Dominion's (D) Largest Battery Storage System Starts Operation

Dominion Energy Inc.’s D largest battery storage facility is now operating in Chesterfield County. The Dry Bridge Battery Energy Storage System has the capacity to store 20 megawatts (MW) of electricity, which is equivalent to four hours of power for 5,000 houses.

The latest system, which went online in late November, is another addition to Dominion Energy's expanding portfolio of battery storage facilities in the Commonwealth. Currently, the company operates three facilities in Powhatan, New Kent and Hanover counties, and two more are being developed in Sussex and Loudoun counties.

D's Focus on Renewable Energy

Dominion aims to attain net-zero carbon and methane emissions from its electric generation and natural gas infrastructure by 2050.

The company is working on battery storage projects, offshore wind projects and hydropower projects to lower emissions. Its long-term objective is to add 24 gigawatts (GW) of battery storage, solar, hydro and wind (offshore as well as onshore) projects by 2036 and increase the renewable energy capacity by more than 15% per year, on average, over the next 15 years.

The Dry Bridge facility's completion follows a number of other significant advancements in battery storage that have occurred recently. At Dulles International Airport, the company started construction on a 50 MW battery storage project in August 2023. Once operational, this battery storage system will be the largest in the company's fleet. Since September, the corporation has been announcing battery storage pilot projects at Virginia State University and Darbytown Power Station. These initiatives are intended to explore longer-lasting, possibly revolutionary alternatives to conventional lithium-ion batteries.

Growth Prospects

A transition is evident in the Utility space, with companies adding more renewable sources of energy to their generation portfolio. The development of renewable projects in the United States will also require the development of efficient battery storage projects that ensure excess electricity generated from renewable projects during off-peak hours remains available to consumers for a longer period of time and is distributed when demand increases.

Battery storage capacity in the country has grown rapidly over the past couple of years. Per the U.S. Energy Information Administration, battery capacity in the United States is likely to double in 2023, with a planned capacity addition of nearly 9.4 GW. This represents the immense potential for battery storage project infrastructure expansion for utilities.

Apart from D, other electric power utility companies like Alliant Energy Corp. LNT, Duke Energy Corp. DUK and Pinnacle West Capital Corporation PNW are also focused on battery storage projects in the United States.

In August 2023, the Public Service Commission of Wisconsin approved two Alliant Energy battery energy storage projects — the 100-MW Grant County Battery project and the 75-MW Wood County Battery project.

LNT’s long-term (three to five years) earnings growth rate is 6.26%. The Zacks Consensus Estimate for its 2023 EPS indicates an increase of 2.5% year over year.

In March 2023, Duke Energy commenced operations at its battery storage project in Onslow County, NC. The project, which boasts a capacity of 11 MW, is claimed to be the largest storage facility in the state.

DUK’s long-term earnings growth rate is 6.09%. The Zacks Consensus Estimate for its 2023 EPS indicates an increase of 6.1% year over year.

Pinnacle West aims to develop 1,600 MW of clean energy and storage that are expected to be placed in service by 2024 for Arizona Public Service Company customers. It also plans to install more than 2,100 MW of energy storage by 2025, including the energy storage projects under purchase power agreements and Arizona sun retrofits.

PNW’s long-term earnings growth rate is 5.9%. The Zacks Consensus Estimate for its 2023 sales indicates an increase of 6.7% year over year.

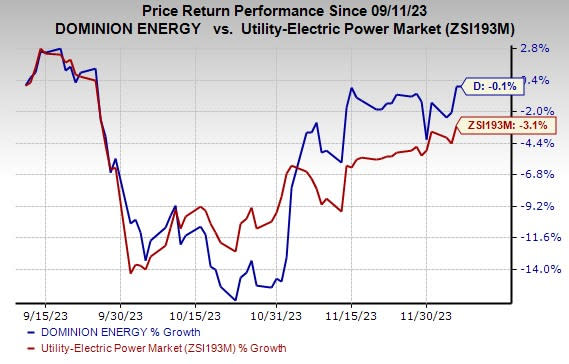

Price Performance

In the past three months, shares of Dominion have lost 0.1% compared with the industry’s 3.1% decline.

Image Source: Zacks Investment Research

Zacks Rank

D currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report