Dividends and Capital Gains Opportunities at Gray Television

Gray Television Inc. (NYSE:GTN) is a broadcasting powerhouse, the second largest in the U.S. Its stations serve 113 television markets that reach 36% of American households. Of those stations, 79 are ranked number one in their markets, while 101 enjoy the highest or second-highest rankings.

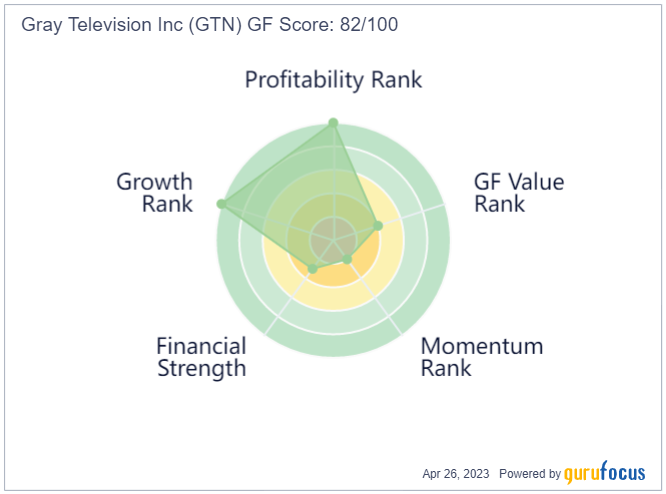

It has some decent fundamentals, as shown by the GF Score of 82 out of 100, and a high dividend yield of 4.22%.

Warning! GuruFocus has detected 6 Warning Signs with GTN. Click here to check it out.

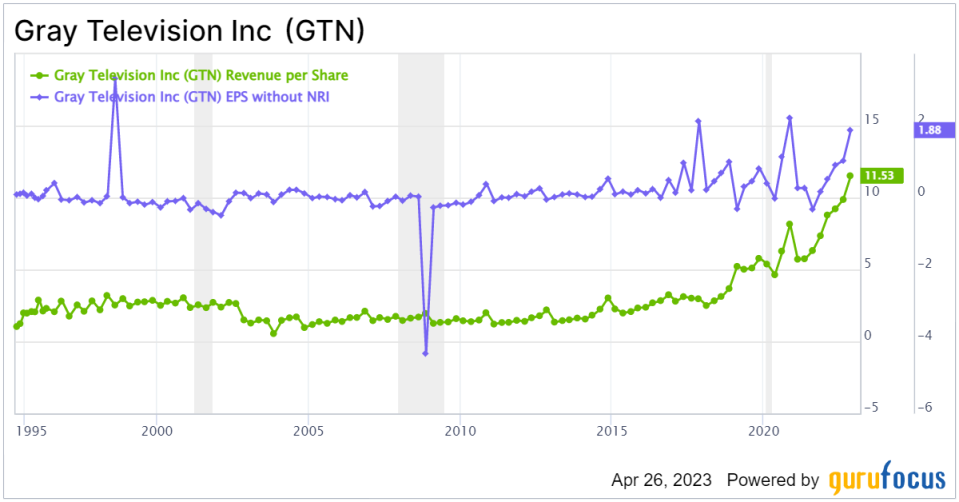

Dividends and Capital Gains Opportunities at Gray Television The company has also grown revenue and earnings per share at a breakneck pace in recent years:

Dividends and Capital Gains Opportunities at Gray Television

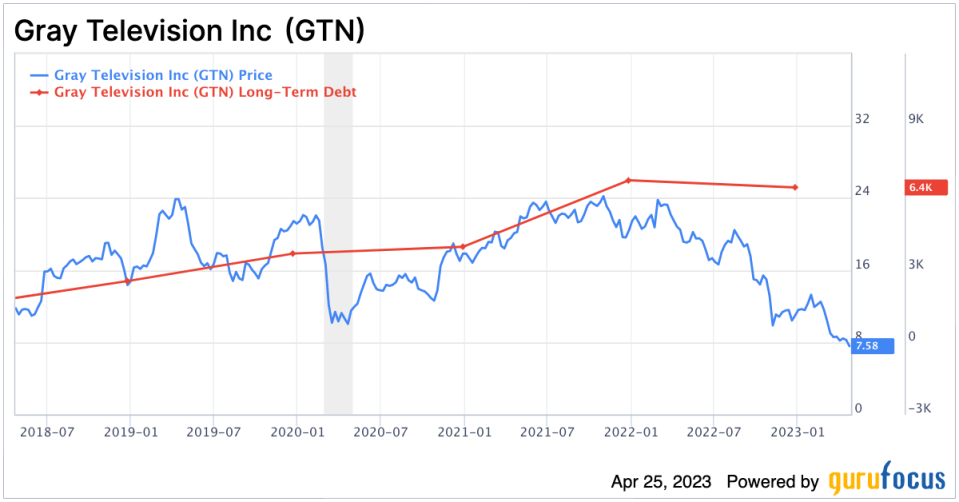

GTN Data by NYSE:MDP) local media group around that time.Dividends and Capital Gains Opportunities at Gray Television Another reason for the lack of investor confidence could come from the current adverse macro environment. In its fourth-quarter earnings release, the company said, Looking ahead, we anticipate that our television stations and production companies will maintain revenues at a level generally flat with recent years should macroeconomic conditions, particularly in local markets, slow during 2023.

However, Gray also reassured investors, "Despite concerns about a possible macroeconomic recession discussed publicly in the general media and by certain sectors of the economy, we believe that our businesses performed well throughout last year and have started 2023 in a strong position.

All in all, it seems like Gray is being unfairly discounted in my view. At the very least, it shouldn't have a price-earnings ratio of just 1.75.Here's why I think this company has rebound potential.

Elections could provide a boost

As the following graphic from a February 2023 company presentation shows, election ads bring in significant amounts of revenue for Gray, especially during presidential election years:

Dividends and Capital Gains Opportunities at Gray Television Dividend

An indication of Gray's business confidence comes from the continuing dividend, which is currently $0.08 per quarter or $0.32 annually. That works out to a yield of 4.22%, thanks mainly to the fact the share price that has fallen to around $7.61 as of this writing.

The board of directors has also authorized further share repurchases after buying back 12.6 million shares for $50 million in 2022. That's a good chunk considering the company's market cap is just $716 million.

Profitability

Turning to fundamentals, Gray is highly profitable. Its operating margin of 26.88 is industry-leading for the media - diversified industry. The net margin is 12.38%, and the company has been profitable every year for the past 10 years.

The three-year revenue growth has averaged 23.00% per year. Meanwhile, Ebitda has increased by an average of 26.60% per year and earnings per share without non-recurring items has shot up by an average of 50.50% per year over the past three years. Free cash flow also has grown, albeit more slowly, at an average of 15.40% per year over the past three years.

Valuation

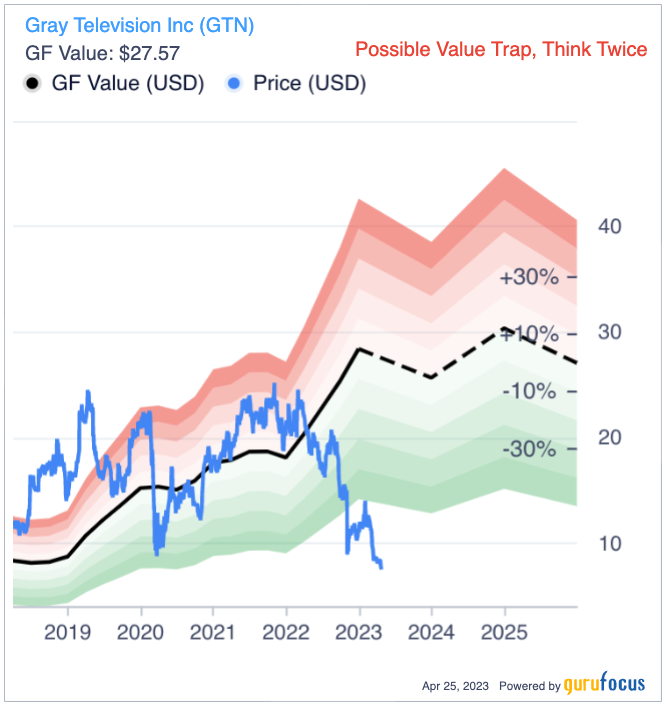

The share price has fallen so far that it has a price-earnings multiple of just 1.75, which is remarkably low. Divide that by a high five-year Ebitda growth rate of 18.80% and the PEG ratio is tiny at 0.09.

Using the GuruFocus discounted cash flow calculator, I plugged in an earnings per share growth rate estimate of 19.6% per year for the next decade as well as a discount rate of 10%, which gives me an intrinsic value estimate of $145.33, which is 19 times higher than the share price as of this writing.

The GF Value chart does warn of a possible value trap due to an extremely weak balance sheet. The low interest coverage ratio of 2.79 is worrying, but as long as earnings continue to grow this shouldn't be a problem.

Dividends and Capital Gains Opportunities at Gray Television Gurus

Five gurus held positions in Gray at the end of 2022, according to 13F filings. The biggest stake among them was that of Seth Klarman (Trades, Portfolio) of The Baupost Group, who owned 3,510,000 shares. Mario Gabelli (Trades, Portfolio) of GAMCO Investors held 379,655 shares, while John Hussman (Trades, Portfolio) of Hussman Strategic Advisors owned 186,000 shares.

Institutional investors held 49.12% of shares outstanding, while insiders owned a solid 4.18%. The biggest holding among the insiders was that of Hilton Howell, Jr., the Chairman, President and CEO, with 617,609.00 shares as of Feb. 7, 2023.

Investors should be aware that 13F filings do not give a complete picture of a firms holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Too good to be true?

With everything seeming to favor Gray as an ideal value, dividend and capital gains stock, is this too good to be true? I would say it is not. While television has been buffeted by disruptive streaming that led to market fragmentation and new forms of competition, it is still a viable business. Its stations remain relevant and powerful thanks to a strategy of emphasizing local news. Gray Television is deeply discounted, despite its strong fundamentals and dividend.

This article first appeared on GuruFocus.