DocGo Inc (DCGO) Reports Record Q4 and Full-Year 2023 Results, Updates 2024 Outlook

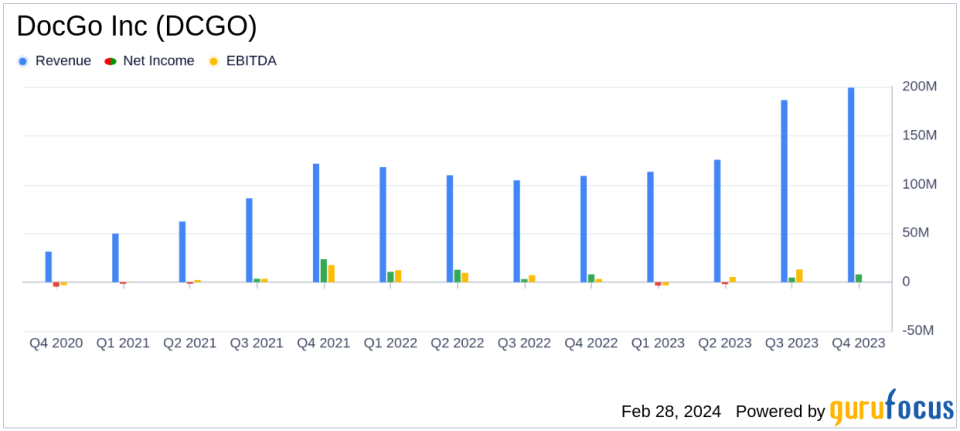

Q4 Revenue: Increased to $199.2 million, up 83% from Q4 2022.

Full-Year Revenue: Rose to $624.2 million, a 42% increase from 2022.

Adjusted EBITDA: Q4 adjusted EBITDA surged 232% to $22.6 million; Full-Year adjusted EBITDA up 31% to $54.0 million.

Net Income: Q4 net income grew 13% to $8.0 million; Full-Year net income declined 67% to $10.0 million.

2024 Guidance: Revenue projected to be $720-$750 million, with adjusted EBITDA expected to be $80-$85 million.

Cash Position: Total cash and cash equivalents, including restricted cash, stood at $72.2 million as of December 31, 2023.

On February 28, 2024, DocGo Inc (NASDAQ:DCGO) released its 8-K filing, announcing a record-setting performance for the fourth quarter and full-year 2023. The company, a leading provider of technology-enabled mobile health services, has reported significant growth in revenue and adjusted EBITDA, while also providing an optimistic outlook for 2024.

DocGo Inc is revolutionizing healthcare delivery by offering mobile health services and integrated medical mobility solutions. The company's innovative approach allows for the provision of care directly to patients' homes or workplaces, in collaboration with remote physicians, thereby enhancing the efficiency and quality of patient care for healthcare facilities, networks, and insurance providers.

Financial Performance and Challenges

DocGo's fourth quarter saw a remarkable 83% increase in total revenues, reaching $199.2 million, driven by a 110% surge in Mobile Health Services revenues. The company's full-year revenues also saw a robust increase of 42%, totaling $624.2 million. Despite these gains, the company faced a decrease in net income for the full year, which was attributed to non-cash, stock-based compensation expenses and an income tax provision recorded in 2023.

Adjusted EBITDA, a key metric for evaluating a company's operating performance, showed impressive growth, with a 232% increase in Q4 and a 31% rise for the full year. This growth in adjusted EBITDA is particularly important for DocGo as it reflects the company's ability to manage its operating costs and improve profitability, even amidst rapid expansion and project start-up costs.

The company's gross margin faced pressure, declining to 31.3% for the full year from 35.1% in 2022, primarily due to significant project start-up costs. However, management expects the trend of increasing profitability to continue over the coming quarters as start-up costs abate and agency labor and overtime utilization rates moderate.

Financial Achievements and Industry Impact

DocGo's financial achievements are significant within the Healthcare Providers & Services industry, as they demonstrate the company's successful scaling of operations and its ability to capitalize on the growing demand for mobile health services. The company's ability to maintain a strong cash position, with a notable increase in cash collections post-year-end, underscores its financial stability and operational efficiency.

The company's 2024 guidance suggests confidence in continued growth and profitability, with projected revenues of $720-$750 million and adjusted EBITDA of $80-$85 million. This guidance reflects management's expectations of moderating migrant-related revenues and reduced start-up costs, which are anticipated to contribute to improved profitability.

Key Financial Details

DocGo's balance sheet as of December 31, 2023, shows a healthy financial position with total assets of $490.4 million. The company's cash and cash equivalents, including restricted cash, stood at $72.2 million, a decrease from the previous year-end but bolstered by approximately $120 million in payments received after year-end.

On the liabilities side, the company has successfully paid down its line of credit in full subsequent to the end of the fourth quarter. This action, along with the announced share repurchase program for up to $36 million, indicates a proactive approach to capital management and shareholder value enhancement.

Management Commentary

"I am extremely proud of our operational execution during the fourth quarter across all three of our key market verticals. Our payer relationships continue to expand with commercial rollouts in Michigan, Connecticut and New Jersey in late 2023. Our work with major hospital systems has continued to grow as well, and we have launched new government population health programs in California and Arizona," said Lee Bienstock, Chief Executive Officer of DocGo.

"Within our 2024 guidance, we have assumed some moderation in migrant-related revenues as the year progresses. At the same time, we expect to see the significant startup costs associated with recent migrant-related program launches continue to abate. We are seeing a variety of forces come together to drive increased profitability, and we expect that trend to continue over the coming quarters," commented Norm Rosenberg, Chief Financial Officer and Treasurer of DocGo.

In summary, DocGo Inc (NASDAQ:DCGO) has demonstrated a strong financial performance in the fourth quarter and full-year 2023, with significant revenue growth and improved adjusted EBITDA. The company's strategic initiatives and operational execution have positioned it well for continued success in the evolving healthcare landscape.

Explore the complete 8-K earnings release (here) from DocGo Inc for further details.

This article first appeared on GuruFocus.