Does ATI Airtest Technologies Inc.'s (CVE:AAT) CEO Salary Compare Well With Others?

George Graham is the CEO of ATI Airtest Technologies Inc. (CVE:AAT). First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for ATI Airtest Technologies

How Does George Graham's Compensation Compare With Similar Sized Companies?

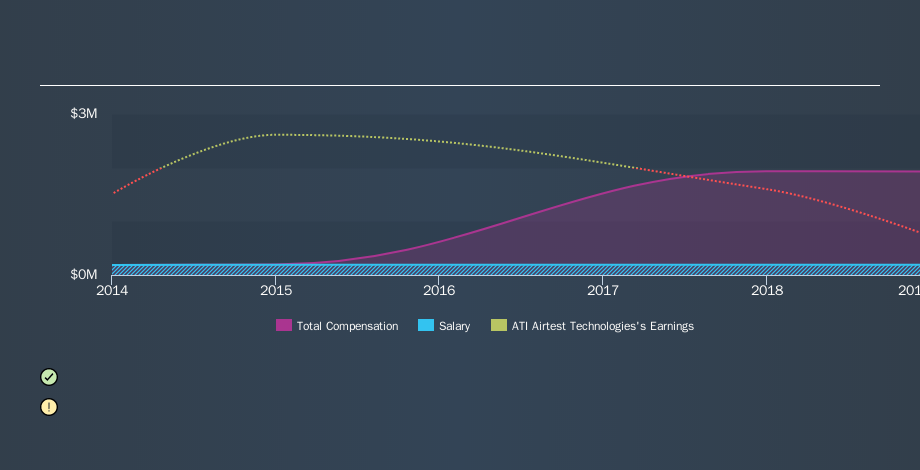

According to our data, ATI Airtest Technologies Inc. has a market capitalization of CA$746k, and paid its CEO total annual compensation worth CA$1.9m over the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at CA$192k. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. We looked at a group of companies with market capitalizations under CA$264m, and the median CEO total compensation was CA$180k.

Thus we can conclude that George Graham receives more in total compensation than the median of a group of companies in the same market, and of similar size to ATI Airtest Technologies Inc.. However, this doesn't necessarily mean the pay is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance.

You can see a visual representation of the CEO compensation at ATI Airtest Technologies, below.

Is ATI Airtest Technologies Inc. Growing?

ATI Airtest Technologies Inc. has reduced its earnings per share by an average of 45% a year, over the last three years (measured with a line of best fit). In the last year, its revenue is up 16%.

Few shareholders would be pleased to read that earnings per share are lower over three years. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that earnings per share has gone backwards over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has ATI Airtest Technologies Inc. Been A Good Investment?

With a three year total loss of 25%, ATI Airtest Technologies Inc. would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared total CEO remuneration at ATI Airtest Technologies Inc. with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

We think many shareholders would be underwhelmed with the business growth over the last three years. Over the same period, investors would have come away with nothing in the way of share price gains. Some might well form the view that the CEO is paid too generously! So you may want to check if insiders are buying ATI Airtest Technologies shares with their own money (free access).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.