Does Hanison Construction Holdings Limited’s (HKG:896) 19.2% Earnings Growth Make It An Outperformer?

Understanding how Hanison Construction Holdings Limited (HKG:896) is performing as a company requires looking at more than just a years’ earnings. Today I will run you through a basic sense check to gain perspective on how Hanison Construction Holdings is doing by comparing its latest earnings with its long-term trend as well as the performance of its construction industry peers.

Check out our latest analysis for Hanison Construction Holdings

Did 896’s recent earnings growth beat the long-term trend and the industry?

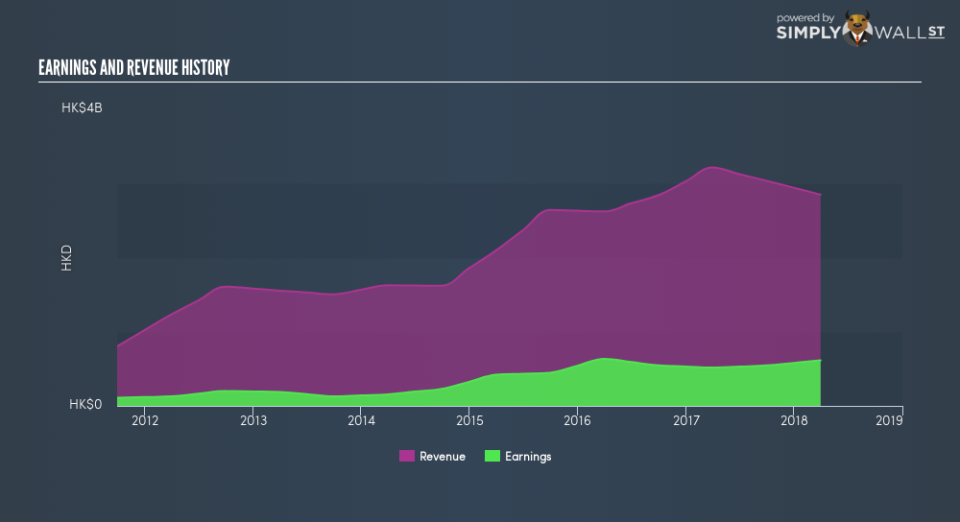

896’s trailing twelve-month earnings (from 31 March 2018) of HK$616.3m has jumped 19.2% compared to the previous year. However, this one-year growth rate has been lower than its average earnings growth rate over the past 5 years of 25.9%, indicating the rate at which 896 is growing has slowed down. To understand what’s happening, let’s look at what’s transpiring with margins and if the rest of the industry is facing the same headwind.

Over the last few years, revenue growth has not been able to catch up, which implies that Hanison Construction Holdings’s bottom line has been driven by unmaintainable cost-cutting. Looking at growth from a sector-level, the HK construction industry has been enduring some headwinds over the previous year, leading to an average earnings drop of -13.6%. This is a significant change, given that the industry has been delivering a positive rate of 6.5%, on average, over the previous five years. This growth is a median of profitable companies of 25 Construction companies in HK including Hong Kong International Construction Investment Management Group, Deson Construction International Holdings and Sam Woo Construction Group. This suggests that whatever near-term headwind the industry is experiencing, Hanison Construction Holdings is relatively better-cushioned than its peers.

In terms of returns from investment, Hanison Construction Holdings has fallen short of achieving a 20% return on equity (ROE), recording 16.5% instead. However, its return on assets (ROA) of 11.9% exceeds the HK Construction industry of 5.6%, indicating Hanison Construction Holdings has used its assets more efficiently. Though, its return on capital (ROC), which also accounts for Hanison Construction Holdings’s debt level, has declined over the past 3 years from 8.4% to 5.8%.

What does this mean?

Though Hanison Construction Holdings’s past data is helpful, it is only one aspect of my investment thesis. Companies that have performed well in the past, such as Hanison Construction Holdings gives investors conviction. However, the next step would be to assess whether the future looks as optimistic. You should continue to research Hanison Construction Holdings to get a more holistic view of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for 896’s future growth? Take a look at our free research report of analyst consensus for 896’s outlook.

Financial Health: Are 896’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 31 March 2018. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.