Dnow Inc (DNOW) Reports Record EBITDA and Robust Free Cash Flow in Full-Year 2023 Results

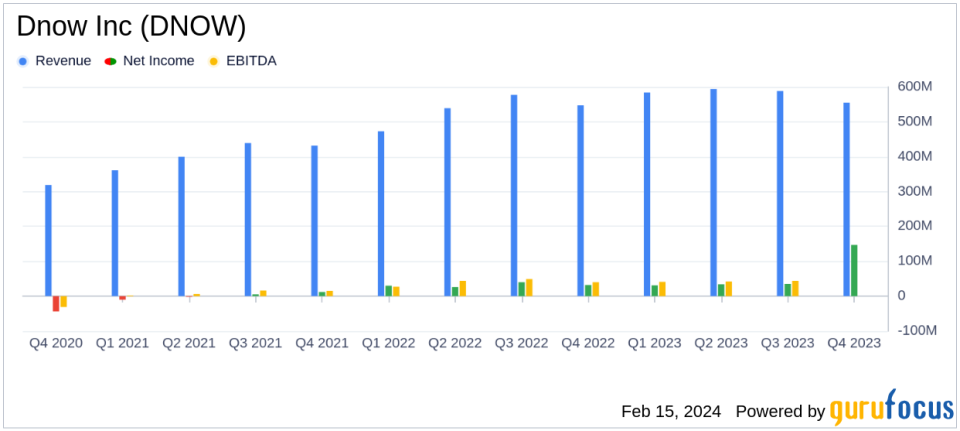

Revenue Growth: Dnow Inc (NYSE:DNOW) reported a 9% increase in annual revenue, amounting to $2,321 million for the year ended December 31, 2023.

EBITDA: Record annual EBITDA of $184 million, excluding other costs, representing 7.9% of revenue.

Free Cash Flow: Generated $171 million in free cash flow, surpassing the initial guidance by more than 100%.

Net Income: Net income attributable to DNOW Inc. was $247 million for the year, with a significant tax benefit contributing to the increase.

Acquisition: The acquisition of Whitco Supply is expected to enhance earnings, free cash flow, and shareholder value.

Stockholders' Equity: Total stockholders' equity increased to $1,063 million from $844 million in the previous year.

On February 15, 2024, Dnow Inc (NYSE:DNOW) released its 8-K filing, announcing its financial results for the fourth quarter and full-year ended December 31, 2023. The company, a global supplier of energy and industrial products, reported a revenue increase to $2,321 million, up 9% from the previous year, and a record EBITDA of $184 million, excluding other costs, which is the highest since its inception as a public entity.

David Cherechinsky, President and CEO of DNOW, expressed enthusiasm over the company's strong finish to the year, highlighting significant growth in the U.S. Process Solutions sector and the generation of $171 million in free cash flow, which more than doubled the company's original forecast. Cherechinsky also emphasized the strategic acquisition of Whitco Supply, which is anticipated to further enhance the company's financial performance and value proposition to shareholders.

Financial Performance Overview

DNOW's balance sheet showed a solid financial position, with cash and cash equivalents increasing to $299 million from $212 million the previous year. Total assets rose to $1,529 million, up from $1,320 million in 2022. The company's stockholders' equity also saw a significant increase to $1,063 million, compared to $844 million at the end of the previous year.

The income statement revealed a net income attributable to DNOW Inc. of $247 million for the year, bolstered by a tax benefit of approximately $149 million from the release of valuation allowances recorded against the company's deferred tax assets. Basic and diluted earnings per share for the year were $2.26 and $2.24, respectively.

DNOW's U.S. segment led revenue generation with $1,749 million, followed by Canada and International segments contributing $282 million and $290 million, respectively. The company's focus on digital solutions and supply chain management continues to drive growth across its diverse customer base in the energy and industrial sectors.

Strategic Moves and Future Outlook

The acquisition of Whitco Supply is a strategic move that aligns with DNOW's growth objectives and is expected to contribute positively to earnings and cash flow. Looking ahead to 2024, DNOW targets to generate $150 million in free cash flow, maintaining its strong financial discipline and operational efficiency.

DNOW's performance in 2023 sets a robust foundation for the company's future, with a clear strategy to capitalize on market opportunities and drive shareholder value. The company's commitment to innovation and customer service, combined with its strategic acquisitions, positions it well for continued success in the evolving energy landscape.

For more detailed information on Dnow Inc (NYSE:DNOW)'s financial results, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Dnow Inc for further details.

This article first appeared on GuruFocus.