Dive Into DEM for Diversification and Dividends

Emerging markets are developing countries that are at various stages in their transition to becoming developed countries. Examples of large developing countries are China, India, Brazil, Russia, South Africa and Indonesia. Developed countries are the United States, Germany, Japan, France, Canada, the U.K. and other European Union countries. There is no bright line distinction as many countries still being classified as "emerging" are actually quite advanced, both technologically and financially, like Taiwan and South Korea and many countries labeled as "developed" may not be, like many in Eastern and Southern Europe.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

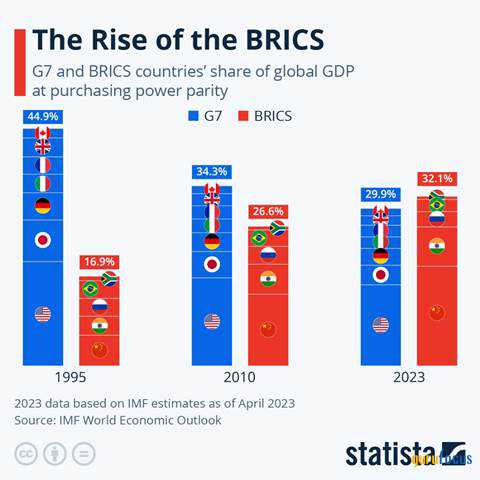

The following chart from Statistica shows the rapid rise of the largest developing countries (BRICS) versus the group of largest developed countries (G7) over the last 18 years. Collectively, the BRICS are not only larger than the G7, but growing much faster.

In general, the rapid growth characteristic of emerging market economies presents investors with the potential for greater returns. However, this heightened growth is often accompanied by increased exposure to inherent risks associated with their developing status as well as currency and governance risk. As time progresses, emerging markets tend to adopt characteristics commonly observed in more developed markets, contributing to their evolution and increased stability. This includes regulations, the rule of law, banking systems and a market-based economy.

The appeal of WisdomTree Emerging Markets High Dividend Fund (DEM), an exchange-traded fund, is the low valuation, high dividend and diversification benefits it provides with one purchase, which is common to ETFs. This ETF is cost effective with a management expense ratio of 0.63% per annum. The net assets of the fund are approximately $2.5 billion, so it is of substantial size.

The dividend is paid quarterly and the current dividend yield is 7.12%. Dividends are an important part of the return profile of the WisdomTree Emerging Markets High Dividend Fund. The following chart shows the performance of the ETF without (blue line) and with the dividend (red line).

Source: Morningstar.com

This fund holds 451 securities, so it is a good way to get broad diversification in emerging markets at low cost and convenience.

The top 10 holding of the fund are as follows:

Vale SA | Metals & Mining | 319,443.90 | 4.96 | |

Petroleo Brasileiro SA Petrobras | Oil & Gas | 497,697.34 | 4.19 | |

MediaTek Inc. | Semiconductors | 1,438,890.02 | 3.63 | |

China Construction Bank Corp. | Banks | 1,155,026.77 | 3.32 | |

Industrial and Commercial Bank of China Ltd. | Banks | 1,713,790.06 | 2.23 | |

Bank of China Ltd. | Banks | 1,133,493.98 | 1.96 | |

Hon Hai Precision Industry Co. Ltd. | Hardware | 1,420,804.52 | 1.92 | |

Nan Ya Plastics Corp. | Chemicals | 540,882.06 | 1.91 | |

PetroChina Co. Ltd. | Oil & Gas | 1,335,815.68 | 1.86 | |

POSCO Holdings Inc. | Steel | 35,168,621.95 | 1.82 |

According to the recent data provided by GuruFocus, the fund is currently trading at just under 6 times earnings and approximately 0.9 times book value. (corresponding data for S&P 500 (SPY) is a price-earnings ratio of 20 and a price-book ratio of 3.85). Notably, the appeal of this ETF lies in its substantial investments in industries such as materials, energy and industrials, offering an opportunity to tap into these sectors at a comparatively lower valuation. Embracing a more contrarian approach, this ETF presents itself as a distinctive play within the emerging market investment landscape.

Strategy

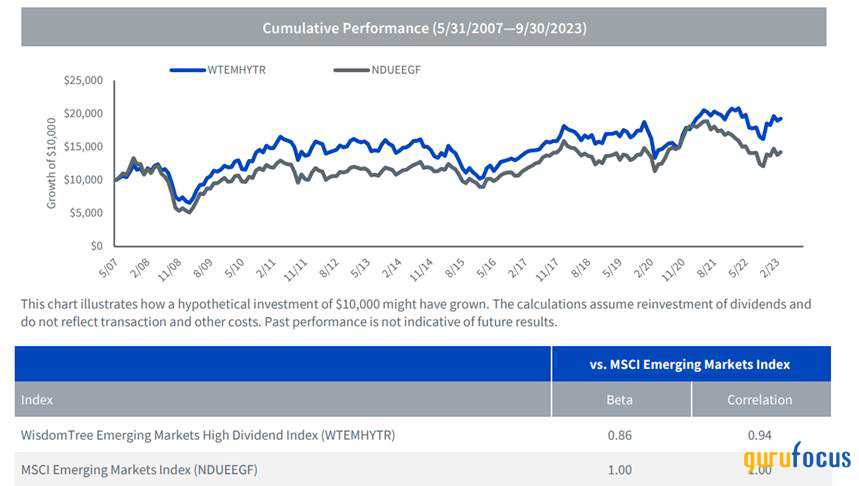

The fund focuses on selecting stocks in emerging markets which pay out substantial dividends. Dividends offer an impartial gauge of a company's well-being and profitability, regardless of the influence of accounting practices or government interventions. By prioritizing the weighting of stocks based on their dividend stream, this approach has the potential to amplify the impact of dividends on performance. This may result in heightened returns or diminished volatility when compared to conventional market cap-weighted strategies. The tangible advantage of this investment strategy becomes apparent when examining the historical performance of the WisdomTree Emerging Markets High Dividend Index as compared to its benchmark MSCI Emerging Market Index.

Source: Fund website

Methodology for stock selection

WisdomTree uses the following crieria to select stocks to include in the ETF. The fund is rebalanced every year.

Source: Fund website

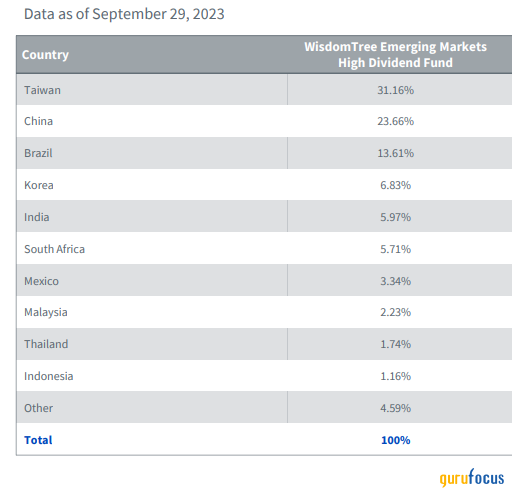

The WisdomTree Emerging Markets High Dividend Fund invests in a number of emerging markets. The highest weighting is given to Taiwan at 31%, followed by China at 23.66%. As can be seen below, among emerging markets, the focus is on more advanced economies within this developing countries grouping.

Source: Fund website

The major issue when it comes to WisdomTree is the roughly 54% exposure to Taiwan and China, both of which carry geopolitical risks. Any escalation in the tensions between these two countries (and the U.S.) could negatively impact the fund's performance. Thus, investors should be cautious of their total China exposure as they invest in this fund.

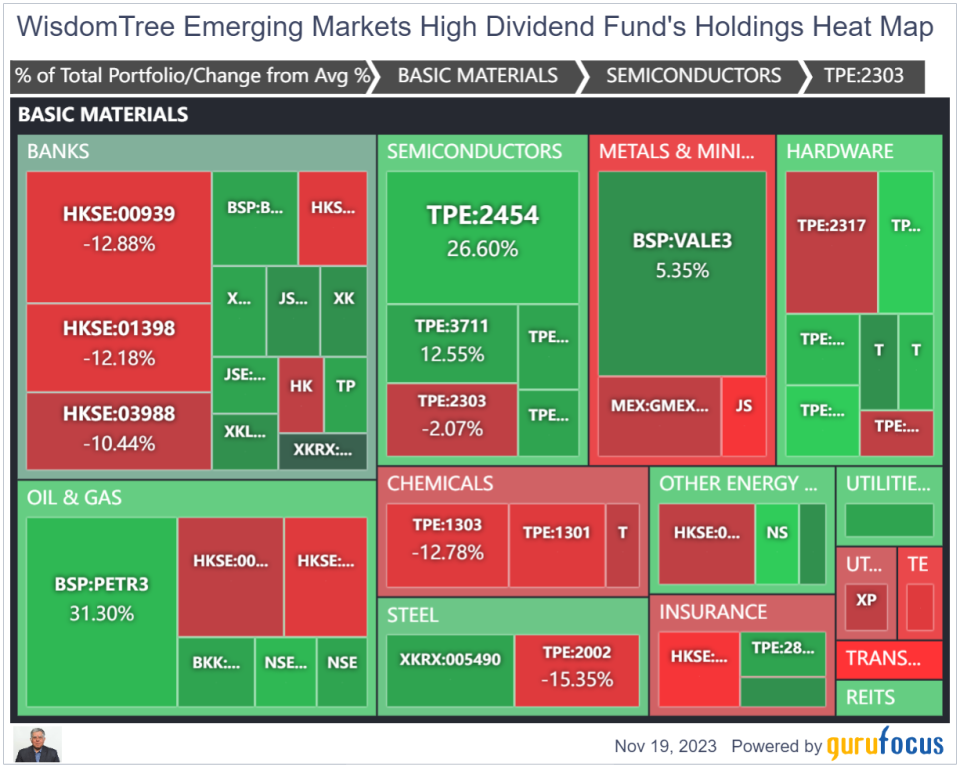

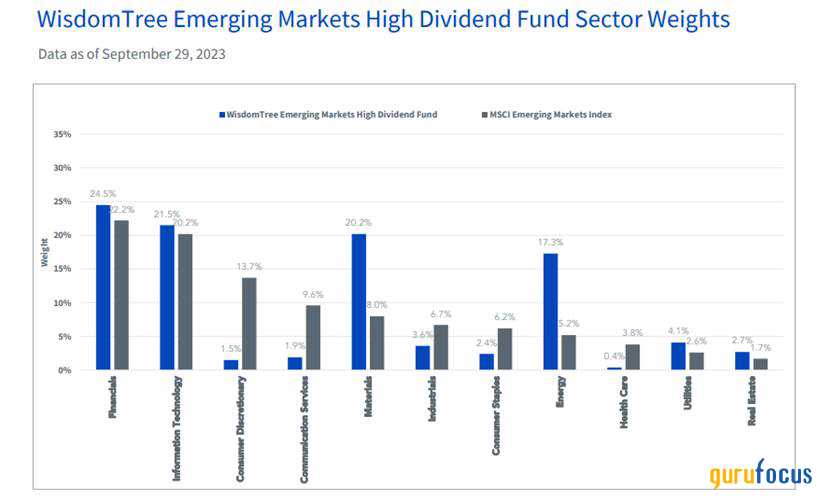

The sector weights of the WisdomTree Emerging Markets High Dividend Fund are as follows:

Source: Fund website

The ETF is more overweighted toward materials and energy as compared to the MSCI index.

Why invest in emerging markets

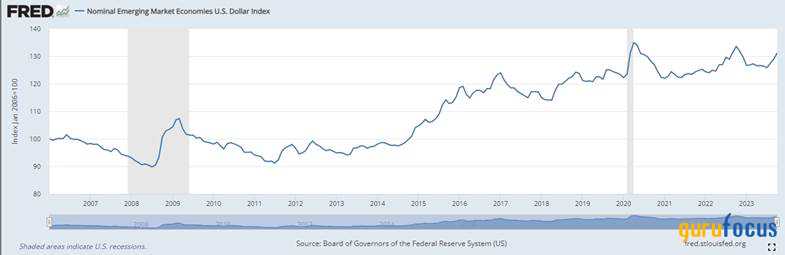

Several factors contribute to the growing appeal of emerging market stocks. A key driver is the anticipated weakening of the U.S. dollar, after a long period of strength, which experts believe will provide a favorable tailwind for emerging markets. Currently, the U.S. dollar is riding very high as compared to emerging market currency. If the dollar weakens, this could provide a huge tailwind to emerging market securities. Therefore, the ETF provides a built-in currency hedge.

As the possibility of a recession in developed markets becomes more apparent, investors are recognizing the potential for other economies to recover. This shift is expected to lead to the outperformance of other currencies over time, creating opportunities for emerging markets.

Furthermore, maturing economies within emerging markets are reaping the benefits of structural reforms, as evidenced by reduced debt-to-gross domestic product ratios and increased stability. Despite the market's lag in acknowledging these improvements, the structural reforms have eliminated fixed exchange rates, lowered debt levels and reduced political uncertainty, resulting in valuations at a 50% discount as compared to the U.S. stock market.

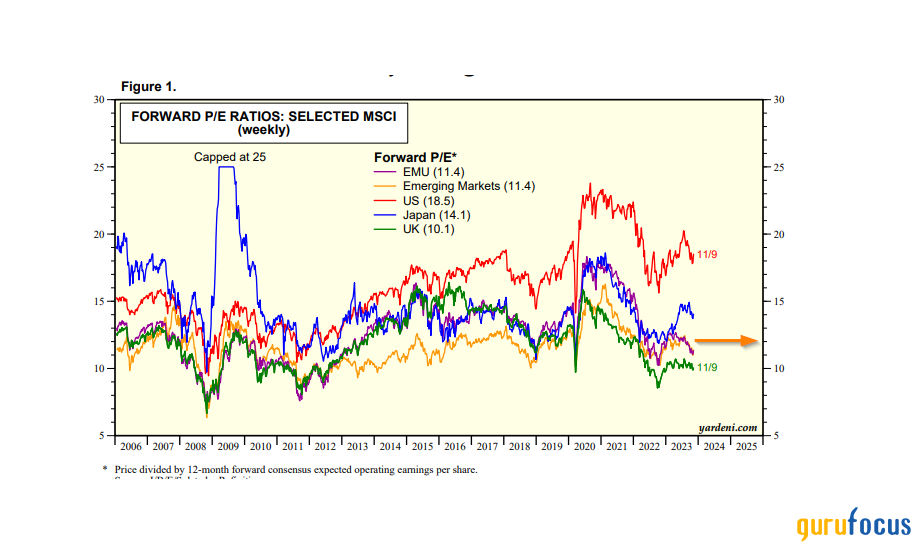

Valuation in emerging markets are lower (with the exception of the U.K.).

Source: Yardeni.com

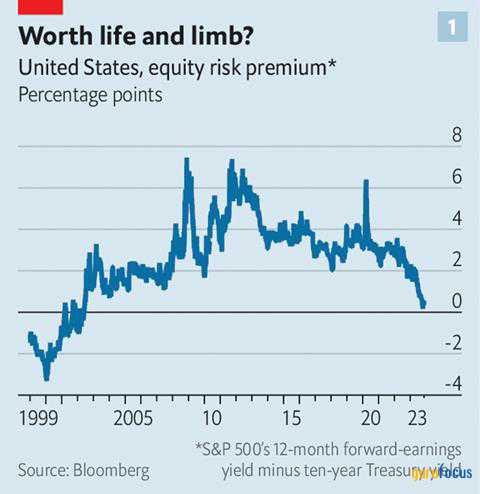

As the following chart from the Economist indicates, investors are not being adequately compensated for taking equity risk over bonds in the U.S. given the market's high valuation.

Source: Economist

Conclusion

Diversification has often been called the only free lunch in investing. It is received wisdom that a portfolio made up of building blocks capable of moving in different directions can have better risk-adjusted returns than its component parts. Allocating to different asset classes can also minimize pain during market corrections and crashes.

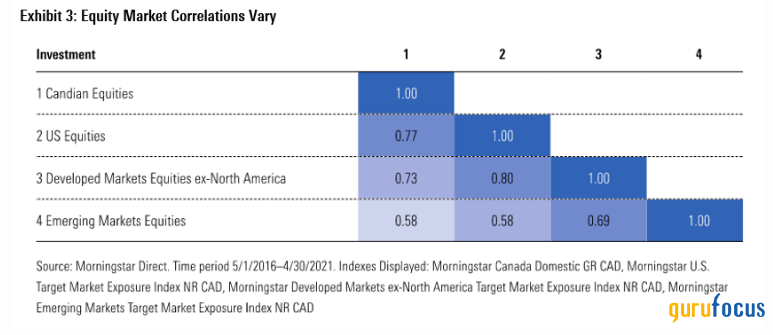

The following chart from Morningstar show correlation of various equity investment classes. Emerging market equities are 58% correlated to the Canadian and U.S. stock markets and 695 correlated to developed markets as a whole.

Source: Morningstar.ca

The WisdomTree Emerging Markets High Dividend Fund aims to provide diversification into emerging market equity asset class and produce a solid income from dividends. It also lets investors avoid single security risk and reduces country-specific risk at a reasonable cost. Thus, it is suitable for retirement portfolios. In my opinion, it is vital for investors to seek exposure to high-growth emerging economies as part of a diversified portfolio, in spite of inherent risks.

The ETF provides a vehicle to invest in high-yielding companies within emerging markets, offering a strategic option for diversifying income strategies or serving as a substitute for both active and passive approaches in the emerging market sector. Additionally, the fund addresses the demand for a combination of growth potential and income focus in investment portfolios. The fund is well rated by the investment advisory service Morningstar with a rating of four stars (out of five).

This article first appeared on GuruFocus.