Domo Inc (DOMO) Posts Narrowed Net Loss in Q4; Subscription Revenue Grows

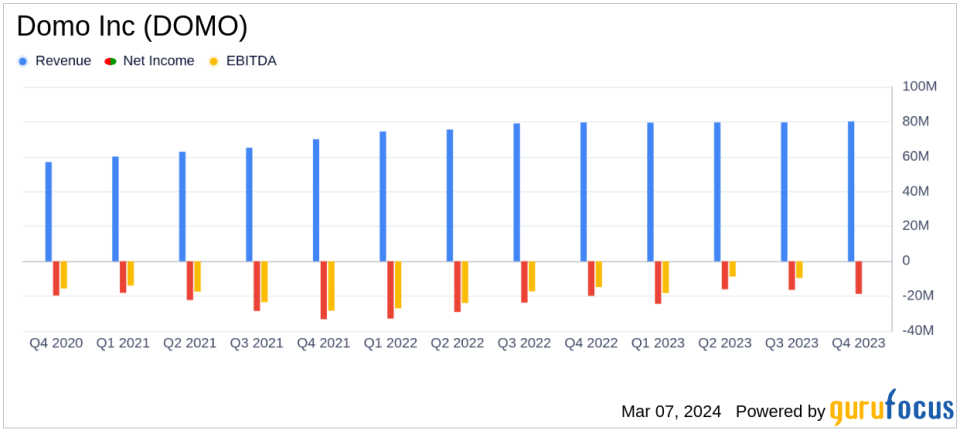

Total Revenue: Q4 total revenue increased by 1% year over year to $80.2 million.

Subscription Revenue: Q4 subscription revenue grew by 2% year over year to $71.9 million.

GAAP and Non-GAAP Net Loss: GAAP net loss was $18.7 million, while non-GAAP net loss was $1.9 million.

Operating Margins: GAAP operating margin improved by 4 percentage points; non-GAAP operating margin improved by 1 percentage point year over year.

Cash Position: Cash, cash equivalents, and restricted cash totaled $60.9 million as of January 31, 2024.

Full Year Revenue: Fiscal 2024 total revenue was $319.0 million, a 3% increase from the previous year.

Billings: Fiscal 2024 billings saw a slight decrease of 1% year over year.

On March 7, 2024, Domo Inc (NASDAQ:DOMO) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full fiscal year 2024. Domo Inc, a cloud-based platform provider, connects data, systems, and people within organizations, enabling real-time insights and business management through mobile devices. The company's subscription-based service has shown resilience, with a year-over-year increase in subscription revenue, indicating the value customers place on Domo's offerings.

Financial Performance and Challenges

Domo Inc's modest revenue growth reflects the competitive nature of the software industry and the challenges of scaling subscription services. Despite a slight increase in total and subscription revenues, the company's billings experienced a marginal decline. The GAAP net loss of $18.7 million, an improvement from the previous year, alongside a non-GAAP net loss of $1.9 million, suggests that Domo is managing its expenses effectively, as evidenced by the improved operating margins. However, the company's ability to convert these improvements into sustainable profitability remains a challenge.

Financial Achievements and Industry Significance

The improvement in operating margins is a significant achievement for Domo Inc, as it indicates better operational efficiency, which is crucial for software companies that bear high upfront development costs. The growth in subscription revenue is particularly important because it represents a stable and recurring revenue stream, which is a key metric for the valuation of software companies.

Key Financial Details

From the income statement, Domo Inc reported a GAAP net loss per share of $0.51, an improvement from the previous fiscal year's $2.10. The balance sheet shows a cash position of $60.9 million, providing the company with a buffer to support its operations and strategic investments. The cash flow statement reveals that net cash provided by operating activities was $5.4 million for the quarter, a positive sign of operational cash generation.

"The strategic investments were making this year will help customers capitalize on the new opportunities offered through artificial intelligence (AI) and data, making it easier and faster to scale Domos full suite of solutions across the entire organization," said Josh James, founder and CEO, Domo.

Analysis of Company Performance

Domo's focus on AI and data is a strategic move to differentiate its offerings and add value to its customers. The company's commitment to innovation is underscored by recognitions such as being named an Overall Leader in the Ventana Research Buyers Guide for Collaborative Analytics. While the financial results show a company in transition, with a need to further boost revenue growth and achieve profitability, Domo's strategic direction appears to align with the evolving needs of the market.

For more detailed information, investors are encouraged to review the full earnings release and financial statements provided by Domo Inc.

Explore the complete 8-K earnings release (here) from Domo Inc for further details.

This article first appeared on GuruFocus.