Diversify Emerging Markets Exposure Away From Xi’s Control With ROAM

This article was originally published on ETFTrends.com.

Many emerging markets investors are looking to diversify away companies under Chinese President Xi Jinping’s control without sacrificing performance.

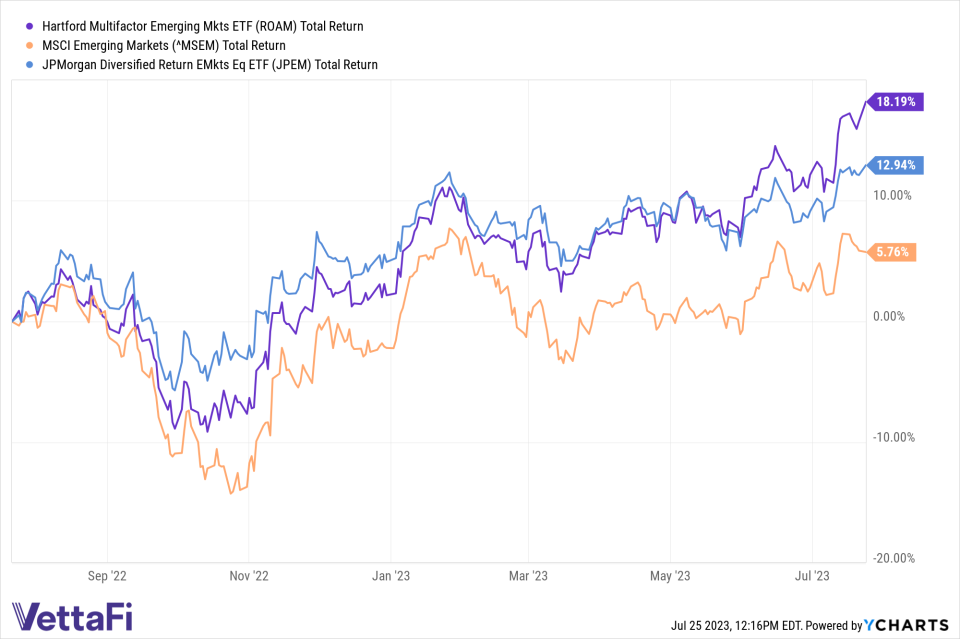

A solution for investors may be the Hartford Multifactor Emerging Markets ETF (ROAM), which underweights mega-cap tech and China compared to category peers and the benchmark MSCI Emerging Markets index. The fund is notably outperforming the largest ETFs in the segment.

ROAM provides less exposure to Chinese companies than the Vanguard FTSE Emerging Markets ETF (VWO), the SPDR Portfolio Emerging Markets ETF (SPEM), the Schwab Emerging Markets Equity ETF (SCHE).

ROAM is also impressively beating VWO, SPEM, and SCHE over various periods. Over a one-year period, ROAM is up 18.2%, outpacing each of the other funds by over 1000 basis points. SPEM, VWO, and SCHE are up 7.2%, 6.5%, and 5.5%, respectively, during the same period.

See more: “ROAM Performance Edge Is in the Details”

Not All Emerging Markets Multifactor Strategies Are the Same

In addition to underweighting China, ROAM is unique in that it is underpinned by a multifactor strategy and targets lower volatility securities. The Hartford Funds’ ETF provides broad exposure to emerging market equities while also seeking to reduce volatility by targeting a 15% volatility reduction over a complete market cycle.

However, a multifactor strategy doesn’t guarantee outperformance – demonstrated by ROAM handily outpacing a multifactor emerging markets peer. The JPMorgan Diversified Return Emerging Markets Equity ETF (JPEM) targets the same factors as ROAM and also underweights China compared to SPEM, SCHE, and VWO. But despite the similarities, there are many differences. Perhaps most notable is the wide return gap between ROAM and JPEM.

See more: “Optimize International Exposure for Current Opportunities”

Over the same one-year period, JPEM is up 12.9% -- trailing ROAM by 525 basis points. ROAM also beats JPEM over five- and three-year periods, as well as year to date.

JPEM has outperformed the other vanilla ETFs in the segment, but it lacks an edge against ROAM considering the two funds have identical expense ratios (44 basis points.)

For more news, information, and analysis, visit the Multifactor Channel.

Investing involves risk, including the possible loss of principal.

This article was prepared as part of Hartford Funds paid sponsorship with VettaFi. Hartford Funds is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, a recommendation for any product or as investment advice.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM