Donald Smith & Co. Adjusts Stake in Textainer Group Holdings Ltd

Overview of Donald Smith & Co (Trades, Portfolio).'s Recent Trade

Donald Smith & Co (Trades, Portfolio)., a notable investment firm, has recently made a significant adjustment to its investment in Textainer Group Holdings Ltd (NYSE:TGH). On December 31, 2023, the firm reduced its holdings in the company by 891,724 shares, resulting in a 31.33% decrease from its previous stake. This transaction had a -1.51% impact on the firm's portfolio, bringing its total share count in Textainer to 1,954,585, which now represents 3.36% of the firm's equity portfolio and 4.84% of Textainer's outstanding shares. The shares were traded at a price of $49.20 each at the time of the transaction.

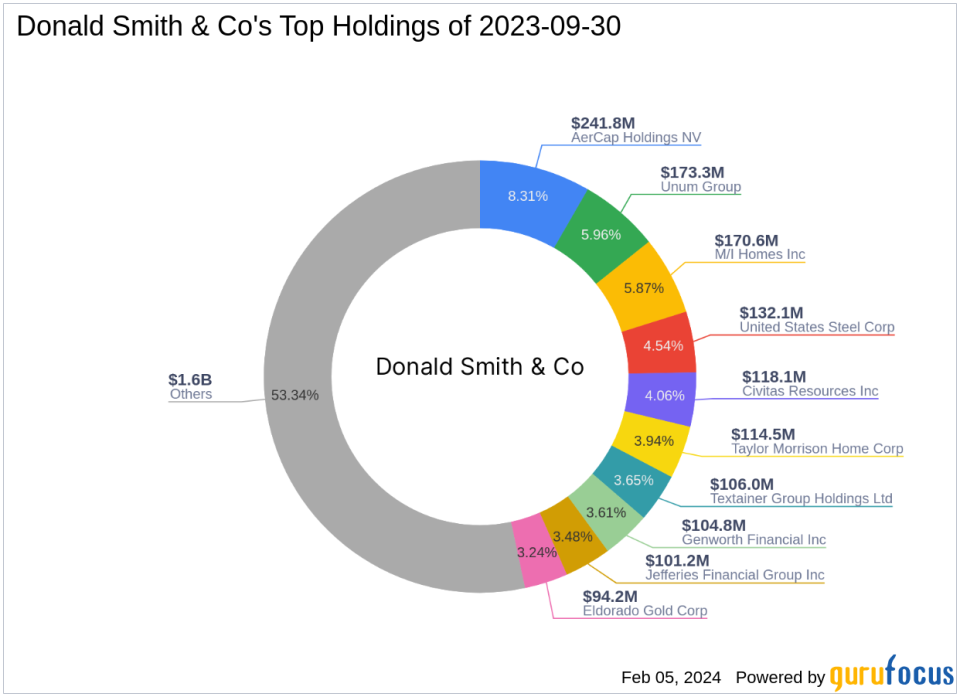

Donald Smith & Co (Trades, Portfolio).'s Investment Approach

Donald Smith & Co (Trades, Portfolio). was founded by the late Donald G. Smith, who was known for his deep-value investment strategy. The firm focuses on purchasing stocks of companies that are out of favor in the market but have the potential for earnings growth over a two to four-year horizon. These companies are typically in the bottom decile of price-to-tangible book ratios. Donald Smith & Co (Trades, Portfolio). has a diverse portfolio with top holdings in various sectors, including financial services and basic materials, with a total equity of $2.91 billion.

Textainer Group Holdings Ltd at a Glance

Textainer Group Holdings Ltd, based in Bermuda, is a leading intermodal container leasing company. Since its IPO on October 10, 2007, the company has been serving a global clientele, including international shipping lines. Textainer operates through segments such as Container Ownership, Container Management, and Container Resale, with the majority of its revenue stemming from lease rental income. The company has a market capitalization of $2.05 billion and a stock price of $49.65 as of the latest data.

Impact of the Trade on Donald Smith & Co (Trades, Portfolio).'s Portfolio

The recent trade by Donald Smith & Co (Trades, Portfolio). has slightly reduced the firm's exposure to Textainer Group Holdings Ltd. The trade price of $49.20 is modestly below the current stock price of $49.65, indicating a slight increase in value since the transaction date. Textainer's stock has shown a significant increase of 198.2% since its IPO and a modest year-to-date gain of 0.73%. The stock is currently rated as modestly overvalued with a GF Value of $40.67 and a price to GF Value ratio of 1.22.

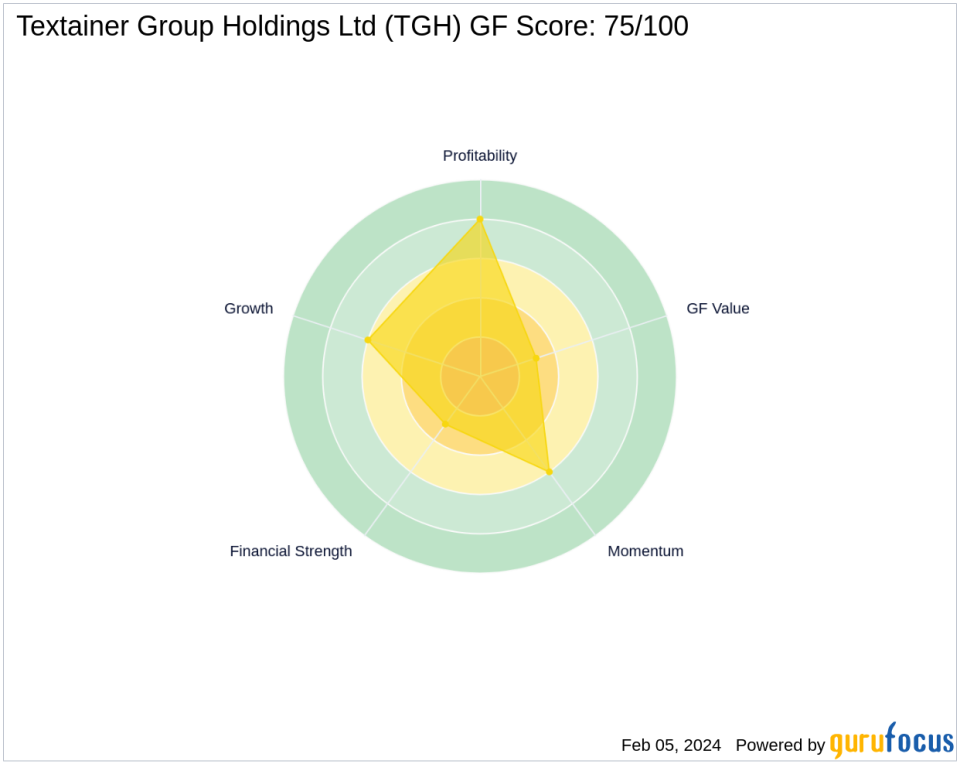

Textainer's Financial Health and Growth Prospects

Textainer's financial health is reflected in its Financial Strength rank of 3/10, with a cash to debt ratio of 0.03. The company's interest coverage stands at 2.68. Textainer's Profitability Rank is more favorable at 8/10, supported by a return on equity (ROE) of 11.60% and a return on assets (ROA) of 3.08%. The company's growth metrics are also solid, with a Growth Rank of 6/10 and a three-year revenue growth rate of 16.10%.

Comparative Analysis with Other Investment Gurus

Donald Smith & Co (Trades, Portfolio). is not the only investment firm with a stake in Textainer. Other notable gurus such as Keeley-Teton Advisors, LLC (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Ken Fisher (Trades, Portfolio) also hold shares in the company. However, Donald Smith & Co (Trades, Portfolio). remains the largest guru shareholder, indicating a strong conviction in the potential of Textainer's stock.

Market Sentiment and Future Outlook for Textainer

The market sentiment towards Textainer is captured by its GF Score of 75/100, suggesting a likelihood of average performance in the future. The stock's momentum is also positive, with RSI and Momentum Index rankings indicating steady investor interest. With these factors in mind, Donald Smith & Co (Trades, Portfolio).'s recent trade appears to be a strategic adjustment rather than a shift in long-term confidence in Textainer's prospects.

In conclusion, Donald Smith & Co (Trades, Portfolio).'s recent reduction in Textainer Group Holdings Ltd shares reflects a nuanced approach to portfolio management, balancing value investment principles with market dynamics. As Textainer continues to navigate the container leasing industry, investors will watch closely to see how this trade influences the firm's performance and position in the market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.