Divisadero Street Capital Management, LP Boosts Stake in Tactile Systems Technology Inc

Divisadero Street Capital Management, LP (Trades, Portfolio), a Miami-based investment firm, has recently increased its holdings in Tactile Systems Technology Inc (NASDAQ:TCMD), a leading medical technology company. This article provides an in-depth analysis of the transaction, the profiles of both the firm and the traded company, and the potential impact of this move on the firm's portfolio.

Details of the Transaction

The transaction took place on July 28, 2023, with Divisadero Street Capital Management, LP (Trades, Portfolio) adding 566,435 shares of Tactile Systems Technology Inc to its portfolio. The shares were traded at a price of $22.43 each. This move has increased the firm's total holdings in the company to 1,371,435 shares, representing 12.75% of its portfolio. The transaction has a 5.27% impact on the firm's portfolio and makes up 5.90% of the total shares of Tactile Systems Technology Inc.

Profile of Divisadero Street Capital Management, LP (Trades, Portfolio)

Divisadero Street Capital Management, LP (Trades, Portfolio) is an investment firm located at 444 Brickell Avenue, Miami, Florida. The firm manages a portfolio of 45 stocks, with a total equity of $229 million. Its top holdings include Red Robin Gourmet Burgers Inc (NASDAQ:RRGB), Tactile Systems Technology Inc (NASDAQ:TCMD), EverQuote Inc (NASDAQ:EVER), Kura Sushi USA Inc (NASDAQ:KRUS), and Xponential Fitness Inc (NYSE:XPOF). The firm primarily invests in the Consumer Cyclical and Technology sectors.

Overview of Tactile Systems Technology Inc

Tactile Systems Technology Inc, based in the USA, is a medical technology company that develops and provides medical devices for the treatment of chronic diseases. The company's proprietary platform, Flexitouch System, offers home-based solutions for lymphedema patients. The company has a market capitalization of $534.663 million and a current stock price of $23.01. Despite operating at a loss, the stock is modestly undervalued according to the GF Valuation, with a GF Value of $32.66.

Performance of Tactile Systems Technology Inc's Stock

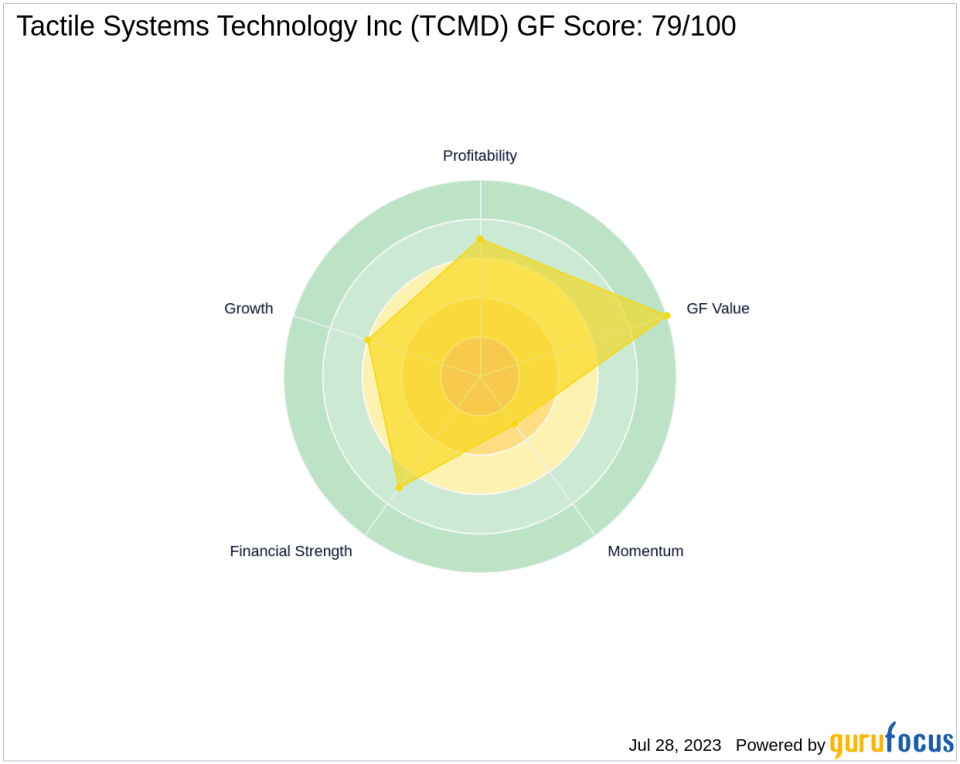

Since its IPO on July 28, 2016, Tactile Systems Technology Inc's stock has seen a price change ratio of 122.32%. The year-to-date price change ratio stands at 94.18%. The stock has a GF Score of 79/100, indicating future performance potential that is on par with the stock market. It also holds a Balance Sheet Rank of 7/10, a Profitability Rank of 7/10, and a Growth Rank of 6/10.

Other Gurus' Investment in Tactile Systems Technology Inc

Divisadero Street Capital Management, LP (Trades, Portfolio) is not the only guru investing in Tactile Systems Technology Inc. Ken Fisher (Trades, Portfolio) also holds shares in the company. The largest guru holding the most shares in the company is First Eagle Investment (Trades, Portfolio) Management, LLC.

Conclusion

In conclusion, Divisadero Street Capital Management, LP (Trades, Portfolio)'s recent acquisition of additional shares in Tactile Systems Technology Inc is a significant move that increases the firm's stake in the medical technology company. Given the company's undervalued status and promising GF Score, this transaction could potentially enhance the firm's portfolio performance. However, as with any investment, it is crucial to monitor market trends and company performance closely.

This article first appeared on GuruFocus.