Director William Hoffman Sells 25,000 Shares of Inari Medical Inc

On October 16, 2023, Director William Hoffman of Inari Medical Inc (NASDAQ:NARI) sold 25,000 shares of the company's stock. This move is part of a larger trend for the insider, who has sold a total of 451,897 shares over the past year and has not made any purchases during the same period.

William Hoffman is a key figure at Inari Medical Inc, a company that specializes in the development, manufacturing, and marketing of medical devices designed to treat venous diseases. The company's innovative products have made a significant impact in the medical field, particularly in the treatment of deep vein thrombosis and pulmonary embolism.

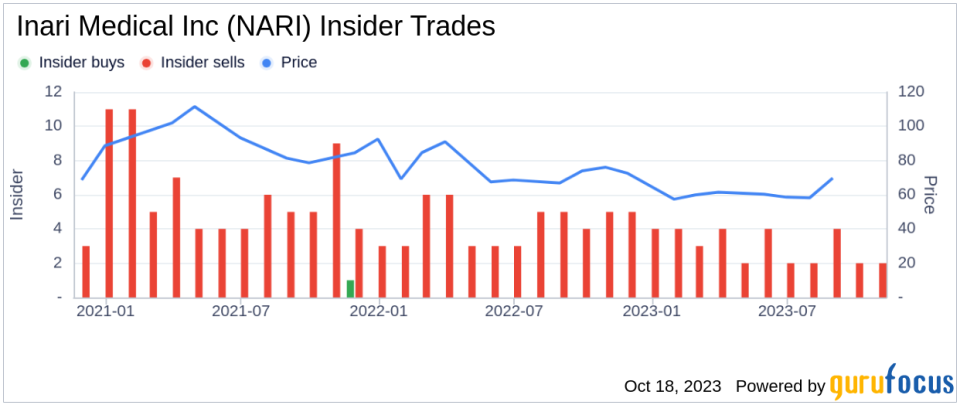

The insider's recent sell-off is part of a broader trend within Inari Medical Inc. Over the past year, there have been 40 insider sells and no insider buys. This could potentially signal a lack of confidence in the company's future performance among its top executives and directors.

Despite the insider's selling trend, Inari Medical Inc's stock price has remained relatively stable. On the day of Hoffman's recent sell, the stock was trading at $57.28, giving the company a market cap of $3.26 billion.

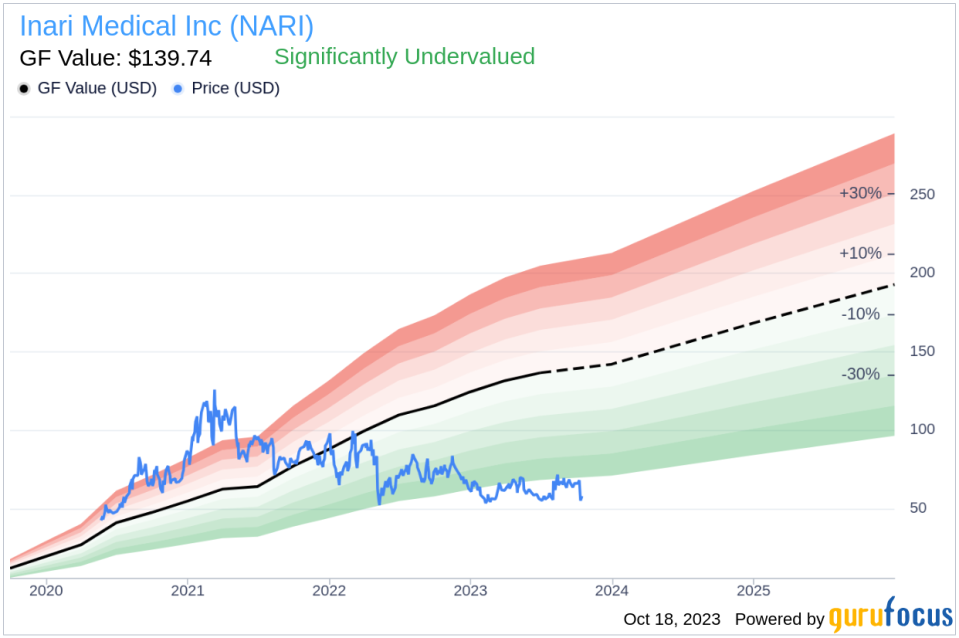

According to GuruFocus Value, Inari Medical Inc is significantly undervalued. The stock's price-to-GF-Value ratio is 0.41, indicating that it is trading well below its intrinsic value. The GF Value is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

While the insider's selling activity may raise some concerns, the stock's undervalued status suggests that it could still be a good investment opportunity. However, potential investors should carefully consider the company's insider trading trends and other relevant factors before making a decision.

It's also worth noting that while the insider has been selling shares, he still retains a significant stake in the company. This could indicate that while he may have some concerns about the company's short-term performance, he still believes in its long-term potential.

In conclusion, while the insider's recent sell-off is noteworthy, it does not necessarily signal a lack of confidence in Inari Medical Inc's future. Investors should keep a close eye on the company's insider trading activity and other key indicators to make informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.