DocuSign (DOCU) Gains on eSignature Strength Despite Cost Hike

DocuSign, Inc. DOCU has had an impressive run over the past six months. The stock has gained 27.5%, outperforming the 13.7% rally of the Zacks S&P 500 composite.

DOCU’s fourth-quarter fiscal 2024 EPS (excluding 63 cents from non-recurring items) was 76 cents per share, which surpassed the Zacks Consensus Estimate by 18.8% and increased 16.9% from the year-ago quarter. Total revenues of $712.4 million beat the consensus mark by 2.1% and improved 8% from fourth-quarter fiscal 2024.

How is DocuSign Doing?

eSignature, DocuSign’s anchor product, enables virtual but secure signing and sending of agreements on a variety of devices from anywhere in the world. The company’s top line is significantly benefiting from continued customer demand for eSignature. Despite this rising demand, the market for eSignature remains largely untapped, and this keeps DocuSign in a position to expand this product across businesses around the world. Partly due to this positive, the company's shares have gained 27.5% in the past six months.

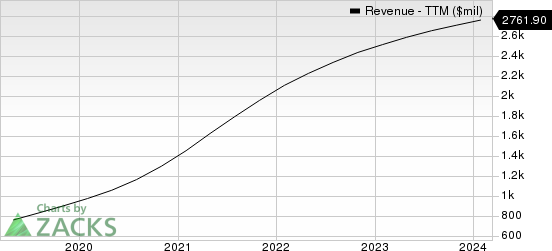

DocuSign Revenue (TTM)

DocuSign revenue-ttm | DocuSign Quote

DocuSign has a set of business growth strategies. The company remains focused on continuously acquiring eSignature customers, expanding eSignature use cases within existing customers, improving its offerings, and popularizing other Agreement Cloud products to new and existing customers, and expanding internationally. The company continues to invest in sales, marketing and technical expertise across a number of industry verticals.

DOCU has deepened its relationships with partners such as Salesforce and Microsoft. For instance, the company has expanded its global strategic partnership with Salesforce. DocuSign and Salesforce co-develop solutions for the automation of the contract process and expansion of collaboration among organizations that use Salesforce’s Slack. DocuSign made an eSignature integration with Microsoft Teams last year. It is currently an official electronic signature provider in Microsoft Teams’ Approvals app.

DocuSign is seeing an increase in expenses as it continues to invest in sales, marketing and technical expertise. Total operating expenses of $2.07 billion increased 21.8% year over year in fiscal 2023. Hence, the company's bottom line is likely to be under pressure, going forward.

Zacks Rank and Stocks to Consider

DocuSign currently carries a Zacks Rank #2 (Buy).

Some better-ranked stocks in the broader Zacks Business Services sector are Booz Allen Hamilton BAH andAppLovin APP.

Booz Allen Hamilton (BAH) sports a Zacks Rank #1 (Strong Buy) at present. BAH has a long-term earnings growth expectation of 12.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

BAH delivered a trailing four-quarter earnings surprise of 12.7%, on average.

AppLovin (APP) flaunts a Zacks Rank #1 at present. APP has a long-term earnings growth expectation of 20%.

APP delivered a trailing four-quarter earnings surprise of 26.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report