Donald Smith & Co. Adjusts Stake in M/I Homes Inc

Overview of Donald Smith & Co (Trades, Portfolio).'s Recent Trade

Donald Smith & Co (Trades, Portfolio)., a firm known for its value investing approach, has recently made a significant adjustment to its investment in M/I Homes Inc (NYSE:MHO). On December 31, 2023, the firm reduced its holdings in the residential construction company by 469,181 shares, resulting in a 23.11% change in its position. This transaction had a -2.22% impact on the firm's portfolio, with the trade executed at a price of $137.74 per share. Following the trade, Donald Smith & Co (Trades, Portfolio). holds 1,561,020 shares of M/I Homes Inc, which now represents 5.61% of their investment portfolio.

Donald Smith & Co (Trades, Portfolio).'s Investment Profile

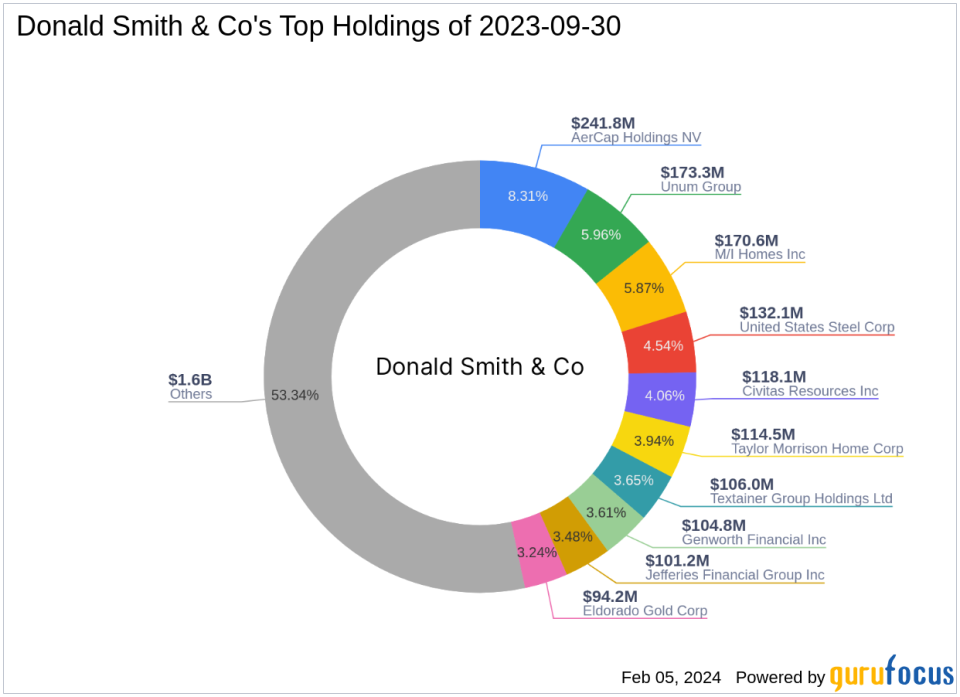

Donald Smith & Co (Trades, Portfolio). was founded by the late Donald G. Smith, who led the firm as Chief Investment Officer from 1980 until his passing in 2019. The firm's investment philosophy is deeply rooted in a bottom-up, deep-value approach, focusing on out-of-favor companies trading at discounts to tangible book value. With a keen eye for companies positioned in the lowest decile of price-to-tangible book ratios, Donald Smith & Co (Trades, Portfolio). seeks out those with a positive earnings outlook over a two to four-year horizon. The firm's current equity stands at $2.91 billion, with top holdings in sectors such as Financial Services and Basic Materials, including AerCap Holdings NV (NYSE:AER) and M/I Homes Inc (NYSE:MHO).

M/I Homes Inc: A Residential Construction Leader

M/I Homes Inc, with its stock symbol MHO, operates primarily in the residential construction industry within the United States. Since its IPO on November 3, 1993, the company has expanded its operations to include homebuilding and financial services. M/I Homes Inc targets a range of homebuyers, from entry-level to luxury, and provides mortgage loans and title services to support its homebuilding operations. With a market capitalization of $3.44 billion, the company has established a strong presence in the Midwest, Mid-Atlantic, and Southern regions of the U.S.

Details of the Recent Transaction

The trade conducted by Donald Smith & Co (Trades, Portfolio). on December 31, 2023, saw the firm's stake in M/I Homes Inc decrease to 1,561,020 shares. The trade price was $137.74, and the position now accounts for 7.56% of the firm's portfolio. This adjustment reflects the firm's ongoing strategy to manage its investments actively and align with its value investing principles.

Market Performance of M/I Homes Inc

Since the trade date, M/I Homes Inc's stock price has experienced a decline, currently sitting at $123.48. This represents a -10.35% change in stock price, with a year-to-date performance showing a -7.85% decrease. Despite this recent dip, the stock has seen a substantial increase of 1617.39% since its IPO.

Financial Health and Valuation Metrics

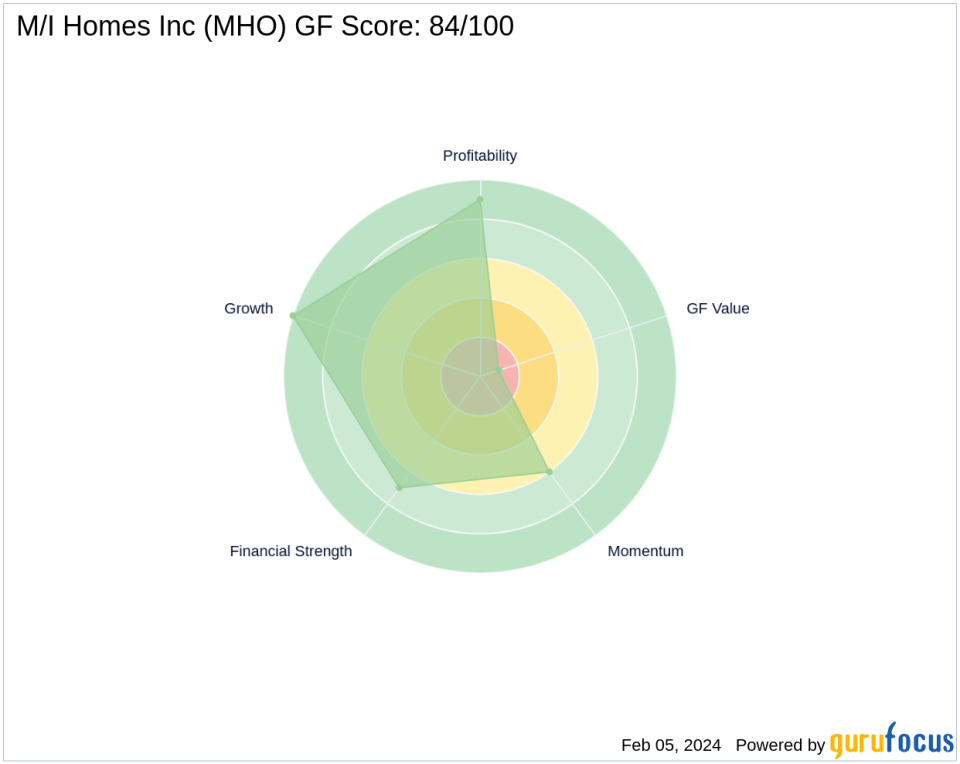

M/I Homes Inc's financial health is reflected in its PE Ratio of 7.60 and a GF Value of $68.60, indicating the stock is significantly overvalued with a Price to GF Value ratio of 1.80. The company's balance sheet, profitability, and growth ranks stand at 7/10, 9/10, and 10/10, respectively, showcasing a strong financial position. However, the GF Value Rank is at a low 1/10, suggesting the market has priced the stock well above its intrinsic value.

Comparative Analysis with Other Gurus

Donald Smith & Co (Trades, Portfolio). is not the only investment firm with an interest in M/I Homes Inc. Other notable investors include HOTCHKIS & WILEY, Ken Fisher (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio). Despite the recent reduction, Donald Smith & Co (Trades, Portfolio). remains a significant shareholder in the company.

Indicators of M/I Homes Inc's Stock Performance

The stock's GF Score stands at 84/100, indicating good outperformance potential. The Piotroski F-Score is at 5, and the Altman Z-Score, which measures credit strength, is at 3.94. The company's momentum and RSI indicators also provide insights into its current market position, with a 14-day RSI of 42.67 and a Momentum Index 6 - 1 Month of 31.11.

In conclusion, Donald Smith & Co (Trades, Portfolio).'s recent transaction in M/I Homes Inc reflects a strategic adjustment in its portfolio. While the stock's market performance has seen a recent downturn, the firm's long-term value investing approach and the company's strong financial health may suggest potential for future growth. Investors will be watching closely to see how this trade impacts both the firm's portfolio and the stock's performance moving forward.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.