The Dollar Holds Strong as Headline Inflation Ticks Back Up

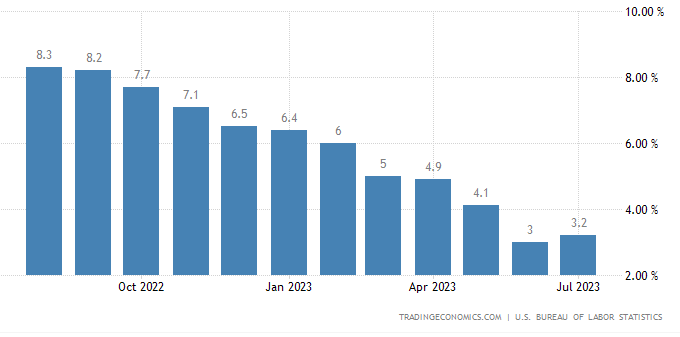

Annual non-core inflation in the USA for July came in at 3.2% on Thursday 10 August, slightly lower than expected but still an uptick from June’s figure. The core figure was also lower than the consensus at 4.7%. The reaction by markets has been muted partially because activity is seasonally low, but the dollar’s gains have continued on the whole while gold has struggled.

Although the pace of rising prices did increase slightly, the general picture is cautiously optimistic for the consumer; prices for food and energy specifically have continued to drop although more slowly than last month. Sentiment in markets remains fairly positive, with many participants becoming more confident in recent months that the USA can avoid a significant recession.

However, the Fed still wants to bring inflation down further, closer to 2% or even below. With job data and GDP relatively strong considering how high and how quickly the funds rate has gone up, it seems like there’s more room for the Fed to keep hiking. For now, the large majority of participants expects the current 5.25-5.5% to be the peak of this cycle of tightening according to CME FedWatch Tool. A pivot is expected at the very end of the first quarter next year at the earliest.

It’s generally not a good idea to read too much into one month’s data for inflation. There’s still one more release on 13 September before the Fed’s next meeting a week after that. The FOMC will consider all of the latest figures within their context when deciding on rates and possibly signalling an extended pause.

Cable, Daily Chart

Apart from American inflation, surprisingly positive British GDP data on Friday 11 August have boosted the pound in many of its pairs. Nevertheless, the Bank of England remains 0.25% behind the Fed on rates despite British inflation at 7.9% being more than double the USA’s. According to recent comments, the Bank of England now expects the UK to avoid a recession. Overall, there isn’t a clear fundamental narrative for cable in either direction at the moment.

That makes the downward movement since the middle of last month understandable as a technical retracement rather than the beginning of a new downtrend, for the moment at least. Volume for cable has remained relatively high this summer, while 3 August’s strong bounce with a dragonfly doji from the 100 SMA would usually suggest a fairly strong buy signal. Acting on that would require patience, but it’s also not certain how the pound will react to the critical job report and inflation data on 15 and 16 August.

S&P 500, Daily Chart

The S&P 500 didn’t react strongly to the release of numbers on inflation, but on Friday 11 August sentiment was somewhat dented by higher producer prices in the USA. These might suggest that the Fed will have to keep rates higher for longer. As for most other markets, there haven’t been any dramatic moves by major American shares this summer so far, with tech and travel-related shares generally remaining strong.

The support in focus remains the 61.8% weekly Fibonacci retracement around 4,350, which was also the limit of the smaller retracement two months ago. It doesn’t seem likely that the price could break through there before activity starts to return later this month and in September unless there are major surprises from the biggest companies still to release earnings reports, including Nvidia, Walmart and Cisco. However, since the price hasn’t clearly broken through the 50 SMA from Bands, it’d be possible to see a bounce in the next few days and a channel forming between 4,450 and 4,600.

If you’d like to discover more about any of these topics and the prospects for the Fed’s next meeting, register for and join Exness’ upcoming webinar on 11 September at 10.00 GMT. Antreas Themistokleous CFTe, trading specialist at Exness, will discuss the latest news affecting major symbols, analyse gold, forex and more live plus answer all relevant questions.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire

More From FXEMPIRE:

USD/JPY Weekly Forecast – US Dollar Spikes Against the Japanese Yen

GBP/JPY Weekly Forecast – British Pound Continues to Threaten a Breakout

GBP/JPY Forecast – British Pound Continues to Threaten a Breakout Against the Japanese Yen

USD/JPY Forecast – US Dollar Continues to Reach Higher Against the Japanese Yen