Director Zachary Nelson Sells 8,433 Shares of Freshworks Inc (FRSH)

In a recent transaction on December 4, 2023, Zachary Nelson, a Director at Freshworks Inc (NASDAQ:FRSH), sold 8,433 shares of the company. This sale is part of a series of insider transactions that have been closely monitored by investors and analysts alike, as insider activity can provide valuable insights into a company's prospects and the sentiment of its senior executives.

Who is Zachary Nelson?

Zachary Nelson is known for his role as a Director at Freshworks Inc. His involvement with the company places him in a position to understand the inner workings and future potential of the business. Directors like Nelson are privy to detailed information about the company's operations, financial health, and strategic direction, which makes their trading activities a point of interest for shareholders and potential investors.

Freshworks Inc's Business Description

Freshworks Inc is a customer engagement software company that provides innovative solutions for customer support, sales automation, and marketing. The company's suite of products is designed to improve customer experiences and enable businesses to foster meaningful relationships with their clients. Freshworks' offerings are cloud-based, making them accessible and scalable for businesses of all sizes. With a focus on ease of use and customer satisfaction, Freshworks has carved out a significant niche in the competitive software-as-a-service (SaaS) industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by the insider, Zachary Nelson, of 8,433 shares at a price of $20.63 per share has resulted in a transaction value of approximately $173,998.79. This sale is part of a broader pattern of insider selling at Freshworks Inc. Over the past year, Nelson has sold a total of 97,360 shares and has not made any purchases. This consistent selling could be interpreted in several ways. On one hand, it might suggest that the insider is taking profits or diversifying their investment portfolio. On the other hand, persistent selling by insiders could also signal a lack of confidence in the company's future growth prospects or perceived overvaluation of the stock.

The relationship between insider trading activity and stock price is complex. While insider buys can be seen as a sign of confidence in the company's future, insider sells are not always indicative of a negative outlook. Insiders might sell shares for personal financial planning reasons that have little to do with their expectations for the company. However, when analyzing insider trends, the volume and frequency of selling can provide clues about the insider's view of the stock's valuation.

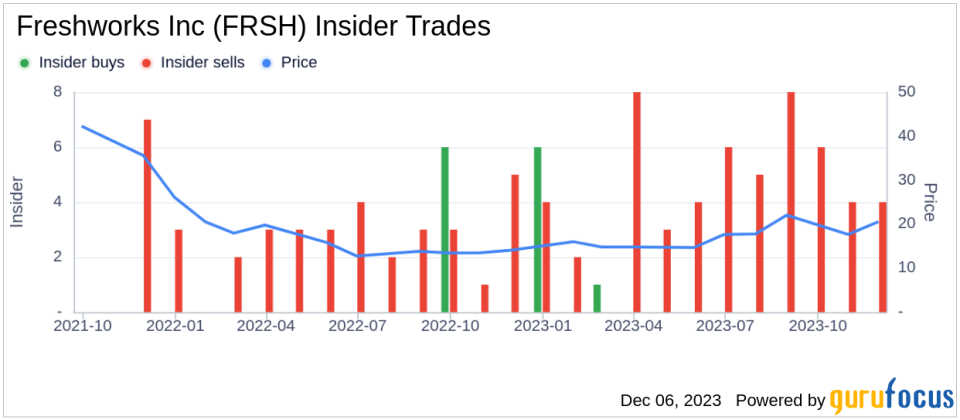

In the case of Freshworks Inc, the insider transaction history shows a disparity between insider buys and sells over the past year, with only 7 insider buys compared to 54 insider sells. This trend could suggest that insiders, on balance, are more inclined to sell their shares than to purchase additional ones. Investors often look at such trends to gauge insider sentiment, although it's important to consider the broader market and economic context when interpreting these actions.

The stock's market cap of $6.165 billion, as of the date of Nelson's recent sale, reflects the aggregate value that the market places on Freshworks Inc. The stock price, in conjunction with the market cap, can be used to assess the company's valuation metrics and compare it to industry peers. A high market cap relative to earnings or sales might suggest a premium valuation, which could be a factor in an insider's decision to sell shares.

Conclusion

The sale of shares by Director Zachary Nelson is a significant event that warrants attention from Freshworks Inc's investors. While it is not uncommon for insiders to sell shares for various reasons, the pattern and volume of sales by insiders at Freshworks Inc over the past year could be a signal worth considering in the context of the company's valuation and stock performance. As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock, and investors should consider a wide range of factors, including company fundamentals, industry trends, and broader market conditions, before making investment decisions.

Investors and analysts will continue to monitor insider activity at Freshworks Inc for further clues about the company's direction and the confidence level of its key executives and directors. As the market digests this information, it will be reflected in the stock's performance, providing ongoing opportunities for those who keep a close eye on these insider trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.