How Does Weis Markets's (NYSE:WMK) P/E Compare To Its Industry, After Its Big Share Price Gain?

It's really great to see that even after a strong run, Weis Markets (NYSE:WMK) shares have been powering on, with a gain of 31% in the last thirty days. The full year gain of 44% is pretty reasonable, too.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

See our latest analysis for Weis Markets

How Does Weis Markets's P/E Ratio Compare To Its Peers?

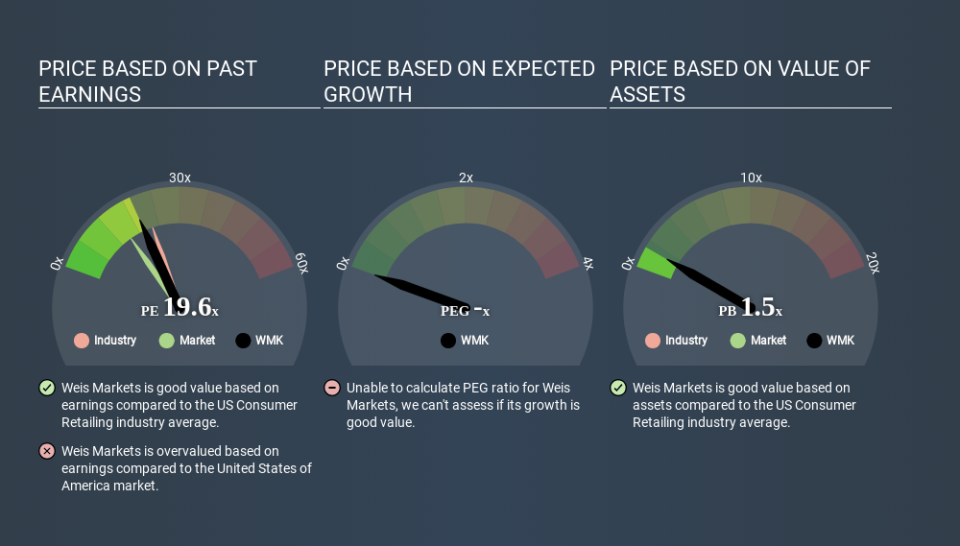

We can tell from its P/E ratio of 19.61 that sentiment around Weis Markets isn't particularly high. We can see in the image below that the average P/E (22.1) for companies in the consumer retailing industry is higher than Weis Markets's P/E.

Weis Markets's P/E tells us that market participants think it will not fare as well as its peers in the same industry. Many investors like to buy stocks when the market is pessimistic about their prospects. You should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. That means even if the current P/E is high, it will reduce over time if the share price stays flat. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Weis Markets increased earnings per share by a whopping 32% last year. And it has bolstered its earnings per share by 8.7% per year over the last five years. With that performance, I would expect it to have an above average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Weis Markets's Balance Sheet

Weis Markets has net cash of US$220m. This is fairly high at 14% of its market capitalization. That might mean balance sheet strength is important to the business, but should also help push the P/E a bit higher than it would otherwise be.

The Bottom Line On Weis Markets's P/E Ratio

Weis Markets's P/E is 19.6 which is above average (15.1) in its market. The excess cash it carries is the gravy on top its fast EPS growth. So based on this analysis we'd expect Weis Markets to have a high P/E ratio. What is very clear is that the market has become more optimistic about Weis Markets over the last month, with the P/E ratio rising from 14.9 back then to 19.6 today. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

Investors should be looking to buy stocks that the market is wrong about. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

You might be able to find a better buy than Weis Markets. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.