Dodge & Cox Bolsters Stake in International Flavors & Fragrances Inc

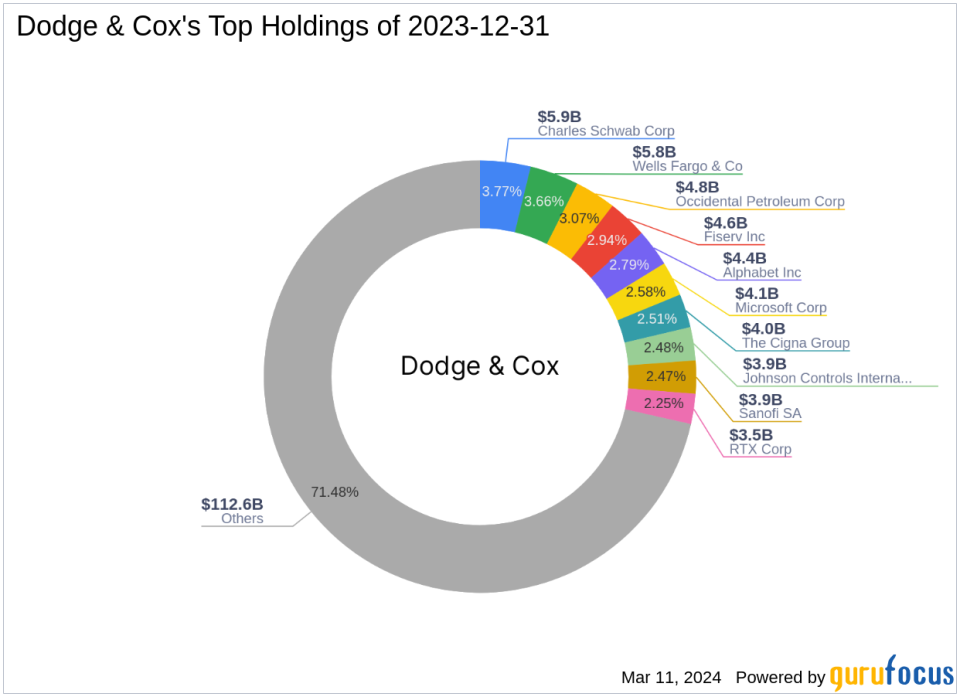

Dodge & Cox (Trades, Portfolio), a renowned investment firm, has recently expanded its investment portfolio by adding a significant number of shares in International Flavors & Fragrances Inc (NYSE:IFF). This move underscores the firm's confidence in IFF's future prospects and aligns with its long-term investment strategy. The transaction details reveal a substantial increase in Dodge & Cox (Trades, Portfolio)'s holdings, which is likely to have a notable impact on its portfolio composition.

Investment Firm Profile: Dodge & Cox (Trades, Portfolio)

Founded in 1930, Dodge & Cox (Trades, Portfolio) stands as a testament to the enduring value of collective investment wisdom. The firm's investment decisions are the product of a collaborative effort by the Investment Policy Committees, ensuring that the firm's philosophy, research, and culture remain consistent over time. Dodge & Cox (Trades, Portfolio)'s investment philosophy is rooted in the pursuit of superior relative value, avoiding overpriced popular choices and focusing on long-term capital appreciation through investments in undervalued companies.

Transaction Details: Dodge & Cox (Trades, Portfolio)'s Increased Stake in IFF

On February 29, 2024, Dodge & Cox (Trades, Portfolio) added 11,599,470 shares of International Flavors & Fragrances Inc to its holdings, at a trade price of $75.50 per share. This addition has increased the firm's total share count in IFF to 27,040,195, representing a 1.29% position in its portfolio and a significant 10.60% ownership of IFF's outstanding shares. The trade had a moderate impact of 0.55% on Dodge & Cox (Trades, Portfolio)'s portfolio.

Company Overview: International Flavors & Fragrances Inc

International Flavors & Fragrances Inc, established in 1964, is a global leader in the creation of flavors and fragrances used in a wide array of consumer products. The company's expertise spans across various segments including Health & Biosciences, Nourish, Pharma Solutions, and Scent. IFF's commitment to innovation and partnership with its customers allows it to deliver tailored solutions that enhance consumer experiences.

Financial and Market Analysis of IFF

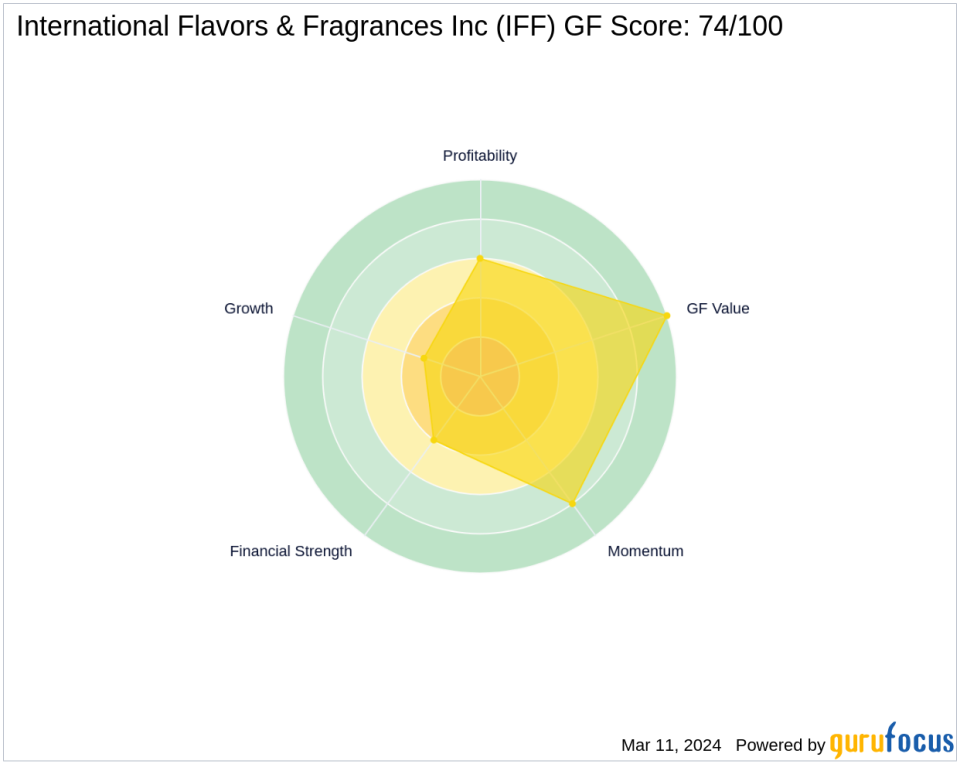

With a market capitalization of $20.62 billion and a current stock price of $80.77, IFF is positioned as a substantial player in the chemicals industry. Despite being labeled as modestly undervalued with a GF Value of $105.69 and a price to GF Value ratio of 0.76, IFF's financial health presents a mixed picture. The company's financial strength and profitability rank at 4/10 and 6/10, respectively, while its growth rank stands at a lower 3/10. However, IFF's GF Value Rank is at the top with 10/10, indicating potential for future valuation improvements.

Performance Metrics and Market Influence

IFF's stock performance has been noteworthy since its IPO, with a 607.27% increase, although it has experienced a slight year-to-date decline of -0.8%. The GF Score of 74/100 suggests a likelihood of average performance in the future. Dodge & Cox (Trades, Portfolio)'s increased stake in IFF not only solidifies its position as the largest guru shareholder but also potentially influences IFF's stock trajectory, given the firm's reputation and investment acumen.

Comparative Guru Holdings in IFF

Dodge & Cox (Trades, Portfolio)'s position in IFF is notable when compared to other esteemed investors such as Carl Icahn (Trades, Portfolio), T Rowe Price Equity Income Fund (Trades, Portfolio), and Barrow, Hanley, Mewhinney & Strauss. The firm's 10.60% share percentage in IFF underscores its significant influence on the stock and reflects its conviction in the company's value proposition.

Conclusion: Assessing the Impact of Dodge & Cox (Trades, Portfolio)'s Trade

The recent acquisition of shares in International Flavors & Fragrances by Dodge & Cox (Trades, Portfolio) is a strategic move that aligns with the firm's investment philosophy of seeking undervalued opportunities with long-term growth potential. This transaction not only enhances Dodge & Cox (Trades, Portfolio)'s portfolio but also reaffirms the firm's role as a key stakeholder in IFF's future. As IFF continues to navigate the competitive landscape of the specialty ingredients market, the backing of a prominent investor like Dodge & Cox (Trades, Portfolio) could be a harbinger of positive developments for the company and its shareholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.