The Diversification Conundrum of High Yield Stock Investing

The S&P 500 index currently offers investors an average dividend yield of a scant 1.4%. You probably couldn't live off of the income stream such a yield would generate unless, of course, you own a particularly large nest egg. So, most dividend-focused investors, particularly those in retirement, will probably be looking for stocks with notably higher yields.

There are plenty of these high-yield offerings to choose from, but there's a potential problem you need to address before you start making any decisions about which ones to add to your portfolio.

Some good places to find income stocks

Real estate investment trusts (REITs) and utilities are two great places to look for dividend stocks. Financially strong REITs with decades of annual dividend increases under their belts, like Realty Income (NYSE: O), can be bought with a yield over 5%. In the utility sector, you can buy Dividend King Black Hills (NYSE: BKH) with a yield of 4.9%.

These aren't anomalies, either; they are just examples of the attractive dividend yields that are often on offer in the REIT and utility sectors. There's another option for finding dividend stocks, though. Sometimes a sector will hit on hard times, and you can pick up some of the strongest companies on the cheap and with historically high yields. During the early days of the coronavirus pandemic, for example, you could have bought integrated energy giants ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) with historically high yields nearing 10%.

There's a potential problem here, though, and that's diversification. REITs and utilities are generally filled with high-yield investments most of the time. And industries that have fallen on hard times, by definition, are a concentrated investment opportunity. If all you look at is dividend yield, you may end up with too many stocks from too few industries. You need to cast a wider net, and that may require you to consider lower-yielding investments.

It's all relative

As an example, Texas Instruments (NASDAQ: TXN) has a yield of around 3.1% today. That's not nearly as good as the 5%-plus you could get from Realty Income or its peers, including NNN (NYSE: NNN) and W.P. Carey (NYSE: WPC). However, the chipmaker has increased its dividend annually for decades, and the dividend yield today happens to be near the highest levels in the company's history.

Would you be better off owning three companies that do almost the exact same thing or two companies in completely different industries? From a diversification standpoint, spreading your eggs into different baskets is likely to be the safer choice. Technology companies with high yields, like Texas Instruments today, can be tough to find, so when they do show up, you might want to consider adding them to your portfolio to spread your bets around a little more.

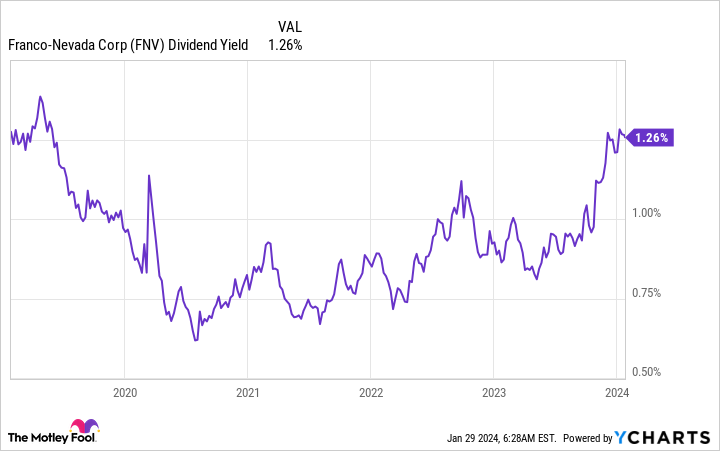

Gold and silver streamer Franco-Nevada (NYSE: FNV) is another example. It has a 1.2% yield, which is near its highest levels over the past five years. Yes, the yield is modest on an absolute basis, but gold is a hard asset that investors often include in a portfolio specifically for diversification. Franco-Nevada might be worth a deep dive.

The thing is, you have to think beyond yield to view Texas Instruments and Franco-Nevada as options for your portfolio. And there are more that could be added to the list, as well. For example, medical device maker Medtronic (NYSE: MDT) has a historically high 3.1% yield. That 3.1% yield isn't as attractive as what you could get from many utilities today, but if all you buy is utilities, you expose yourself to concentration risk. That's a risk that you can easily avoid if you take just a little broader view with your dividend approach and opportunistically add companies in other areas, like healthcare.

Yield is important but not the only consideration

There isn't one right way to invest, but there are ways that have a history of leading to problems. One big mistake that investors make is focusing so much on yield that they fail to adequately diversify their portfolios. The reason is simple: High-yield stocks are often found in the same sectors. Take a look at your portfolio. If you are highly concentrated in just a few sectors, you might want to widen your investment lens. You may have to lower your yield expectations, but the long-term diversification benefit will likely be well worth it (and it will probably help you sleep better at night, too).

10 stocks we like better than Walmart

When our analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Walmart wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of 1/29/2024

Reuben Gregg Brewer has positions in Black Hills, Franco-Nevada, Medtronic, Realty Income, and Texas Instruments. The Motley Fool has positions in and recommends Chevron, Realty Income, and Texas Instruments. The Motley Fool recommends Medtronic and W. P. Carey. The Motley Fool has a disclosure policy.

The Diversification Conundrum of High Yield Stock Investing was originally published by The Motley Fool