Don’t Sell Guaranty Federal Bancshares Inc (NASDAQ:GFED) Before You Read This

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We’ll show how you can use Guaranty Federal Bancshares Inc’s (NASDAQ:GFED) P/E ratio to inform your assessment of the investment opportunity. Guaranty Federal Bancshares has a P/E ratio of 19.48, based on the last twelve months. That corresponds to an earnings yield of approximately 5.1%.

See our latest analysis for Guaranty Federal Bancshares

How Do I Calculate A Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Guaranty Federal Bancshares:

P/E of 19.48 = $23.79 ÷ $1.22 (Based on the trailing twelve months to September 2018.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each $1 the company has earned over the last year. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the ‘E’ will be lower. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. Then, a higher P/E might scare off shareholders, pushing the share price down.

Guaranty Federal Bancshares’s earnings per share fell by 15% in the last twelve months. And over the longer term (5 years) earnings per share have decreased 7.2% annually. This might lead to muted expectations.

How Does Guaranty Federal Bancshares’s P/E Ratio Compare To Its Peers?

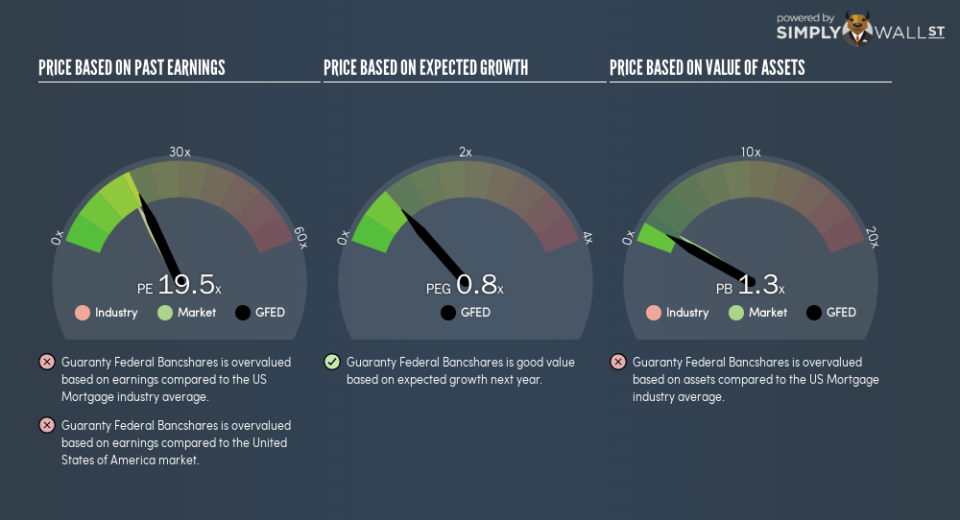

The P/E ratio indicates whether the market has higher or lower expectations of a company. As you can see below, Guaranty Federal Bancshares has a higher P/E than the average company (17.7) in the mortgage industry.

Its relatively high P/E ratio indicates that Guaranty Federal Bancshares shareholders think it will perform better than other companies in its industry classification. Shareholders are clearly optimistic, but the future is always uncertain. So investors should always consider the P/E ratio alongside other factors, such as whether company directors have been buying shares.

Remember: P/E Ratios Don’t Consider The Balance Sheet

It’s important to note that the P/E ratio considers the market capitalization, not the enterprise value. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Is Debt Impacting Guaranty Federal Bancshares’s P/E?

Guaranty Federal Bancshares’s net debt is 87% of its market cap. This is a reasonably significant level of debt — all else being equal you’d expect a much lower P/E than if it had net cash.

The Verdict On Guaranty Federal Bancshares’s P/E Ratio

Guaranty Federal Bancshares has a P/E of 19.5. That’s higher than the average in the US market, which is 17.9. With meaningful debt and a lack of recent earnings growth, the market has high expectations that the business will earn more in the future.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, ‘In the short run, the market is a voting machine but in the long run, it is a weighing machine.’ So this free visual report on analyst forecasts could hold they key to an excellent investment decision.

Of course you might be able to find a better stock than Guaranty Federal Bancshares. So you may wish to see this free collection of other companies that have grown earnings strongly.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.