Is Diversicare Healthcare Services (NASDAQ:DVCR) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Diversicare Healthcare Services, Inc. (NASDAQ:DVCR) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Diversicare Healthcare Services

How Much Debt Does Diversicare Healthcare Services Carry?

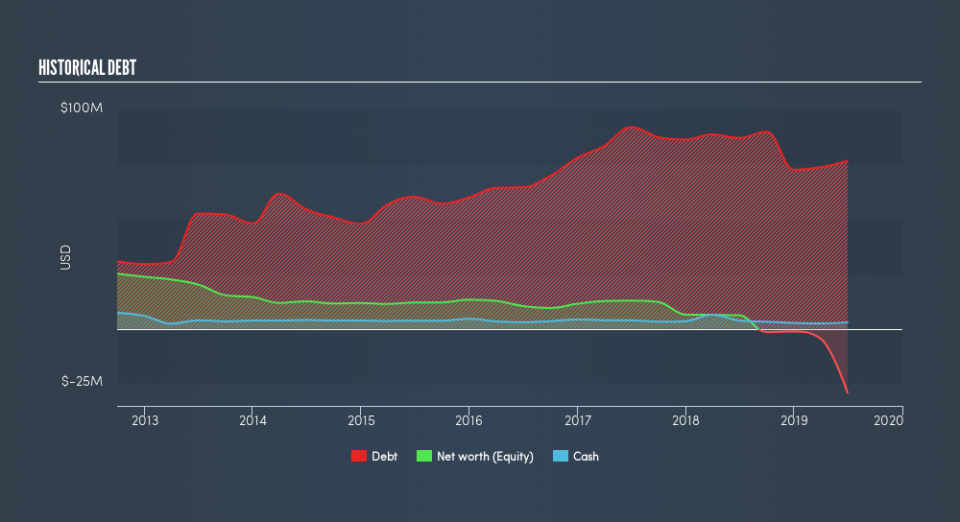

As you can see below, Diversicare Healthcare Services had US$76.6m of debt at June 2019, down from US$87.0m a year prior. However, it does have US$2.99m in cash offsetting this, leading to net debt of about US$73.6m.

How Healthy Is Diversicare Healthcare Services's Balance Sheet?

The latest balance sheet data shows that Diversicare Healthcare Services had liabilities of US$89.8m due within a year, and liabilities of US$449.6m falling due after that. On the other hand, it had cash of US$2.99m and US$72.1m worth of receivables due within a year. So its liabilities total US$464.2m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$21.1m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Diversicare Healthcare Services would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Diversicare Healthcare Services shareholders face the double whammy of a high net debt to EBITDA ratio (5.2), and fairly weak interest coverage, since EBIT is just 0.51 times the interest expense. This means we'd consider it to have a heavy debt load. Worse, Diversicare Healthcare Services's EBIT was down 80% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Diversicare Healthcare Services will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Diversicare Healthcare Services burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Diversicare Healthcare Services's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And even its interest cover fails to inspire much confidence. It's also worth noting that Diversicare Healthcare Services is in the Healthcare industry, which is often considered to be quite defensive. It looks to us like Diversicare Healthcare Services carries a significant balance sheet burden. If you play with fire you risk getting burnt, so we'd probably give this stock a wide berth. While Diversicare Healthcare Services didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away.Click here to see if its earnings are heading in the right direction, over the medium term.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.