Dominion (D) Lowers Q2 Earnings Guidance Due to Unplanned Outages

Dominion Energy Inc. D lowered its second-quarter 2023 operating earnings guidance to 44-50 cents per share from the previously guided range of 58-68 cents per share. The company reported earnings of 77 cents per share in the year-ago quarter.

Factors Impacting Q2 Earnings

Extremely mild weather in the company's electric service regions (compared with the 15-year average) is anticipated to reduce operating earnings by 7-9 cents per share in the second quarter.

On Apr 6, 2023, Millstone Power Station Unit 2 entered a planned refueling outage. The downtime lasted longer than anticipated due to additional work that was discovered during the outage. Once all the essential repairs are made, the unit will be prepared for service.

Millstone Power Station Unit 3 had an automatic reactor trip on May 30, 2023, as a result of a turbine shutdown caused by electrical protection. All systems responded as expected to the trip, and the device was put back to use on Jun 29.

The aforementioned negative factors were marginally offset by the cost saving initiatives of the company during the second quarter.

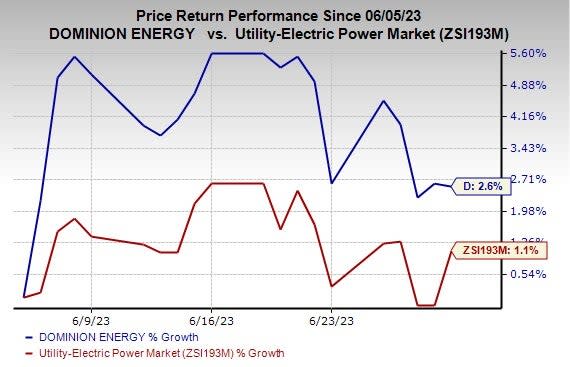

Price Performance

In the past month, shares of Dominion have risen 2.6% compared with the industry’s 1.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Dominion currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the same industry are PPL Corporation PPL, NiSource Inc. NI and DTE Energy Company DTE, each carrying Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PPL’s long-term (three- to five-year) earnings growth rate is 7.4%. The Zacks Consensus Estimate for 2023 earnings per share (EPS) indicates a year-over-year increase of 12.8%.

NiSource’s long-term earnings growth rate is 7%. The Zacks Consensus Estimate for 2023 EPS indicates a year-over-year improvement of 8.8%.

DTE’s long-term earnings growth rate is 6%. The Zacks Consensus Estimate for 2023 EPS implies year-over-year growth of 1.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

NiSource, Inc (NI) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report