Dominion (D) Proposes Additional Solar Projects in Virginia

Dominion Energy Inc’s D announced that it has proposed more than a dozen additional solar projects for Virginia customers. If approved, these would produce 772 megawatt (MW) of carbon-free electricity, which at full capacity could power about 200,000 homes in Virginia.

The proposal would significantly increase Dominion’s solar fleet, which is now the second-largest in the country. If permitted, the company would install more than 4,600 MW of solar power in Virginia, which at full capacity could supply energy to over 1.1 million homes.

Details of the Initiative

The plan involves six solar projects with a combined capacity of 337 MW that Dominion Energy Virginia will either own or buy. It also contains 13 power purchase agreements (PPAs) with independently owned solar projects that would have a combined capacity of 435 MW. A competitive solicitation method was used to choose the PPAs.

The cost of these projects is anticipated to raise monthly bills for typical residential customers by around $1.54. Current rates from Dominion Energy Virginia are 32% below average on the East Coast and 16% below average nationwide.

These initiatives help Dominion in maintaining its commitment to providing its consumers with cheap, reliable and cleaner energy.

In addition to SCC’s approval, the utility-owned projects require local and state permission before the construction of the same begins. If approved, the work is expected to be completed between 2024 and 2026.

Focus on Renewable Energy

Dominion plans to expand its supply of sustainable energy. In order to attain net-zero emissions from its electric generating and natural gas infrastructure by 2050, the solar projects will complement their existing renewable energy projects.

D’s long-term objective is to add 24 gigawatt (GW) of battery storage, solar, hydro and wind (offshore as well as onshore) projects by 2036 and increase the renewable energy capacity by more than 15% per year, on average, over the next 15 years. The company plans to invest $42 billion in offshore wind and solar projects during 2022-2035 to further expand its renewable operations.

Growth Prospects

Utilities in the United States are gradually gaining strength from renewable sources of energy, with an increased focus on solar projects. Per the U.S. Energy Information Administration (EIA), solar and wind have been two dominant sources of U.S. electricity generation in recent years. EIA expects an increase in utility-scale solar capacity of 26 GW and 33 GW in 2023 and 2024, respectively. These would be the highest solar installations for any year on record.

According to the Solar Energy Industries Association (SEIA), the industry continues to recover slowly from the supply chain constraints it felt acutely in 2022. There is a cumulative total of 153 GW-direct current of solar capacity installed through the first half of 2023, and SEIA expects this figure to grow to 375 GW- direct current by the end of 2028.

Along with Dominion, other electric power companies like Xcel Energy, Inc. XEL, FirstEnergy Corporation FE and Ameren Corp. AEE are also focused on strengthening their footprint in the U.S. solar market.

In September 2023, Xcel Energy received approval from Minnesota officials for the expansion of a solar energy project under construction. This initiative will add 250 MW to a 460-MW array, which is a part of the Sherco solar project. More than 150,000 houses will have access to the 710-MW project's yearly energy supply.

XEL’s long-term (three to five years) earnings growth rate is 6.34%. The Zacks Consensus Estimate for 2023 earnings per share (EPS) implies a year-over-year improvement of 5.4%.

In September 2023, FirstEnergy’s subsidiaries, Mon Power and Potomac Edison, received approval from the West Virginia Public Service Commission for the construction of three solar projects in West Virginia. This would enable consumers to purchase renewable energy and meet sustainability objectives.

The Zacks Consensus Estimate for FE’s 2023 EPS implies a year-over-year improvement of 4.6%. The same for sales indicates a year-over-year increase of 5.1%.

In June 2023, Ameren announced that its arm, Ameren Missouri, has planned to increase its renewable energy generation capability with 550 MW of solar projects. AEE aims to either acquire or construct four solar projects, which will be enough to power more than 95,000 average-sized homes.

AEE’s long-term earnings growth rate is 6.43%. It delivered an average earnings surprise of 8.9% in the last four quarters.

Price Performance

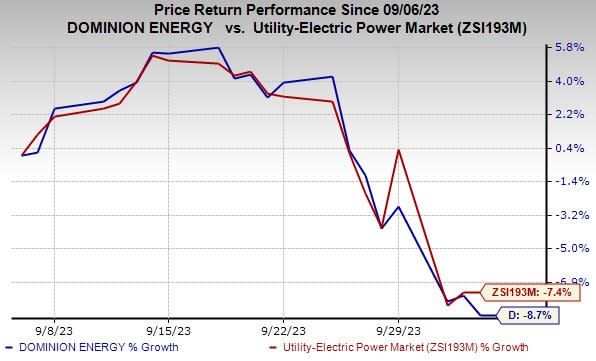

In the past month, shares of Dominion have lost 8.7% compared with the industry’s 7.4% decline.

Image Source: Zacks Investment Research

Zacks Rank

Dominion currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report