Donald Smith & Co. Bolsters Position in Eldorado Gold Corp

Introduction to the Transaction

Donald Smith & Co (Trades, Portfolio). has recently increased its investment in Eldorado Gold Corp (NYSE:EGO), a notable move that underscores the firm's confidence in the gold mining company. On December 31, 2023, the firm added 2,136,824 shares to its holdings, marking a significant 20.21% increase in its position. This transaction impacted the firm's portfolio by 0.94%, with the shares purchased at an average price of $12.97. Following this addition, Donald Smith & Co (Trades, Portfolio). now holds a total of 12,708,184 shares in Eldorado Gold Corp, representing 5.61% of the firm's portfolio and 6.26% of the company's shares.

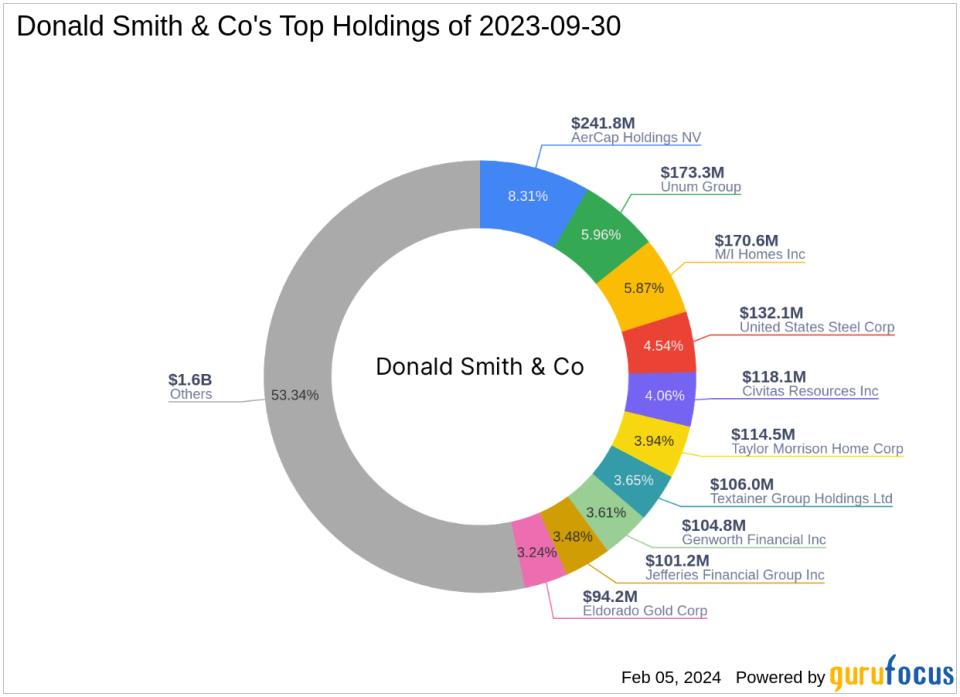

Profile of Donald Smith & Co (Trades, Portfolio).

Donald Smith & Co (Trades, Portfolio). was founded by the late Donald G. Smith, who served as the Chief Investment Officer from 1980 until his passing in 2019. The firm is known for its deep-value investment strategy, focusing on out-of-favor companies trading at discounts to tangible book value. With a keen eye for undervalued stocks and a long-term outlook on earnings potential, Donald Smith & Co (Trades, Portfolio). has established a reputation for its rigorous bottom-up approach to value investing. The firm currently manages an equity portfolio worth $2.91 billion, with top holdings in diverse sectors such as Financial Services and Basic Materials, including AerCap Holdings NV (NYSE:AER) and United States Steel Corp (NYSE:X).

Eldorado Gold Corp Company Overview

Eldorado Gold Corp, operating under the stock symbol EGO, is a Canadian-based gold and base metals producer with a market capitalization of $2.49 billion. Since its IPO on January 23, 2003, the company has engaged in mining, development, and exploration across Turkey, Canada, Greece, and Romania. Despite being labeled as "Significantly Overvalued" with a GF Value of $9.06 and a price to GF Value ratio of 1.35, Eldorado Gold Corp has maintained a GF Score of 72/100, indicating a potential for average performance in the long term.

Analysis of the Trade's Significance

The recent acquisition by Donald Smith & Co (Trades, Portfolio). has not only increased the firm's stake in Eldorado Gold Corp but also reflects a strategic move within the Metals & Mining industry. The firm's portfolio now has a more pronounced emphasis on this sector, with Eldorado Gold Corp playing a significant role. Prior to the transaction, the firm's position in Eldorado Gold Corp was already substantial, and this additional investment further solidifies its commitment to the company's future prospects.

Eldorado Gold Corp's Financial Health and Market Valuation

Eldorado Gold Corp's financial metrics present a mixed picture. The company's PE Ratio stands at 36.97, indicating a premium compared to industry peers. Despite this, the company's financial strength and profitability rank at 6/10, with a growth rank of 7/10, suggesting a robust outlook for future expansion. However, the GF Value Rank is at a low 1/10, reflecting the market's perception of the stock being overvalued. Eldorado Gold Corp's Piotroski F-Score of 7 points to a healthy financial situation, but the Altman Z-Score of 0.79 raises concerns about financial distress. The company's cash to debt ratio of 0.77 and interest coverage of 4.11 further contribute to a nuanced view of its financial health.

Sector and Industry Context

Donald Smith & Co (Trades, Portfolio).'s top sectors include Financial Services and Basic Materials, with Eldorado Gold Corp now a key component of the latter. The Metals & Mining industry is known for its volatility, and Eldorado Gold Corp's position within this sector is significant. The firm's investment strategy appears to align with the potential for value appreciation in this industry, despite the current market valuation of Eldorado Gold Corp suggesting a premium.

Other Notable Investors in Eldorado Gold Corp

Donald Smith & Co (Trades, Portfolio). is not the only prominent investor in Eldorado Gold Corp. Mario Gabelli (Trades, Portfolio) is another guru who holds shares in the company. However, Donald Smith & Co (Trades, Portfolio). is currently the largest guru shareholder, demonstrating a strong conviction in the potential of Eldorado Gold Corp.

Conclusion

The recent transaction by Donald Smith & Co (Trades, Portfolio). to increase its stake in Eldorado Gold Corp is a strategic move that aligns with the firm's value investing philosophy. Despite Eldorado Gold Corp's current market valuation suggesting it is significantly overvalued, the firm's decision to bolster its position indicates a belief in the company's long-term growth prospects. This investment may serve as a signal to other value investors about the potential opportunities within the Metals & Mining sector, particularly in companies like Eldorado Gold Corp that exhibit solid financial and growth metrics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.