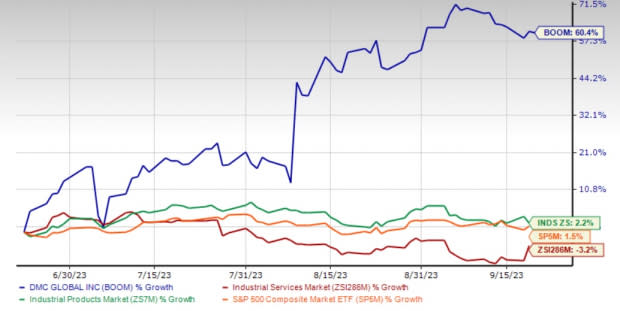

DMC Global (BOOM) Stock Up 60% in 3 Months: Here's Why

Shares of DMC Global BOOM have gained 60.4% in the past three months, faring better than the industry, which witnessed a 3.2% decline. The Industrial Products sector and the S&P 500 composite have gained 2.2% and 1.5%, respectively, in the same time frame.

BOOM has a market capitalization of $495 million. The average volume of shares traded in the last three months was 205.5K.

DMC Global currently sports a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Solid Demand, Cost-Saving Actions Drive Q2 Results

DMC Global shares have gained 42% since it reported solid second-quarter 2023 results and upbeat third-quarter guidance on Aug 8, 2023. Sales improved 14% year over year to hit a record $188.7 million. Adjusted earnings per share surged 148% to 72 cents. The company also beat the Zacks Consensus Estimate for both revenues and earnings. This improved performance was aided by strong demand for its differentiated products and improved operating efficiencies at all of its businesses (Arcadia, DynaEnergetics and NobelClad).

Total adjusted EBITDA attributable to the company in the second quarter was a record $31.8 million, up 42% year over year. All three businesses delivered adjusted EBITDA margins of more than 20% in the quarter as actions implemented by the company earlier this year to streamline its cost structure and improve operating efficiencies are bearing fruit.

Upbeat Q3 View

DMC Global expects total sales in the third quarter of 2023 to be in the range of $178 to $188 million. The midpoint of the range suggests year-over-year growth of 5%. Adjusted EBITDA attributable to the company is projected to be between $24 million and $27 million, the midpoint of which suggests 17% year-over-year growth.

Segments Poised Well for Growth

BOOM’s building products business, Arcadia, has been gaining on steady demand across its commercial construction and high-end residential markets. Its margins are reflecting the several initiatives undertaken by the company to reduce costs and strengthen manufacturing operations. Also, Arcadia has recently completed its transition to a new enterprise resource planning platform, which will improve visibility into the key areas of Arcadia’s operations going forward. The company is focusing on boosting the segment’s manufacturing capacity, growing presence in targeted geographic markets and increasing share of high-end residential market, which will drive long-term growth.

DynaEnergetics, the energy products business, is witnessing strong demand in both North American and international markets. The company’s focus on improving operational efficiencies will continue to drive the segment’s margins.

The growing demand for NobelClad’s composite metal products is being reflected in its expanding order backlog, which increased to $64 million from $60 million in the first quarter. NobelClad’s book-to-bill ratio remained a healthy 1.2. Its strengthening end markets bode well.

Efforts to Lower Debt Are Encouraging

BOOM’s debt-to-adjusted EBITDA leverage ratio improved to 1.3x at the end of the second quarter of 2023, representing the sixth consecutive quarter of de-levering its balance sheet. 'The company expects free cash flow to accelerate in the second half of 2023 as it continues to focus on cost and capital discipline, investing in highest ROI initiatives and driving operating excellence. It plans to end the year with a leverage ratio near 1.0x.

Favorable Estimate Revisions

The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Over the past 90 days, the Zacks Consensus Estimate for DMC Global’s 2023 earnings has increased 10%. The estimate for 2024 has been revised upward by 7%.

Key Picks

Some other top-ranked stocks from the Industrial Products sector are Caterpillar Inc. CAT, Astec Industries, Inc. ASTE and Eaton Corporation plc. ETN. CAT and ASTE sport a Zacks Rank of 1, and ETN has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.81 per share. The consensus estimate for 2023 earnings has moved 11.4% north in the past 60 days. Its shares have gained 17% in the last three months.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $2.81 per share. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. ASTE’s shares have gained 10% in the past three months.

The Zacks Consensus Estimate for Eaton’s 2023 earnings per share is pegged at $8.80. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 3%. Shares of ETN have gained 10% in the last three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

DMC Global (BOOM) : Free Stock Analysis Report