Does Cambridge Bancorp (NASDAQ:CATC) Deserve A Spot On Your Watchlist?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Cambridge Bancorp (NASDAQ:CATC). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Cambridge Bancorp

How Fast Is Cambridge Bancorp Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Cambridge Bancorp managed to grow EPS by 14% per year, over three years. That's a good rate of growth, if it can be sustained.

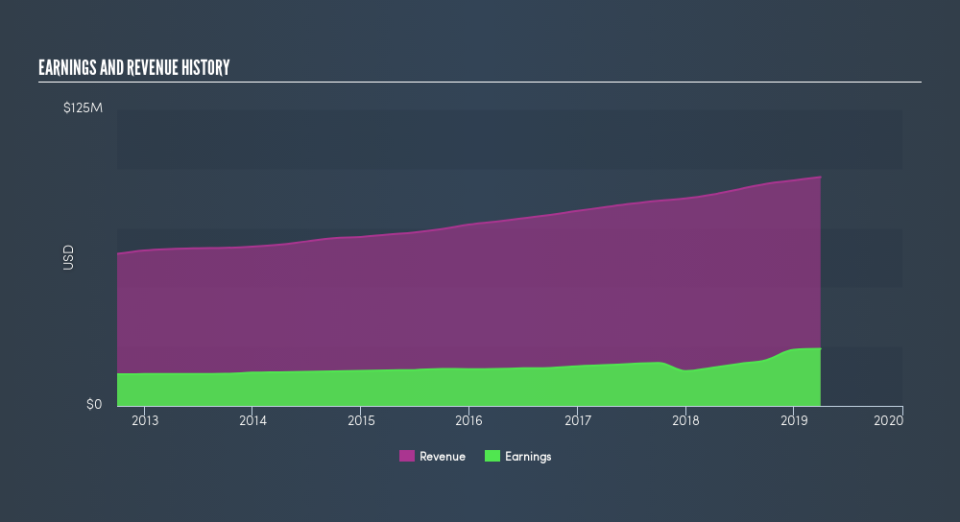

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Cambridge Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Cambridge Bancorp maintained stable EBIT margins over the last year, all while growing revenue 8.2% to US$96m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Cambridge Bancorp's balance sheet strength, before getting too excited.

Are Cambridge Bancorp Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Cambridge Bancorp shares worth a considerable sum. To be specific, they have US$16m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 4.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Cambridge Bancorp To Your Watchlist?

One important encouraging feature of Cambridge Bancorp is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. If you think Cambridge Bancorp might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.