DMC Global Inc (BOOM) Reports Mixed Q4 Results Amid Varied Market Conditions

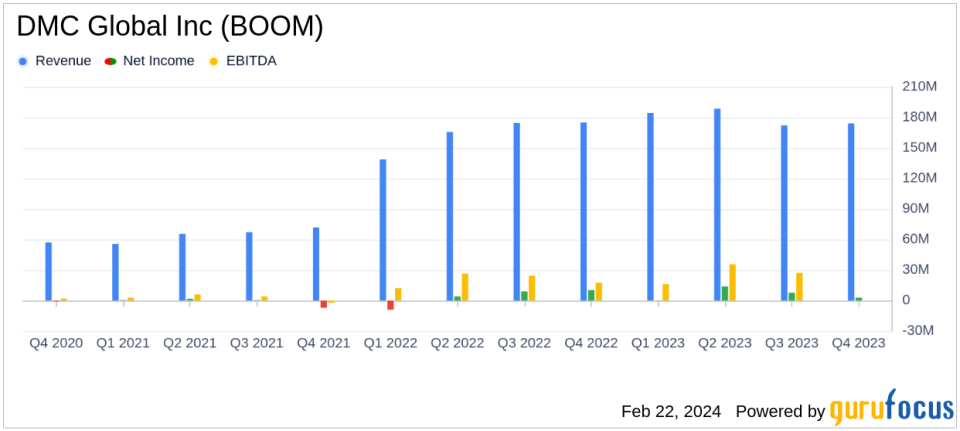

Net Sales: Q4 sales remained flat at $174.0 million compared to Q4 2022.

Net Income: Q4 net income attributable to DMC was $2.8 million, a 15% decrease year-over-year.

Adjusted EBITDA: Q4 Adjusted EBITDA attributable to DMC reached $19.6 million.

Free-Cash Flow: DMC reported a strong free-cash flow of $15.0 million in Q4.

Annual Performance: Record annual sales, adjusted EBITDA, and free-cash flow for the full year.

Segment Performance: NobelClad segment shined with a 33% increase in sales, while Arcadia and DynaEnergetics faced market challenges.

On February 22, 2024, DMC Global Inc (NASDAQ:BOOM) released its 8-K filing, disclosing its financial results for the fourth quarter ended December 31, 2023. The company, which operates a diversified family of technical product and process businesses serving the energy, industrial, and infrastructure markets, reported flat quarterly sales of $174.0 million compared to the same period in the previous year. Net income attributable to DMC was $2.8 million, marking a 15% decrease from the fourth quarter of 2022. Adjusted net income attributable to DMC was $5.2 million, or $0.26 per diluted share, representing a 22% increase year-over-year.

DMC Global operates through three segments: Arcadia, DynaEnergetics, and NobelClad. Arcadia, which provides architectural building products, experienced a 9% decrease in sales due to lower pricing in several markets. Despite this, the segment's adjusted EBITDA margin improved to 13.6% from 9.6% in the comparable quarter of the previous year, benefiting from a less pronounced drop in raw material costs. DynaEnergetics, serving the oilfield products market, saw a 3% decrease in sales due to industry consolidation in the United States impacting pricing. NobelClad, the composite metals business, however, reported a robust 33% increase in sales year-over-year, with adjusted EBITDA margins soaring to 24.7%.

The company's full-year results included record sales, adjusted EBITDA attributable to DMC, and free-cash flow performance. DMC's President and CEO, Michael Kuta, highlighted the milestone year and the company's refined operating strategies. He also mentioned the initiation of a review of alternative structures for DMCs portfolio as part of a broader strategy for enhancing stakeholder value.

Eric Walter, CFO of DMC, emphasized the strengthened balance sheet and enhanced financial flexibility due to the new $300 million senior secured credit facility. The company believes it can fund its growth programs while maintaining leverage and debt-service costs at prudent levels.

DMC Global's performance is significant as it reflects the company's resilience in a challenging market environment and its ability to generate strong cash flows. The varied conditions across its industrial end markets and the strategic initiatives to enhance shareholder value are key factors that may influence the company's future performance.

Financial Highlights and Challenges

The fourth quarter saw DMC Global navigating a mixed market landscape. While NobelClad's strong performance contributed positively to the company's overall results, the challenges faced by Arcadia and DynaEnergetics underscore the impact of market volatility on DMC's diverse portfolio. The company's ability to maintain flat sales year-over-year despite these challenges demonstrates its operational strength and the strategic value of its diversified business model.

DMC Global's financial achievements, particularly in the context of the oil and gas industry, underscore the importance of innovation and market leadership. DynaEnergetics' continued strong demand in international and North American markets, despite pricing pressures, reflects the segment's robust position in the industry. NobelClad's exceptional performance, with significant sales growth and margin expansion, highlights the segment's ability to capitalize on favorable market conditions and a strong product mix.

The company's financial statements reveal key metrics that are vital to understanding its performance. Gross profit percentage for the fourth quarter stood at 26.1%, while SG&A expenses saw an 11% decrease year-over-year. The adjusted EBITDA before non-controlling interest (NCI) allocation increased by 4% year-over-year to $23.3 million. These metrics, along with the strong free-cash flow, are important indicators of DMC Global's operational efficiency and financial health.

"As we enter 2024, our primary objective is to unlock value for DMCs shareholders," said Michael Kuta. "We are working with our financial advisors to explore strategic alternatives for NobelClad and DynaEnergetics, two valuable and innovative businesses that will continue to lead their respective industries."

DMC Global's performance analysis suggests that while the company faces headwinds in certain segments, its overall strategy and diversified portfolio position it well to navigate market fluctuations and continue delivering value to shareholders.

For more detailed information on DMC Global Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from DMC Global Inc for further details.

This article first appeared on GuruFocus.