DLH Holdings Corp Reports Notable Revenue Growth and EBITDA Expansion in Q1 Fiscal 2024

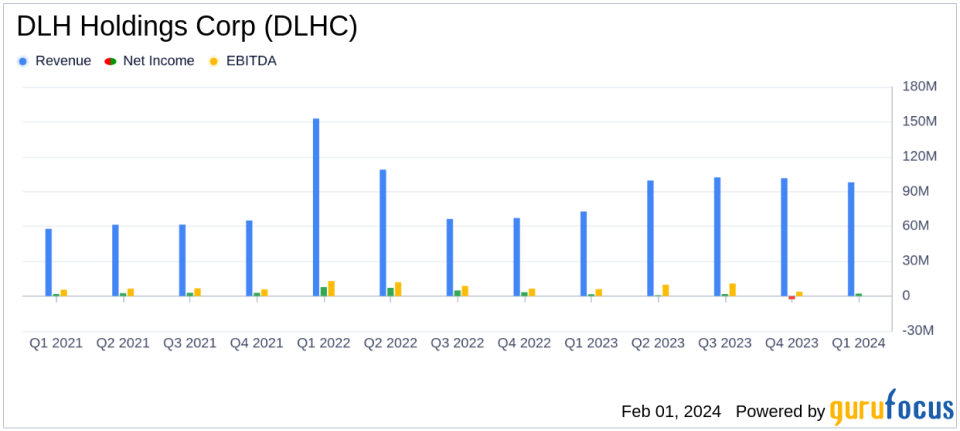

Revenue: Increased to $97.9 million in Q1 FY2024 from $72.7 million in Q1 FY2023.

Net Income: Rose to $2.2 million, or $0.15 per diluted share, compared to $1.5 million, or $0.11 per diluted share in the prior year's quarter.

EBITDA: Improved significantly to $11.1 million, representing 11.3% of revenue.

Debt Reduction: Total debt decreased to $174.4 million, with voluntary prepayments of $5 million during the quarter.

Contract Backlog: Stood at $653.5 million, a decrease from $704.8 million at the end of FY2023.

On January 31, 2024, DLH Holdings Corp (NASDAQ:DLHC), a prominent provider of technology-enabled solutions to federal agencies, announced its financial results for the first quarter of fiscal year 2024, which ended December 31, 2023. The company released its 8-K filing, showcasing a strong start to the fiscal year with significant revenue growth and EBITDA expansion.

Company Overview

DLH Holdings Corp is a provider of technology-enabled business process outsourcing and program management solutions in the United States. The company serves several government agencies, including the Department of Veteran Affairs, and is engaged in public health, performance evaluation, and health operations. DLHC leverages digital transformation, artificial intelligence, analytics, cloud-based applications, and telehealth systems to address the complex challenges faced by civilian and military customers.

Financial Performance and Challenges

DLHC's revenue for the first quarter of fiscal 2024 was $97.9 million, a substantial increase from $72.7 million in the same quarter of the previous fiscal year. This growth was largely attributed to the company's strategic acquisition in December 2022. Net income also saw an uptick to $2.2 million, or $0.15 per diluted share, compared to $1.5 million, or $0.11 per diluted share, in the first quarter of fiscal 2023. The increase in net income was a result of higher income from operations, despite a rise in interest expense.

EBITDA for the quarter stood at $11.1 million, compared to $6.3 million in the prior-year period, reflecting the impact of the acquisition and increased operating leverage on general and administrative expenses. However, DLHC faced challenges such as slower-than-expected release of bidding opportunities and decisions on contract awards across multiple fronts. Despite these headwinds, the company remains focused on growth acceleration within its target markets.

Financial Achievements and Importance

The company's financial achievements, including the reduction of total debt to $174.4 million from $179.4 million, demonstrate DLHC's commitment to financial prudence and its ability to generate strong cash flows. The debt reduction efforts are particularly important for a company in the Business Services industry, as it allows for greater operational flexibility and the potential to invest in growth opportunities.

Key Financial Metrics

DLHC's performance in the first quarter of fiscal 2024 is highlighted by several key financial metrics:

"Even with the government operating under a Continuing Resolution for a prolonged period of time, DLH has successfully navigated this period of uncertainty with a high degree of customer satisfaction and solid underlying results," said Zach Parker, DLH President and Chief Executive Officer.

Operating cash flow was robust at $5.1 million, and the company's contract backlog, although lower than the previous quarter, remained substantial at $653.5 million. The balance sheet showed cash of $0.1 million and a well-managed debt structure. These metrics are crucial for DLHC as they reflect the company's ability to maintain financial stability and invest in strategic initiatives that support long-term growth.

Analysis of DLH Holdings Corp's Performance

DLHC's first-quarter results indicate a strong financial position, with significant revenue growth driven by strategic acquisitions and an improved EBITDA margin. The company's ability to reduce debt while facing industry challenges showcases its operational efficiency and prudent financial management. As DLHC continues to navigate the competitive landscape, its focus on technology-enabled platforms and robust capabilities positions it well for future growth and expansion.

For more detailed insights and analysis on DLH Holdings Corp's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from DLH Holdings Corp for further details.

This article first appeared on GuruFocus.