Dodge & Cox Bolsters Stake in Johnson Controls International PLC

Introduction to the Transaction

Dodge & Cox, a renowned investment firm, has recently increased its investment in Johnson Controls International PLC (NYSE:JCI), signaling a strategic move in its portfolio management. On December 31, 2023, the firm added 3,772,228 shares to its position, bringing the total share count to 67,468,500. This transaction had a 0.15% impact on the portfolio, with the shares purchased at an average price of $57.64. The addition has elevated JCI's position in Dodge & Cox's portfolio to 2.62%, with the firm now holding a significant 9.90% of JCI's outstanding shares.

Profile of Dodge & Cox

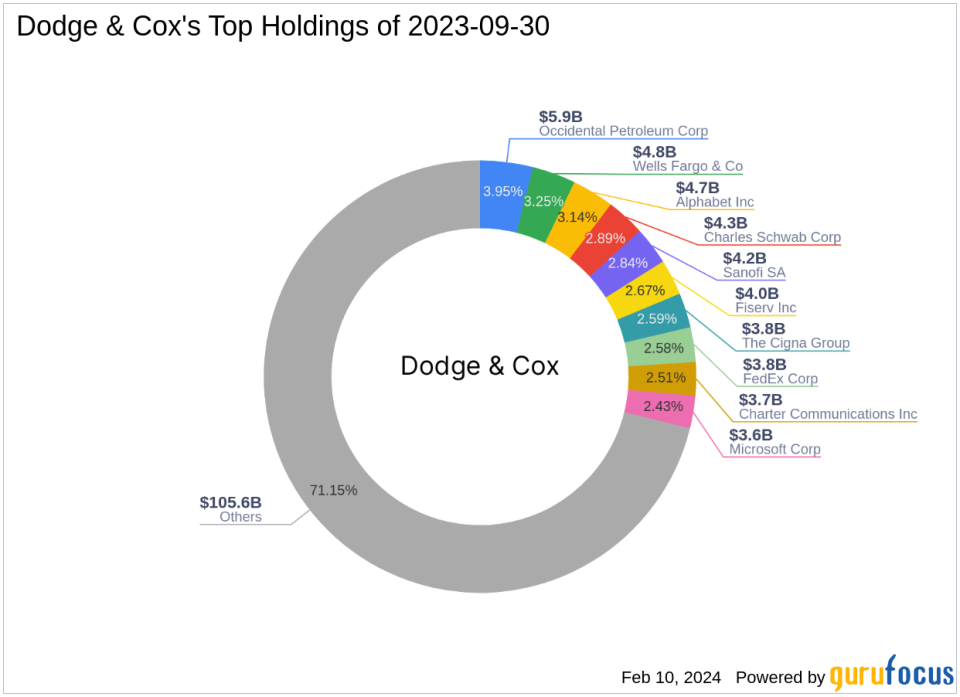

Founded in 1930 by Van Duyn Dodge and E. Morris Cox, Dodge & Cox has established itself as a firm that values a collective research approach and group decision-making in its investment strategies. The firm's Investment Policy Committees are central to its decision-making process, ensuring that its investment philosophy and culture remain consistent over time. Dodge & Cox's investment philosophy is rooted in finding superior relative value and investing in undervalued assets to maximize capital appreciation over the long term. With 193 stocks in its portfolio and a total equity of $148.4 billion, the firm's top holdings include Alphabet Inc (NASDAQ:GOOG), Occidental Petroleum Corp (NYSE:OXY), and Charles Schwab Corp (NYSE:SCHW), predominantly in the Financial Services and Healthcare sectors.

Johnson Controls International PLC at a Glance

Johnson Controls International PLC, headquartered in Ireland, has been a leading player in the construction industry since its IPO in 1965. The company specializes in manufacturing, installing, and servicing a wide range of products, including HVAC systems, building management systems, and fire and security solutions. With a diverse portfolio of business segments and a global presence, Johnson Controls reported nearly $27 billion in revenue for fiscal 2023. The company's stock is currently modestly undervalued with a GF Value of $70.31 and a market capitalization of $37.82 billion.

Analysis of the Trade's Significance

The recent acquisition by Dodge & Cox is a testament to the firm's confidence in Johnson Controls' future prospects. The trade has not only increased the firm's stake in JCI but also solidified its position as one of the top holdings in Dodge & Cox's portfolio. This move aligns with the firm's long-term investment strategy and its penchant for investing in companies with strong value potential.

Market Context and Stock Valuation

Johnson Controls' current stock price stands at $55.5, slightly below the trade price of $57.64, indicating a -3.71% change since the transaction. The stock is trading at a price-to-GF Value ratio of 0.79, suggesting that it is modestly undervalued compared to the GF Value of $70.31. Despite a year-to-date price change ratio of -2.77%, the company's long-term performance has been impressive, with a 2457.6% increase since its IPO.

Performance Metrics and Rankings

Johnson Controls boasts a strong GF Score of 87/100, indicating good potential for outperformance. The company's financial strength and Profitability Rank are commendable, with scores of 6/10 and 7/10, respectively. Growth metrics are also robust, with an 8/10 Growth Rank and a 9/10 GF Value Rank. The company's Operating Margin growth stands at 8.00%, and it has shown a solid EBITDA growth of 16.60% over the past three years.

Sector and Industry Perspective

Dodge & Cox's investment in Johnson Controls aligns with its significant exposure to the Financial Services and Healthcare sectors. The firm's strategy of seeking undervalued assets with long-term growth potential fits well with the construction industry's outlook, where Johnson Controls holds a competitive position.

Other Notable Investors

Other prominent investors with stakes in Johnson Controls include Ken Fisher (Trades, Portfolio), Chris Davis (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio). Dodge & Cox's position in JCI is comparative to these investors, showcasing the firm's significant conviction in the stock's value proposition.

Transaction Analysis

The recent addition of Johnson Controls shares by Dodge & Cox is a strategic move that reflects the firm's confidence in the stock's intrinsic value and growth potential. This transaction not only reinforces the firm's investment philosophy but also highlights the stock's promising position within the construction industry. As the largest shareholder in JCI, Dodge & Cox's increased stake is a strong endorsement of the company's future prospects and may influence other investors' perceptions of the stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.