Dollar Tree Inc (DLTR) Faces Headwinds Despite Revenue Growth

Net Sales: Increased by 8.0% to $30.6 billion in fiscal 2023.

Same-Store Sales: Dollar Tree segment grew by 5.8%, while Family Dollar decreased by 1.2% in Q4.

Adjusted EPS: $2.55 in Q4, reflecting a 25.0% increase, and $5.89 for fiscal 2023, down by 18.3%.

Net Loss: Reported a diluted loss per share of $7.85 due to significant impairment charges.

Store Closures: Plans to close approximately 600 Family Dollar stores in H1 fiscal 2024.

Fiscal 2024 Outlook: Net sales expected to range from $31.0 billion to $32.0 billion, with diluted EPS between $6.70 and $7.30.

Share Repurchase: No shares repurchased in Q4, with $1.35 billion remaining under the authorization.

On March 13, 2024, Dollar Tree Inc (NASDAQ:DLTR) released its 8-K filing, disclosing the financial outcomes of a challenging fiscal year. The company, known for its discount stores across North America, operates over 16,000 shops under the Dollar Tree and Family Dollar banners. Dollar Tree's sales are primarily composed of consumables and variety items, with most merchandise sold at the $1.25 price point. Family Dollar, on the other hand, focuses on consumable merchandise at prices below $10.

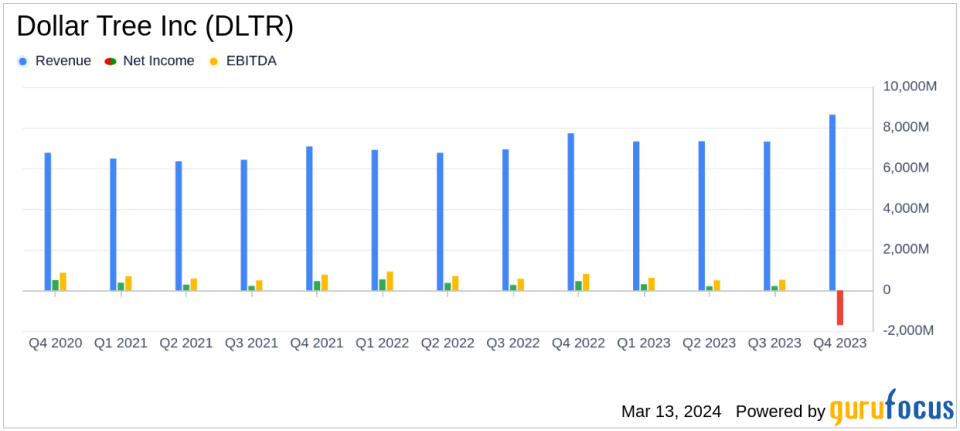

The fiscal year 2023 was marked by a mixed performance, with Dollar Tree segment showing resilience with a 5.8% increase in same-store sales, while Family Dollar struggled with a 1.2% decrease in the fourth quarter. Despite these challenges, the company managed to increase its net sales by 8.0% to $30.6 billion for the year.

However, the company faced significant headwinds, including a net loss with a diluted loss per share of $7.85, primarily due to a $594.4 million charge for portfolio optimization review, a $1.07 billion goodwill impairment charge, and a $950 million trade name intangible asset impairment charge. These charges reflect the company's strategic decisions to close approximately 600 Family Dollar stores in the first half of fiscal 2024 and additional closures as leases expire.

Financial Highlights and Challenges

The fourth quarter adjusted earnings per share (EPS) stood at $2.55, which includes $0.17 of costs primarily related to general liability claims. The adjusted EPS for the fiscal year was $5.89, down 18.3% from the previous year. The company's gross profit increased by 16.2% to $2.77 billion in the fourth quarter, with gross margin expanding by 120 basis points to 32.1%. This expansion was driven by lower freight costs and sales leverage, among other factors.

Despite the revenue growth, Dollar Tree Inc (NASDAQ:DLTR) encountered increased selling, general, and administrative expenses, which surged to 54.0% of total revenue due to the aforementioned impairment charges. The operating loss for the fourth quarter was a substantial $1.89 billion, with an operating margin of -21.9%. The adjusted operating income, however, paints a more favorable picture, with a 21.2% increase to $749.1 million and an adjusted operating margin expansion of 70 basis points to 8.7%.

The company's balance sheet shows a cash and cash equivalents position of $684.9 million as of February 3, 2024, with merchandise inventories at $5.1 billion. The net cash provided by operating activities increased by $1.07 billion in fiscal 2023, and free cash flow improved by $217.2 million compared to fiscal 2022.

Looking ahead, Dollar Tree Inc (NASDAQ:DLTR) has set a fiscal 2024 net sales outlook range of $31.0 billion to $32.0 billion, with diluted EPS expected to be between $6.70 and $7.30. The company's CFO Jeff Davis remains optimistic about the future, stating, "We are making solid progress on our key growth initiatives and are encouraged by the early results of our business transformation efforts."

Value investors may find interest in Dollar Tree's forward-looking strategies and the potential for a turnaround following the portfolio optimization. However, the significant impairment charges and store closures indicate a period of transition that warrants careful consideration of the company's future performance.

"We finished the year strong, with fourth quarter results reflecting positive traffic trends, market share gains, and adjusted margin improvement across both segments," said Rick Dreiling, Chairman and Chief Executive Officer. "While we are still in the early stages of our transformation journey, I am proud of what our team accomplished in 2023 and see a long runway of growth ahead of us."

For a detailed analysis of Dollar Tree Inc (NASDAQ:DLTR)'s financials and future prospects, investors are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Dollar Tree Inc for further details.

This article first appeared on GuruFocus.