Does Amazon Prime Day deliver for investors? It's complicated.

One of the biggest online shopping days is only a few days away.

Amazon’s (AMZN) fifth annual Prime Day kicks off Monday, July 15, at midnight and will run for a full 48 hours, up from the 36 hour event last year. If previous years are any indication, this year’s Prime Day is gearing up to be another record-breaking shopping event for Amazon.

While the actual Prime Day starts on Monday, the e-commerce giant started the party early on Wednesday night. Actress Jane Lynch hosted Amazon’s Prime Day concert, which featured performances from Taylor Swift, Dua Lipa, SZA and Becky G.

Not only does Prime Day drive massive traffic to Amazon.com, it’s a great way to sell Amazon products and rack up new Amazon Prime members. Though the company does not provide sales figures, Amazon said that in 2018 that it sold over 100 million products with over $1.5 billion in sales by third-party sellers. Amazon also signed up a record amount of Amazon Prime members around the world.

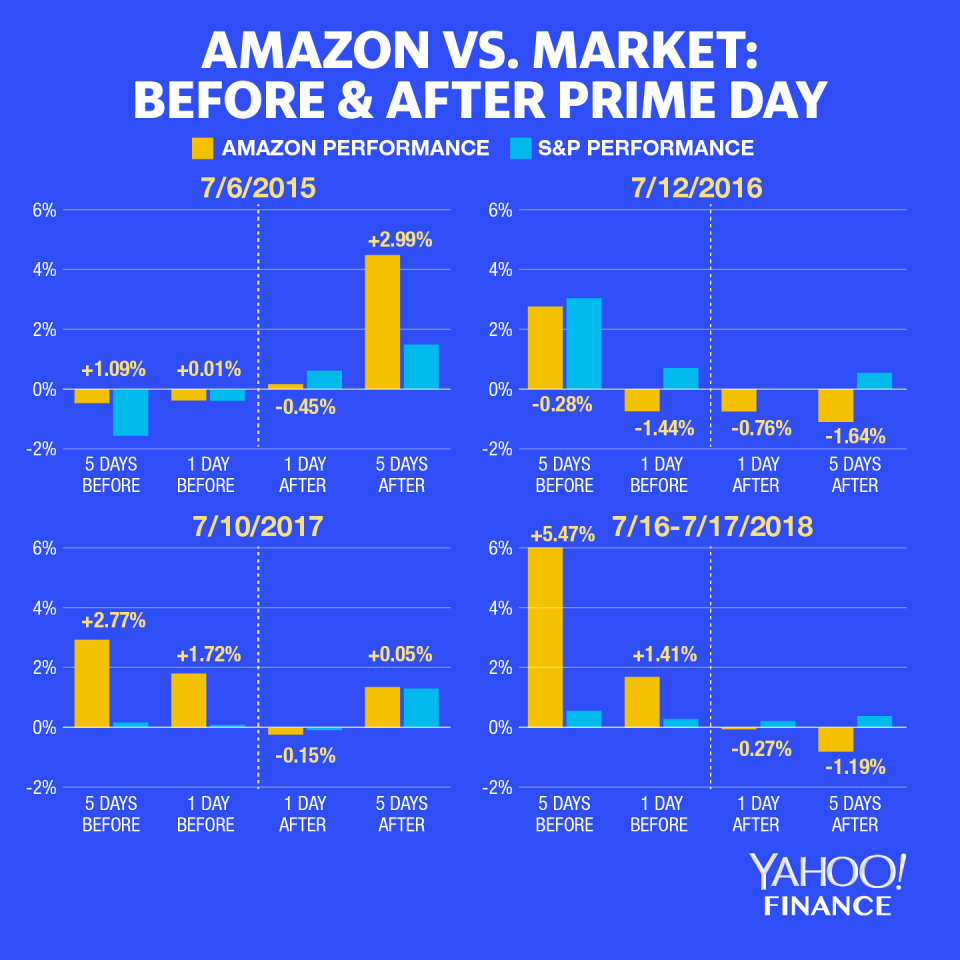

There is no doubt that Prime Day is a huge event for Amazon, but the annual event doesn’t necessarily deliver above-average returns for Amazon investors, at least in the short term. Yahoo Finance crunched the numbers and took a look at Amazon’s stock performance relative to the broader market for the seven days prior, one day prior, one day after and seven days after Prime Day.

The results were a mixed bag. For instance, in 2015 and 2017, Amazon shares outperformed the S&P 500 (^GSPC) in the five trading days before Prime Day, one day before and five days following. However, Amazon underperformed the broader market every year in the one day following the event.

While this proved that there may be limited short-term gains for investors, the long-term story is quite different. Since the beginning of Amazon Prime day four years ago, Amazon shares have soared an impressive 353%, while the S&P gained a more modest 56%.

Amazon’s Prime Day is about more than incremental gross merchandise value (GMV) and revenue, according to analyst John Blackledge at Cowen. Prime Day drives strong Prime subscriber penetration, engagement across Amazon’s ecosystem and reinforcement of Prime’s value proposition and brand.

“The event’s role in driving further Prime adoption is nearly as important as the financial impact, as we view Prime as the biggest driver of Amazon’s [worldwide] GMV longer term, which we estimate rising from $344 billion in 2019 to ~$713 billion in 2024,” Blackledge said in a note on Wednesday.

Editor’s note: This story was originally published on July 10.

More Prime Day coverage:

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

Jobs report smashes expectations

Job cuts during the first half of the year were the highest since 2009: Challenger

U.S. private sector employment grows at disappointingly slow pace

McDonald’s Japan is one of the most popular places on Facebook