Dolby's (DLB) Q1 Earnings & Revenues Beat Estimates, Down Y/Y

Dolby Laboratories, Inc DLB reported first-quarter fiscal 2024 results, with non-GAAP earnings per share (EPS) of $1.01 compared with $1.11 reported in the prior-year quarter. The bottom line surpassed the Zacks Consensus Estimate of 89 cents.

Total revenues were $315.6 million, lower than $334.9 million in the year-ago quarter. However, the top line surpassed the Zacks Consensus Estimate by 1.5%.

The company announced a dividend of 30 cents per share, payable on Feb 22, 2024, to shareholders of record as of Feb 13, 2024.

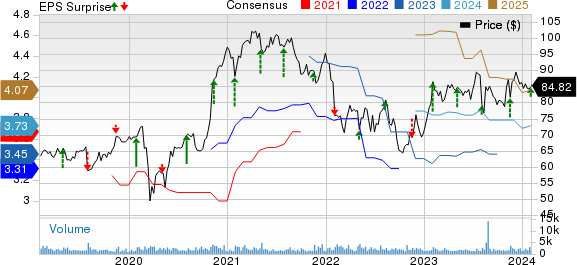

Dolby Laboratories Price, Consensus and EPS Surprise

Dolby Laboratories price-consensus-eps-surprise-chart | Dolby Laboratories Quote

Segmental Performance

Revenues from Licensing were $293.8 million, down from $308 million in the prior-year quarter. Products and Services’ revenues were $21.8 million compared with $26.9 million in the year-ago quarter. The downtick was mainly due to lower cinema product sales and the timing of orders now expected later in the year.

We expected revenues from Licensing, and Products and Services to be $286.1 million and $24.6 million, respectively, for the fiscal first quarter.

Broadcast Licensing contributed 38% to total licensing revenues in the fiscal first quarter. Mobile Licensing, Consumer Electronics, PC Licensing and Licensing from Other Markets accounted for 12%, 18%, 10% and 22% of licensing revenues, respectively.

Other Details

Gross profit in the fiscal first quarter was $283.5 million compared with $300.5 million in the year-ago quarter. Total operating expenses increased to $217.3 million from $206.4 million in the year-ago quarter.

Operating income was $66.2 million in the reported quarter compared with $94.1 million in the year-ago quarter.

Cash Flow and Liquidity

In the fiscal first quarter, Dolby generated $8.4 million of net cash from operating activities compared with $56.4 million in the prior-year period.

As of Dec 29, 2023, the company had $656.8 million in cash and cash equivalents, with $573.2 million in total liabilities.

Dolby repurchased 968,000 shares in the quarter under review and has $132 million of stock repurchase authorization available going forward.

2024 Guidance

For the second quarter of fiscal 2024, the company expects GAAP EPS to be 82-97 cents and non-GAAP EPS to be $1.14 -$1.29 on revenues of $345-$375 million.

On a GAAP basis, operating expenses are expected in the range of $215-$225 million, whereas, on a non-GAAP basis, the metric is anticipated to be between $180 million and $190 million.

For fiscal 2024, the company expects revenues to be $1.30 billion. GAAP operating margin is expected to be 20%, while non-GAAP operating margin is expected to be nearly 32%.

On a GAAP basis, operating expenses are expected to be between $885 million and $895 million, whereas, on a non-GAAP basis, the metric is suggested in the range of $740-$750 million. The company expects GAAP EPS to be $2.30-$2.45 and non-GAAP EPS to be $3.60-$3.75.

Zacks Rank

Dolby currently has a Zacks Rank #2 (Buy).

Other Stocks to Consider

Other stocks worth consideration in the broader technology space are Watts Water Technologies WTS, NETGEAR NTGR and Blackbaud BLKB. While NETGEAR currently sports a Zacks Rank #1 (Strong Buy), Watts Water and Blackbaud carry a Zacks Rank of 2 each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Watts Water Technologies’ 2023 EPS has improved by 1.1% in the past 60 days to $8.09. WTS’ earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.8%. Shares of WTS have jumped 17.6% in the past year.

The Zacks Consensus Estimate for 2023 is pegged at a loss of 9 cents per share for NETGEAR, which remained unchanged in the past 30 days. NTGR’s earnings outpaced the Zacks Consensus Estimate in three of the last four quarters while missing once. The average surprise was 127.5%. Shares of NTGR were down 26.3% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 EPS has improved by 1% in the past 60 days to $3.86. BLKB’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 10.6%. Shares of BLKB have gained 31% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dolby Laboratories (DLB) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report