Director Zachary Nelson Sells 8,433 Shares of Freshworks Inc (FRSH)

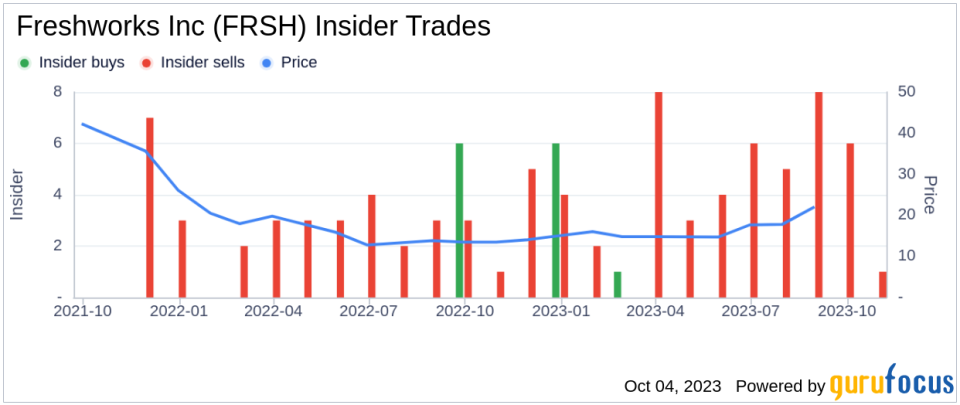

On October 2, 2023, Zachary Nelson, a director at Freshworks Inc (NASDAQ:FRSH), sold 8,433 shares of the company. This move comes amidst a flurry of insider activity at the company, with a total of 53 insider sells over the past year.

Zachary Nelson is a seasoned executive with a wealth of experience in the tech industry. He has been a director at Freshworks Inc, a customer engagement software company, for several years. Freshworks Inc provides innovative customer engagement software for businesses of all sizes, making it easy for teams to acquire, close, and keep their customers for life. The company provides a 360-degree view of the customer, helping businesses provide better service, increase sales, and more.

Over the past year, the insider has sold a total of 101,584 shares and has not made any purchases. This recent sale of 8,433 shares is just a fraction of the insider's total trades over the past year.

The insider's selling trend is worth noting, especially when considering the stock's performance. On the day of the insider's recent sale, shares of Freshworks Inc were trading for $19.49 apiece. This gives the stock a market cap of $5.46 billion.

The insider's selling activity could be interpreted in several ways. It could be a sign that the insider believes the stock is currently overvalued, or it could simply be a personal financial decision. Regardless, it's important for investors to consider this insider activity as part of their overall analysis of the stock.

Over the past year, there have been 7 insider buys and 53 insider sells at Freshworks Inc. This suggests a trend towards selling amongst insiders, which could be a bearish signal. However, it's also important to consider the context of these trades. For example, if the sells were part of a planned selling program, it might not necessarily indicate a lack of confidence in the company's future prospects.

In conclusion, while the insider's recent sale of shares is noteworthy, it's just one piece of the puzzle. Investors should also consider other factors such as the company's financial health, its competitive position, and the overall market conditions before making investment decisions.

This article first appeared on GuruFocus.