Does Jiayin Group (NASDAQ:JFIN) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Jiayin Group (NASDAQ:JFIN), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Jiayin Group

Jiayin Group's Improving Profits

Jiayin Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Jiayin Group's EPS grew from CN¥12.04 to CN¥25.84, over the previous 12 months. It's a rarity to see 115% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

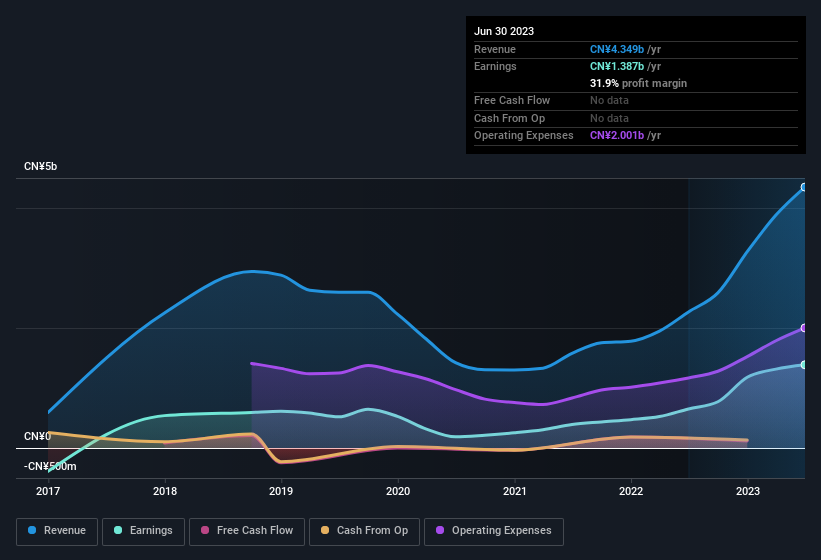

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Jiayin Group maintained stable EBIT margins over the last year, all while growing revenue 92% to CN¥4.3b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Jiayin Group is no giant, with a market capitalisation of US$269m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Jiayin Group Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Jiayin Group insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 64%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have CN¥174m invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Jiayin Group Deserve A Spot On Your Watchlist?

Jiayin Group's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Jiayin Group very closely. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Jiayin Group shapes up to industry peers, when it comes to ROE.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.