Dodge & Cox Bolsters Position in Aegon Ltd with Significant Share Acquisition

Introduction to Dodge & Cox (Trades, Portfolio)'s Latest Investment Move

Dodge & Cox (Trades, Portfolio), a seasoned investment firm, has recently expanded its portfolio by adding a substantial number of shares in Aegon Ltd (NYSE:AEG), a prominent life insurance and savings company. This strategic move by the firm involved the acquisition of 47,609,603 shares, which has made a notable impact on its investment spread. The transaction, executed on December 31, 2023, reflects Dodge & Cox (Trades, Portfolio)'s confidence in Aegon Ltd's future prospects and aligns with the firm's investment philosophy of seeking superior relative value.

Insight into Dodge & Cox (Trades, Portfolio)'s Investment Ethos

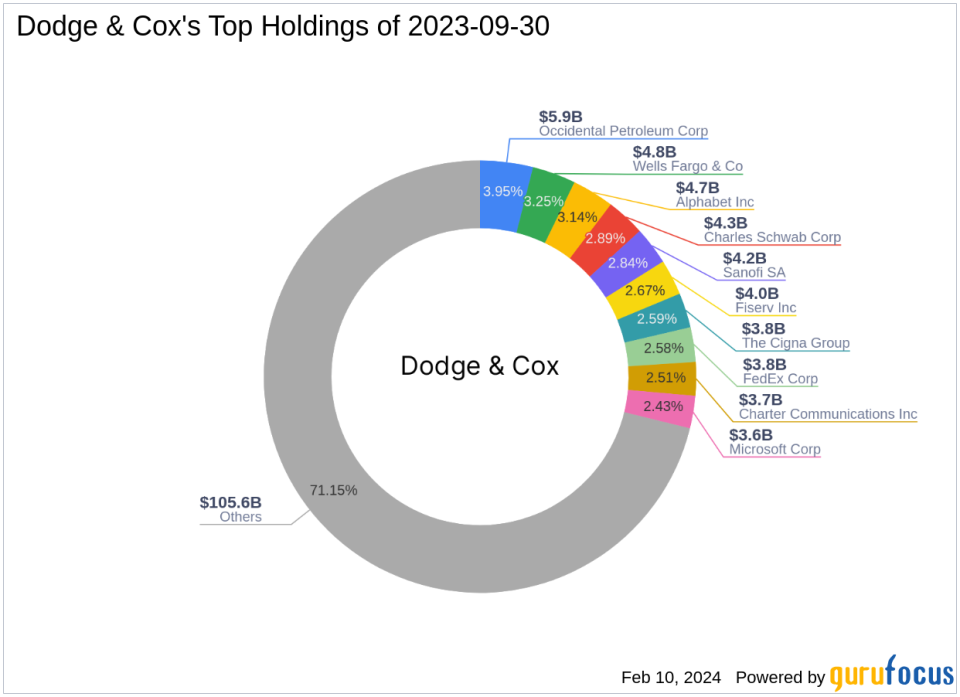

Founded in 1930, Dodge & Cox (Trades, Portfolio) stands as a testament to the enduring partnership of Van Duyn Dodge and E. Morris Cox. The firm's investment decisions are the product of collective wisdom, shaped by its Investment Policy Committees. This collaborative approach ensures that the firm's investment philosophy and culture remain consistent, even as committee members evolve over time. Dodge & Cox (Trades, Portfolio)'s investment strategy is rooted in the pursuit of undervalued assets, with a focus on long-term capital appreciation and a cautious approach to popular, overpriced investments. The firm's top holdings include industry giants such as Alphabet Inc (NASDAQ:GOOG) and Wells Fargo & Co (NYSE:WFC), showcasing its preference for financially robust companies.

Overview of Aegon Ltd's Business Operations

Aegon Ltd, headquartered in the Netherlands, has been a key player in the life insurance and long-term savings market since its IPO in 1985. The company has undergone significant transformation, streamlining its operations to focus on strategic business groups and divesting from non-core segments. Aegon's business is spread across the Americas, the United Kingdom, and several growth markets, including Brazil and China. The company's commitment to reducing capital-intensive and volatile earnings products in favor of more predictable and capital-light offerings is a testament to its strategic reorientation.

Details of the Transaction and Its Portfolio Impact

The acquisition of Aegon Ltd shares by Dodge & Cox (Trades, Portfolio) on December 31, 2023, increased the firm's total holdings to 173,145,420 shares, representing a 0.67% position in its portfolio and a 9.80% stake in Aegon Ltd. The trade, executed at a price of $5.76 per share, has had a 0.18% impact on Dodge & Cox (Trades, Portfolio)'s portfolio. Notably, the current stock price of Aegon Ltd stands at $5.79, slightly above the trade price, indicating a modest gain since the transaction.

Assessing Aegon Ltd's Market Valuation and Performance

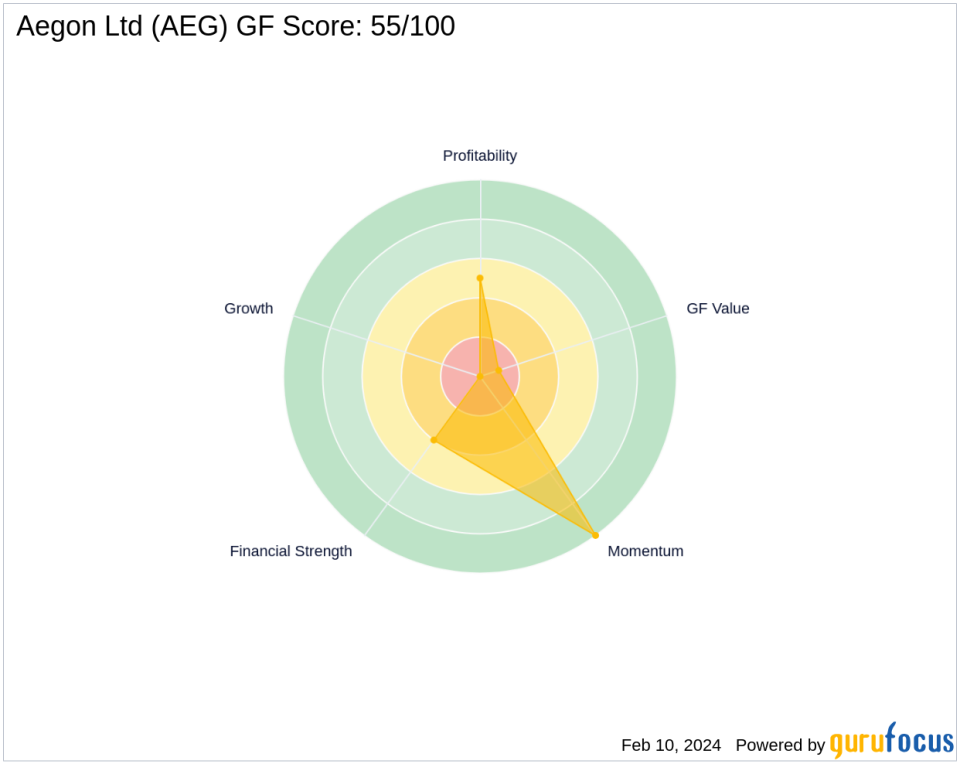

Aegon Ltd's market capitalization is currently valued at $10.23 billion, with the stock price hovering around $5.79. Despite the company's significant market presence, its stock is deemed Significantly Overvalued according to the GF Value, with a GF Value of $2.45 and a price to GF Value ratio of 2.36. The stock's performance indicators, such as the PE Percentage, are not applicable due to the company's current lack of profitability. However, the GF Score of 55/100 suggests a moderate future performance potential.

Dodge & Cox (Trades, Portfolio)'s Position in Aegon Ltd Compared to Other Gurus

Dodge & Cox (Trades, Portfolio)'s increased stake in Aegon Ltd solidifies its position as a significant shareholder in the company. The firm's 9.80% holding in Aegon Ltd is a clear indication of its conviction in the stock's potential. In comparison, other notable investors like Charles Brandes (Trades, Portfolio) also maintain positions in Aegon Ltd, although Dodge & Cox (Trades, Portfolio) holds the largest share among them.

Evaluating Aegon Ltd's Financial Health and Market Standing

Aegon Ltd's financial health, as indicated by its Financial Strength rank of 4/10 and Profitability Rank of 5/10, presents a mixed picture. The company's Growth Rank is not available, and its GF Value Rank stands at a low 1/10. Aegon's cash to debt ratio of 0.70, ROE of -11.36, and ROA of -0.41 highlight areas of concern, suggesting that the company's profitability and asset utilization could be improved.

Market Reaction and Prospects for Aegon Ltd

The market's response to Aegon Ltd's stock has been tepid, with RSI indicators such as the 14-day RSI at 48.59, reflecting a neutral momentum. The stock's future performance potential, as suggested by the GF Score and other ranks, indicates that while there are areas for improvement, there may still be opportunities for growth. Dodge & Cox (Trades, Portfolio)'s recent transaction could be seen as a vote of confidence in Aegon Ltd's ability to navigate its challenges and capitalize on its strengths in the long term.

In conclusion, Dodge & Cox (Trades, Portfolio)'s acquisition of Aegon Ltd shares is a strategic addition to its portfolio, aligning with the firm's value-driven investment philosophy. While Aegon Ltd faces certain financial challenges, the firm's significant stake in the company demonstrates a belief in its potential for future growth and profitability.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.