Does Emerald Resources (ASX:EMR) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Emerald Resources (ASX:EMR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Emerald Resources

Emerald Resources' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It is awe-striking that Emerald Resources' EPS went from AU$0.0063 to AU$0.10 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

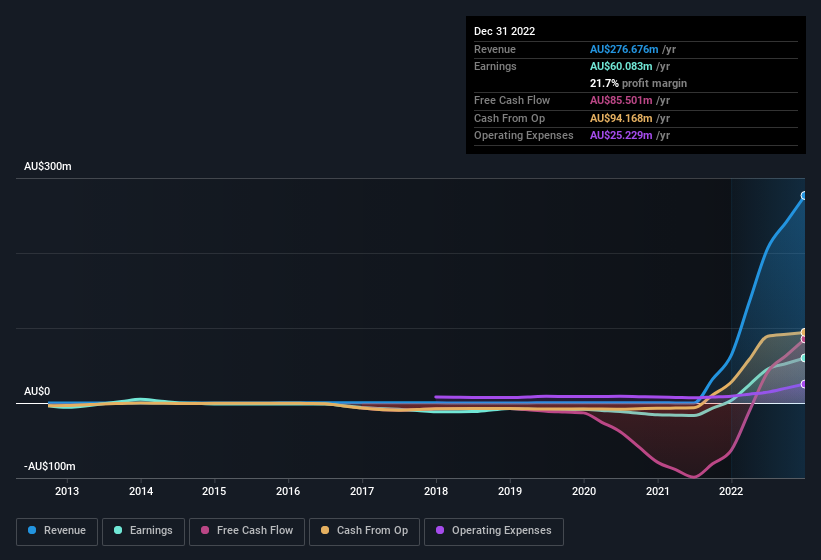

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Emerald Resources is growing revenues, and EBIT margins improved by 8.1 percentage points to 37%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Emerald Resources' balance sheet strength, before getting too excited.

Are Emerald Resources Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Emerald Resources insiders have a significant amount of capital invested in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at AU$283m. Coming in at 20% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Emerald Resources, with market caps between AU$620m and AU$2.5b, is around AU$1.6m.

The CEO of Emerald Resources only received AU$581k in total compensation for the year ending June 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Emerald Resources Deserve A Spot On Your Watchlist?

Emerald Resources' earnings per share have been soaring, with growth rates sky high. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. Emerald Resources is certainly doing some things right and is well worth investigating. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Emerald Resources is trading on a high P/E or a low P/E, relative to its industry.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.