Dollar Tree (NASDAQ:DLTR) Reports Q4 In Line With Expectations But Stock Drops on Guidance

Discount treasure-hunt retailer Dollar Tree (NASDAQ:DLTR) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 11.9% year on year to $8.64 billion. The company expects next quarter's revenue to be around $7.75 billion, slightly above analysts' estimates. It made a GAAP loss of $7.85 per share, down from its profit of $2.04 per share in the same quarter last year.

Is now the time to buy Dollar Tree? Find out by accessing our full research report, it's free.

Dollar Tree (DLTR) Q4 FY2023 Highlights:

Revenue: $8.64 billion vs analyst estimates of $8.65 billion (small miss)

EPS: -$7.85 vs analyst estimates of $2.65 (-$10.50 miss) ($1.1 billion impairment charge)

Revenue Guidance for Q1 2024 is $7.75 billion at the midpoint, above analyst estimates of $7.69 billion

Management's revenue guidance for the upcoming financial year 2024 is $31.5 billion at the midpoint, missing analyst estimates by 0.7% and implying 2.9% growth (vs 7.9% in FY2023)

Management's EPS guidance for the upcoming financial year 2024 is $7.00 at the midpoint, missing analyst estimates of $7.07 by 1.0%

Gross Margin (GAAP): 32.2%, up from 31% in the same quarter last year

Free Cash Flow of $470.8 million, down 14.8% from the same quarter last year

Same-Store Sales were up 3% year on year (slight beat)

Store Locations: 16,774 at quarter end, increasing by 434 over the last 12 months

Market Capitalization: $32.61 billion

“We finished the year strong, with fourth quarter results reflecting positive traffic trends, market share gains, and adjusted margin improvement across both segments,” said Rick Dreiling, Chairman and Chief Executive Officer.

A treasure hunt because there’s no guarantee of consistent product selection, Dollar Tree (NASDAQ:DLTR) is a discount retailer that sells general merchandise and select packaged food at extremely low prices.

Discount Grocery Store

Traditional grocery stores are go-tos for many families, but discount grocers serve those who may not have a traditional grocery store nearby or who may have different spending thresholds. Certain rural or lower-income areas simply don’t have a grocery store. Additionally, some lower-income families would prefer to buy in smaller quantities than available at most stores (think one or two paper towel rolls at a time). While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of buying food. Furthermore, those buying small quantities for immediate need are even less likely to leverage e-commerce for these purposes.

Sales Growth

Dollar Tree is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

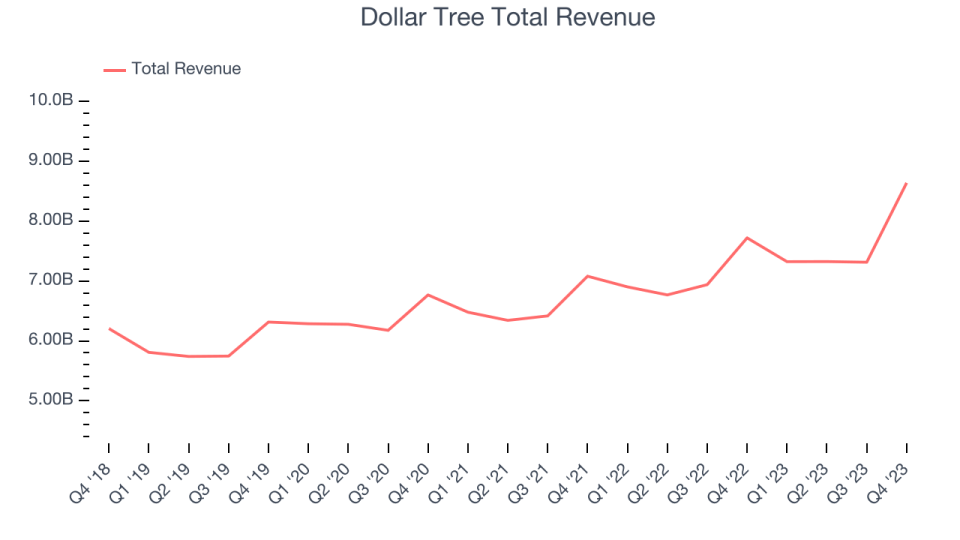

As you can see below, the company's annualized revenue growth rate of 6.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, Dollar Tree's revenue grew 11.9% year on year to $8.64 billion, falling short of Wall Street's estimates. The company is guiding for revenue to rise 5.8% year on year to $7.75 billion next quarter, in line with the 6.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 3.5% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

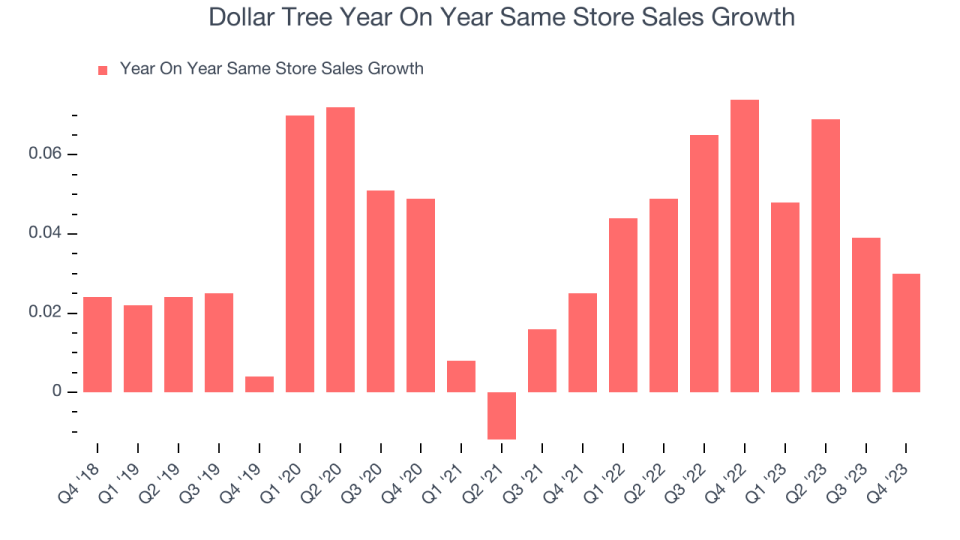

Dollar Tree's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 5.2% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Dollar Tree is reaching more customers and growing sales.

In the latest quarter, Dollar Tree's same-store sales rose 3% year on year. By the company's standards, this growth was a meaningful deceleration from the 7.4% year-on-year increase it posted 12 months ago. We'll be watching Dollar Tree closely to see if it can reaccelerate growth.

Key Takeaways from Dollar Tree's Q4 Results

It was encouraging to see Dollar Tree slightly beat analysts' revenue guidance expectations. On the other hand, its full year revenue and EPS guidance both missed Wall Street's estimates. Overall, this was a mixed quarter for Dollar Tree. The company is down 6.5% on the results and currently trades at $140.06 per share.

Dollar Tree may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.