Domino's (DPZ) Benefits From Expansion Efforts & Robust Comps

Domino's Pizza, Inc. DPZ has experienced an upward trend due to its successful global expansion, strong comparable sales growth, effective strategies to boost sales, innovative menu additions and advancements in digital technology.

This Zacks Rank #3 (Hold) company’s earnings and sales in 2024 are likely to witness a rise of 8.4% and 6.8% year over year, respectively. The company has an impressive long-term earnings growth rate of 12.8%. However, headwinds related to staffing challenges and inflationary pressures persist.

Factors Driving Growth

DPZ remains dedicated to strengthening its business through strategic expansion in high-growth international markets. It continues to achieve robust and diverse international growth, driven by strong unit-level economics.

In the fiscal third quarter, DPZ successfully integrated 27 net new stores in the United States, bringing the total U.S. system store count to 6,762. Simultaneously, the international segment saw the addition of 190 net new stores. Although DPZ foresees its annual global net store growth potentially aligning with or slightly below the low end of the 5-7% two-to-three-year outlook, the positive trend in store growth is expected to be advantageous in the upcoming period.

The company is gaining from robust comparable sales growth. During the fiscal third quarter, global retail sales (including total franchise and company-owned units) rose 5.3% on a year-over-year basis. The upside was driven by higher international store sales (up 9.8% year over year) and global net store growth. Meanwhile, the U.S. store sales inched up 1.7% year over year. Without foreign currency adjustments, global retail sales increased 5.1% from the prior-year levels.

Comps at international stores, excluding foreign currency translation, improved 3.3% year over year. In the prior-year quarter, the metric inched down 1.8%. For the fiscal fourth quarter, our model predicts comps at the U.S. company-owned and franchise stores to be 2.9% and 1% compared with the prior year’s respective figures of 3.4% and 0.8%. Also, we expect international comps to be 3.3% compared with 2.6% a year ago.

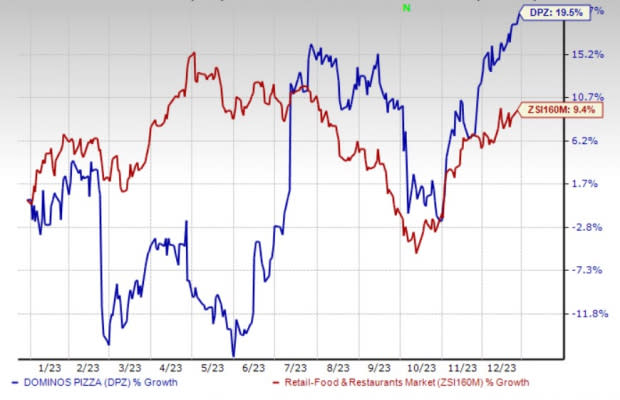

Image Source: Zacks Investment Research

Concerns

Lower supply-chain revenues (owing to a decline in market basket pricing and lower order volumes) and lower U.S. company-owned store revenues remain concerns. Going forward, the company anticipates headwinds related to staffing challenges and inflationary pressures to affect operations for some time.

Inflationary pressures in commodity and labor costs continue to hurt Domino’s. The industry players expect to witness higher costs due to labor shortages for quite some time. DPZ has been witnessing labor challenges in a handful of markets.

Key Picks

Below, we present some better-ranked stocks from the Zacks Retail-Wholesale sector.

Arcos Dorados Holdings Inc. ARCO sports a Zacks Rank #1 (Strong Buy) at present. The company has a trailing four-quarter earnings surprise of 28.3%, on average. Shares of ARCO have surged 55.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ARCO’s 2024 sales and earnings per share (EPS) indicates 10.6% and 15.5% growth, respectively, from the year-ago period’s levels.

Brinker International, Inc. EAT flaunts a Zacks Rank #1 at present. It has a trailing four-quarter earnings surprise of 223.6%, on average. Shares of EAT have gained 38.9% in the past year.

The Zacks Consensus Estimate for EAT’s 2024 sales and EPS indicates 5.1% and 26.2% growth, respectively, from the year-ago period’s levels.

Wingstop Inc. WING sports a Zacks Rank #1 at present. It has a trailing four-quarter earnings surprise of 28.9%, on average. The stock has gained 83.6% in the past year.

The Zacks Consensus Estimate for WING’s 2024 sales and EPS suggests 15.8% and 18.2% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report