Director Walden Rhines' Strategic Investment in Qorvo Inc

In the realm of stock market movements, insider trading activity is often a beacon, signaling the confidence levels of a company's leadership in its future prospects. One such notable transaction has occurred at Qorvo Inc (NASDAQ:QRVO), where Director Walden Rhines has recently increased his stake in the company. This article delves into the details of the transaction, the background of the insider, and the business landscape of Qorvo Inc, providing an objective analysis based on the available data.

Who is Walden Rhines?

Walden Rhines is a seasoned veteran in the semiconductor industry, known for his leadership and strategic vision. His tenure in the technology sector has been marked by significant contributions, particularly during his time as CEO of Mentor Graphics, a leading electronic design automation company. Rhines' expertise in the field is well-regarded, and his decisions in the market are closely watched by investors seeking insights into the semiconductor industry.

Qorvo Inc's Business Description

Qorvo Inc is a prominent player in the semiconductor industry, specializing in providing core technologies and radio frequency (RF) solutions for mobile, infrastructure, and aerospace/defense applications. The company's innovative product portfolio includes advanced RF solutions that are integral to the rapidly growing fields of 5G, IoT (Internet of Things), and connectivity. With a focus on high-performance applications, Qorvo is positioned at the forefront of technological advancements, catering to a global market that demands ever-increasing data speeds and reliable wireless communication.

Insider Buy/Sell Description

Insider buying and selling refer to the transactions made by company insiders such as executives, directors, and major shareholders in the company's own stock. These transactions are closely monitored as they can provide insights into the insiders' perspective on the company's future. Insider buying is often interpreted as a positive sign, indicating that insiders believe the stock is undervalued or that the company is poised for growth. Conversely, insider selling can sometimes raise concerns about the company's future prospects, although it may also reflect personal financial planning decisions by the insiders.

Walden Rhines' Recent Insider Buying Activity

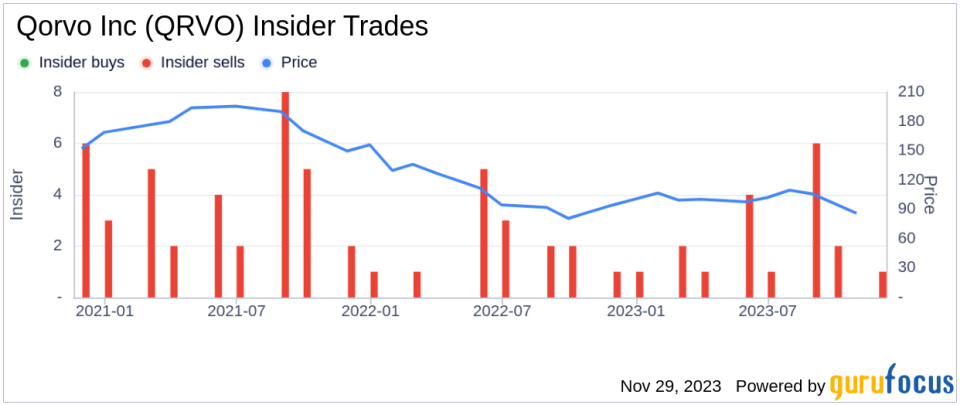

On November 27, 2023, Walden Rhines made a significant investment in Qorvo Inc by purchasing 5,000 shares. This transaction is particularly noteworthy as it is the only insider buy recorded over the past year, contrasting with 18 insider sells during the same period. The insider's decision to increase his holdings in the company, amidst a backdrop of more prevalent selling, suggests a strong belief in the company's value and potential.

Insider Trends at Qorvo Inc

The insider transaction history at Qorvo Inc reveals a pattern that leans more towards selling, with 18 insider sells and only 1 insider buy over the past year. This trend could be indicative of various factors, including profit-taking or diversification of personal investment portfolios by the insiders. However, the recent purchase by Walden Rhines stands out as a counter to this trend, potentially signaling a turning point or an undervalued opportunity recognized by the insider.

Valuation and Market Cap of Qorvo Inc

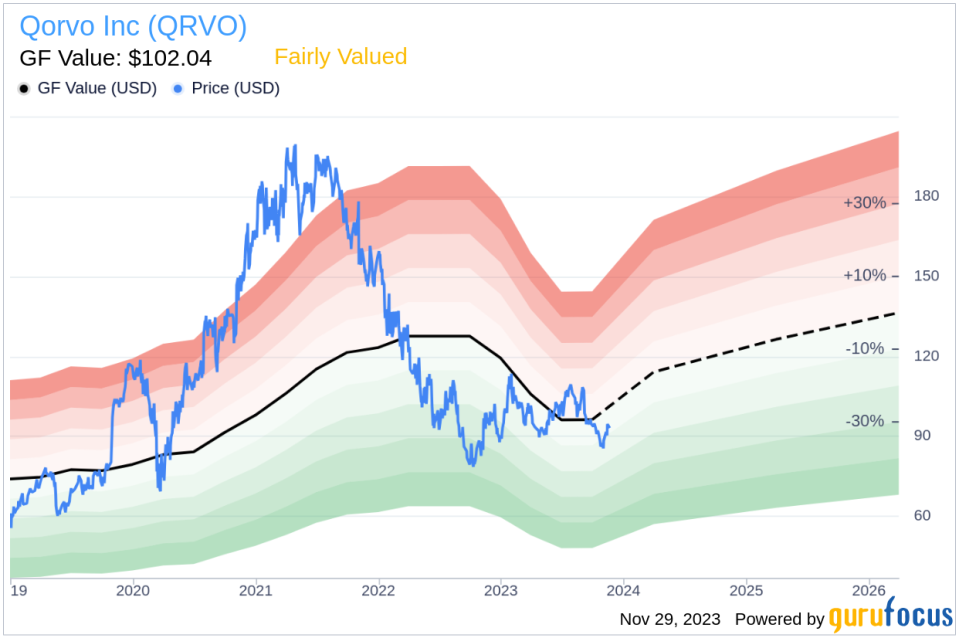

On the day of the insider's purchase, Qorvo Inc's shares were trading at $93.19, valuing the company at a market cap of $9.102 billion. This valuation places Qorvo Inc in a significant position within the semiconductor industry, reflecting its status as a key player in the market.

Qorvo Inc's Price-to-GF-Value Ratio

The price-to-GF-Value ratio is a metric used to determine whether a stock is trading at a fair value relative to its intrinsic value as estimated by GuruFocus. With a share price of $93.19 and a GF Value of $102.04, Qorvo Inc has a price-to-GF-Value ratio of 0.91, indicating that the stock is Fairly Valued based on its GF Value.

The GF Value is derived from a combination of historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. This comprehensive approach to valuation provides a robust framework for assessing the stock's intrinsic value.

Conclusion

The insider buying activity by Walden Rhines at Qorvo Inc presents an intriguing data point for investors. While the broader trend of insider transactions has skewed towards selling, the insider's recent purchase could be interpreted as a strong vote of confidence in the company's future. With the stock trading at a fair value according to the GF Value, and considering the insider's deep understanding of the semiconductor industry, this investment move warrants attention from the investment community.As with any insider transaction, it is essential to consider the broader market context and the company's fundamentals before drawing conclusions. However, the data presented here provides a factual basis for investors to further explore the potential implications of Walden Rhines' investment in Qorvo Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.