Director William Sandbrook Sells 7,500 Shares of Comfort Systems USA Inc

On September 12, 2023, William Sandbrook, a director at Comfort Systems USA Inc (NYSE:FIX), sold 7,500 shares of the company. This move comes amidst a year where the insider has sold a total of 7,500 shares and purchased none.

William Sandbrook is a key figure at Comfort Systems USA Inc, a company that provides comprehensive heating, ventilation and air conditioning (HVAC) installation, maintenance, repair, and replacement services within the mechanical services industry across the United States. The company operates through three segments: HVAC Services, Mechanical Services, and Building Products.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. Let's delve deeper into the company's financials and insider trading trends to gain a better understanding.

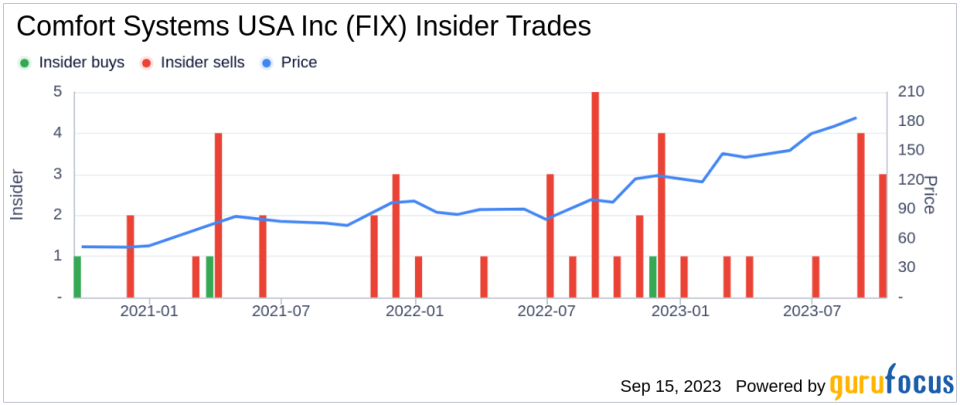

The insider transaction history for Comfort Systems USA Inc shows a trend of more sells than buys over the past year. There have been 17 insider sells and only 1 insider buy. This could indicate that insiders believe the company's shares are overvalued, prompting them to sell.

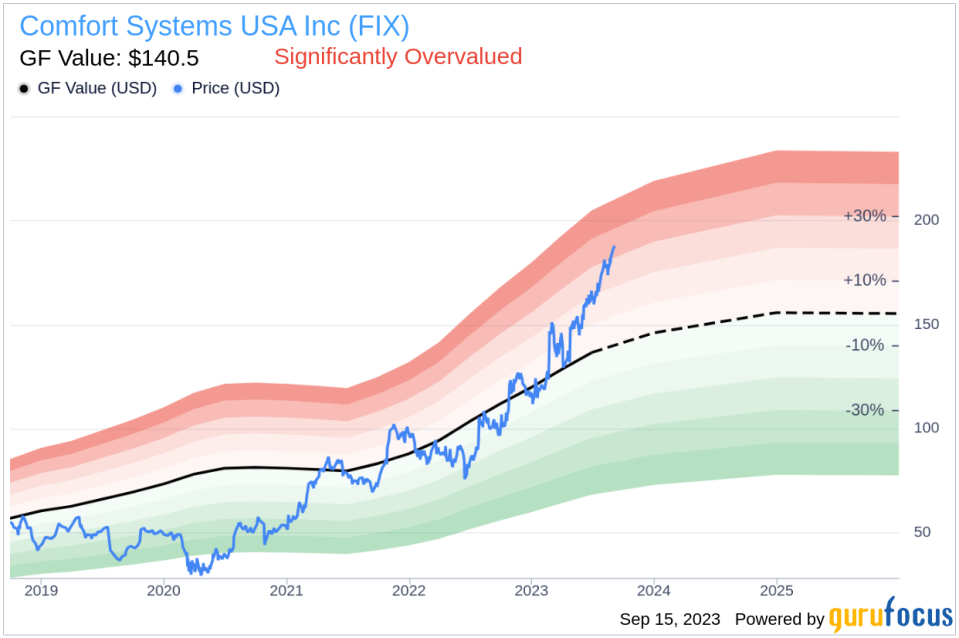

On the day of the insider's recent sell, shares of Comfort Systems USA Inc were trading at $187.52, giving the company a market cap of $6.75 billion. This is significantly higher than the company's GuruFocus Value of $140.50, suggesting that the stock is significantly overvalued.

The company's price-earnings ratio stands at 27.87, which is higher than both the industry median of 14.39 and the company's historical median price-earnings ratio. This further supports the notion that the stock is overvalued.

The GF Value, an intrinsic value estimate developed by GuruFocus, is calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts. With a price-to-GF-Value ratio of 1.33, Comfort Systems USA Inc's stock appears to be significantly overvalued.

In conclusion, the recent sell-off by the insider, coupled with the company's high valuation metrics, could be a signal for investors to exercise caution. It's always important to conduct thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.