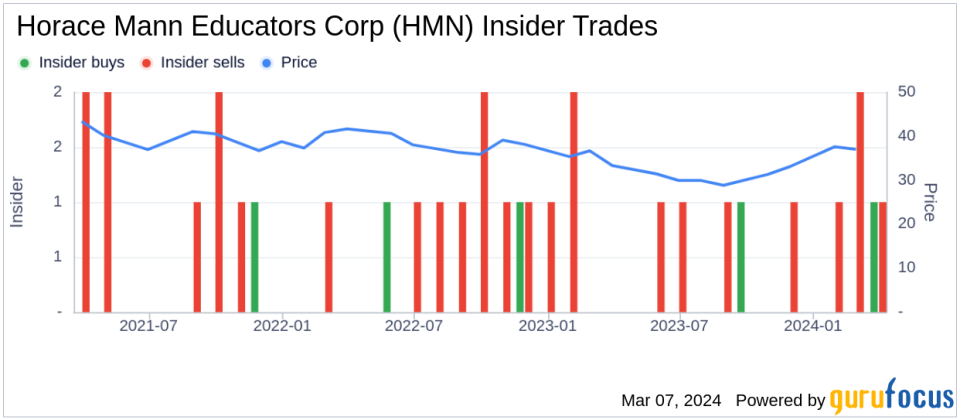

The insider's transaction history indicates a pattern of confidence in the company's prospects. Over the past year, Victor Fetter has purchased a total of 7,200 shares and has not sold any shares.Horace Mann Educators Corp is a provider of insurance and financial services to educators, school employees, and their families. The company offers a variety of insurance products, including auto, property, and life insurance, as well as retirement annuities.In terms of insider trends, there have been 2 insider buys and 8 insider sells over the past year at Horace Mann Educators Corp. This activity provides a glimpse into the sentiment of those with intimate knowledge of the company.On the valuation front, shares of Horace Mann Educators Corp were trading at $35.95 on the day of the insider's purchase, with a market capitalization of $1.436 billion. The price-earnings ratio stands at 32.54, which is above both the industry median of 12.71 and the company's historical median.

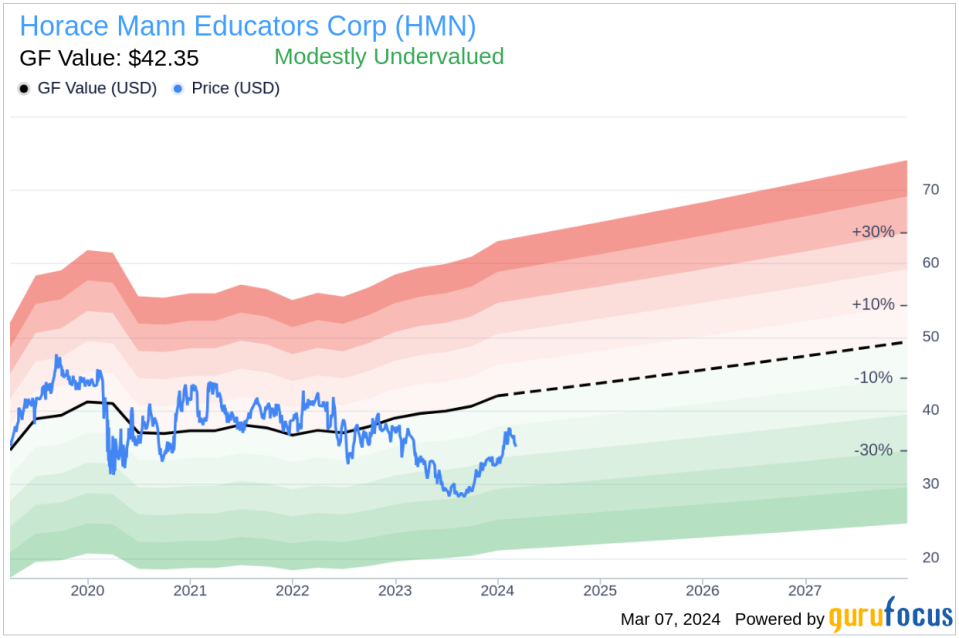

The stock's price relative to the GuruFocus Value (GF Value) suggests that Horace Mann Educators Corp is modestly undervalued. The GF Value, which is $42.35, results in a price-to-GF-Value ratio of 0.85. The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.This insider purchase could be a signal to investors that those within the company see current market prices as an attractive entry point, given the stock's valuation relative to its GF Value. However, investors should always conduct their own due diligence before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.