Dodge & Cox Bolsters Stake in Aegon Ltd

Dodge & Cox, a seasoned investment firm, has recently increased its investment in Aegon Ltd (NYSE:AEG), a notable insurance company based in the Netherlands. On January 31, 2024, the firm executed an addition to its position, purchasing 19,434,690 shares at a price of $5.78 each. This transaction expanded Dodge & Cox's holding to a total of 192,580,110 shares, marking a significant move with a trade impact of 0.08% on its portfolio. The firm's position in Aegon now represents 10.90% of its total shares, underscoring the strategic importance of this investment.

Investment Firm Profile: Dodge & Cox

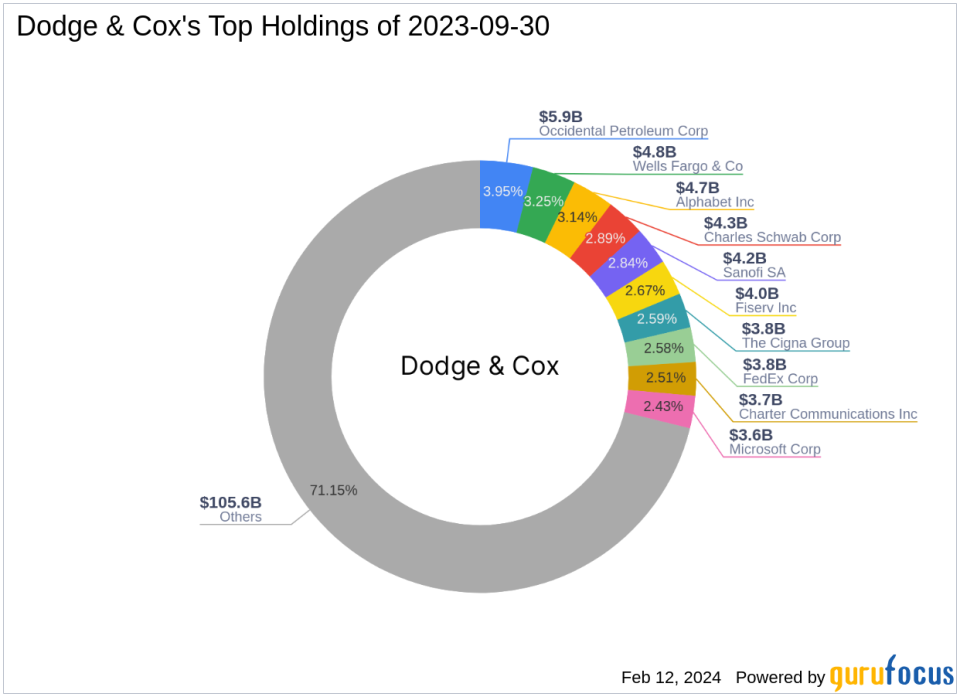

Founded in 1930, Dodge & Cox has established itself through a team research approach to investment, guided by the collective wisdom of its Investment Policy Committees. The firm's investment philosophy is rooted in the pursuit of superior relative value, with a focus on long-term capital appreciation through investments in undervalued companies. Dodge & Cox's portfolio includes a diverse array of 193 stocks, with top holdings in major companies such as Alphabet Inc (NASDAQ:GOOG) and Wells Fargo & Co (NYSE:WFC), and a strong presence in the financial services and healthcare sectors. With an equity portfolio valued at $148.4 billion, the firm's investment decisions are a significant indicator of market trends.

About Aegon Ltd

Aegon Ltd, with its roots in the Netherlands and an IPO date of July 1, 1985, is a life insurance and long-term savings company. The company has undergone a transformation program aimed at divesting non-core operations and improving its risk profile. Aegon's strategic focus is on capital-light and predictable business segments, with operations spanning across the Americas, the United Kingdom, and growth markets in Brazil, China, Portugal, and Spain.

Aegon's Financial Landscape

As of the date of this article, Aegon Ltd boasts a market capitalization of $10.23 billion, with a current stock price of $5.79. However, the company's financial metrics present a mixed picture. Aegon is currently labeled as "Significantly Overvalued" according to the GF Valuation, with a price to GF Value ratio of 2.36. The stock's PE percentage stands at 0.00, indicating that the company is not generating a profit at this time.

Strategic Investment in Aegon by Dodge & Cox

Aegon Ltd represents a strategic investment within Dodge & Cox's portfolio, accounting for 0.75% of its total investments. When compared to the firm's top holdings and sectors, Aegon's current valuation suggests a contrarian approach, aligning with Dodge & Cox's philosophy of investing in undervalued assets.

Market Performance of Aegon Ltd

Aegon's stock has seen a year-to-date percent change of 1.05% and a modest gain of 0.17% since Dodge & Cox's recent trade. The long-term performance since its IPO has been more significant, with a price change ratio of 355.91%.

Assessing Aegon's Fundamental Strength

Aegon's GF Score stands at 53/100, indicating potential challenges in future performance. The company's financial strength and profitability are both ranked at 4/10, while its growth rank is not applicable due to insufficient data. The GF Value Rank is at the low end with a score of 1/10, and the Momentum Rank is relatively high at 8/10, suggesting some short-term positive movement.

Other Notable Investors in Aegon

Dodge & Cox is not the only investment firm with a stake in Aegon Ltd. Charles Brandes (Trades, Portfolio) is another notable investor, although Dodge & Cox holds the largest share percentage among the investing gurus.

Transaction Analysis and Impact

The recent acquisition by Dodge & Cox reflects a calculated move to capitalize on Aegon's long-term value. Despite the company's current overvaluation and lack of profitability, the firm's significant increase in shares suggests confidence in Aegon's future prospects. This transaction not only reinforces Dodge & Cox's investment strategy but also may influence Aegon's stock performance as other investors take note of this significant endorsement.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.